Get the free TERM DEPOSIT

Show details

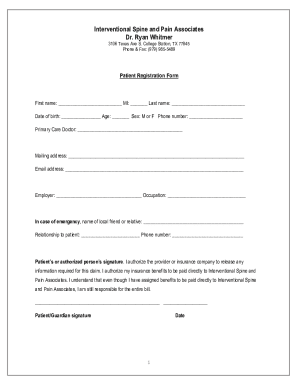

Form used for opening term deposit accounts for residents at ING Vysya Bank, detailing applicant information, account preferences, and instructions for deposit management.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term deposit

Edit your term deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term deposit online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit term deposit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term deposit

How to fill out TERM DEPOSIT

01

Research different financial institutions offering term deposits.

02

Compare interest rates, terms, and conditions to find the best option.

03

Choose the term length for your deposit (e.g., 1 month, 1 year, etc.).

04

Fill out the application form provided by the financial institution.

05

Provide necessary identification and personal information.

06

Select the amount you wish to deposit.

07

Review and sign the terms and conditions.

08

Submit the application and funding to the bank or credit union.

Who needs TERM DEPOSIT?

01

Individuals looking to save money for a specific goal with a guaranteed return.

02

People who want to earn higher interest rates than traditional savings accounts.

03

Investors seeking a low-risk investment option with defined terms.

04

Those who do not need immediate access to their funds.

Fill

form

: Try Risk Free

People Also Ask about

Is a term deposit a good idea?

While term deposits are secure and reliable, they do have limitations. The fixed-term nature means you cannot access your funds easily, and interest rates may not always keep pace with inflation.

What does a term deposit do?

While savings account interest rates can fluctuate with market conditions, term deposits provide a fixed interest rate for a set period of time, ensuring you know exactly how much you'll earn and for how long.

How does a term deposit work?

To earn interest on your term deposit, your money is locked away for a chosen period of time. If you need your money before the term ends, you may have to pay a penalty fee. You may only receive a proportion of the interest earnt, or none at all.

What are term deposits and how do they work?

Term deposits offer a fixed interest rate over a specific period. So, unlike a high-interest savings account where rates can fluctuate, they offer a predictable return on your investment. This can be particularly beneficial for retirees or those who are risk-averse and prefer a conservative investment approach.

What is the term deposit in simple words?

In Term Deposits, the sum of money is kept for a fixed maturity and the depositor is not allowed to withdraw this sum till the end of the maturity period. That is why they are called as Term Deposits because they are kept up to a particular term.

What is considered a term deposit?

A term deposit is a cash investment with a guaranteed return and generally offered at a fixed interest rate over a set period (the term). You'll also encounter the term Guaranteed Investment Certificates (GICs), which are basically the same thing as term deposits.

What is a term deposit in English?

Term Deposits are one of the best investment options for people who are looking for a stable and safe return on their investments. In Term Deposits, the sum of money is kept for a fixed maturity and the depositor is not allowed to withdraw this sum till the end of the maturity period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TERM DEPOSIT?

A TERM DEPOSIT is a financial product offered by banks and credit unions where money is deposited for a fixed term at a predetermined interest rate.

Who is required to file TERM DEPOSIT?

Individuals or entities that wish to open a term deposit account with a financial institution are required to file relevant forms and documentation.

How to fill out TERM DEPOSIT?

To fill out a term deposit, one typically needs to provide personal information, choose the deposit amount, select the term duration, and sign the deposit agreement.

What is the purpose of TERM DEPOSIT?

The purpose of a term deposit is to securely invest savings for a specific period while earning higher interest compared to regular savings accounts.

What information must be reported on TERM DEPOSIT?

Information that must be reported on a term deposit includes the account holder's personal identification details, deposit amount, interest rate, term duration, and maturity date.

Fill out your term deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.