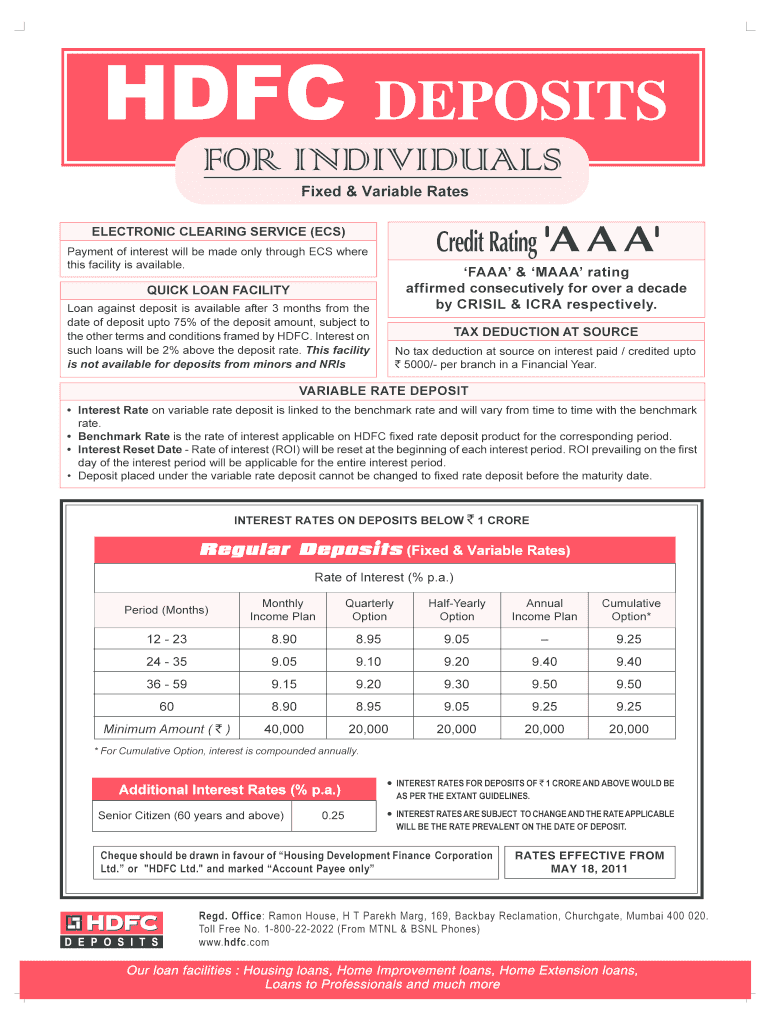

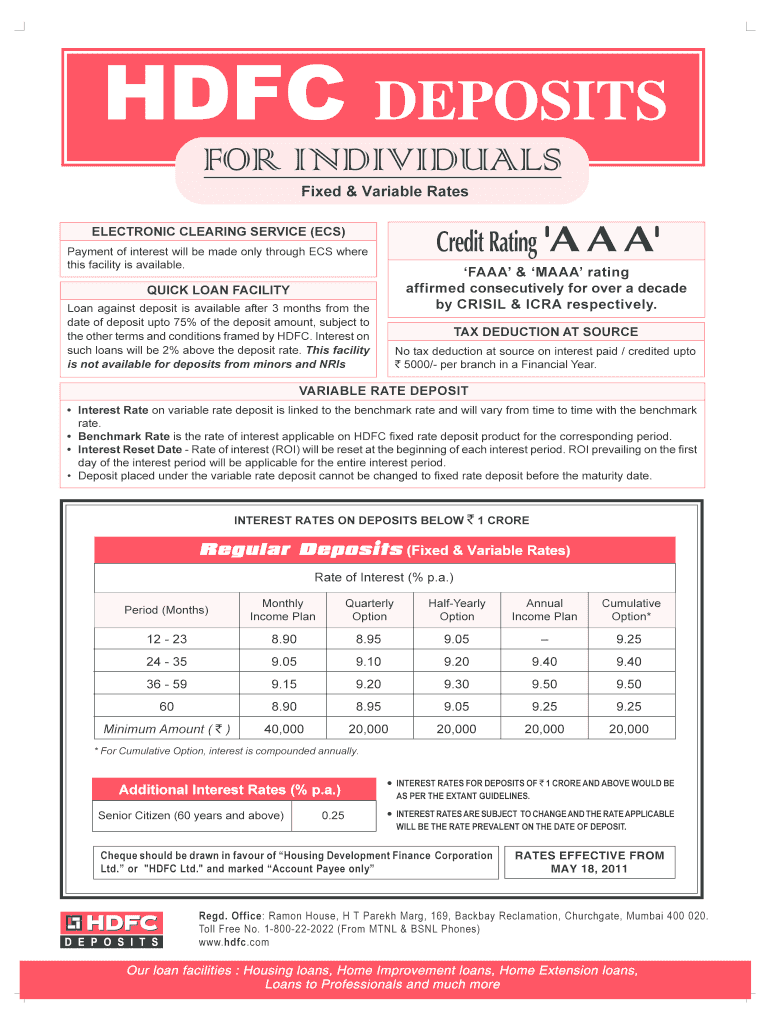

Get the free HDFC DEPOSITS FOR INDIVIDUALS

Show details

This document provides information about various deposit schemes offered by HDFC for individuals, including fixed and variable rate deposit options, interest rates, loan facilities against deposits,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hdfc deposits for individuals

Edit your hdfc deposits for individuals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hdfc deposits for individuals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hdfc deposits for individuals online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hdfc deposits for individuals. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hdfc deposits for individuals

How to fill out HDFC DEPOSITS FOR INDIVIDUALS

01

Gather necessary documents: ID proof, address proof, and income proof.

02

Visit the nearest HDFC Bank branch or access their online platform.

03

Fill out the HDFC Deposits application form completely.

04

Select the type of deposit (fixed deposit, recurring deposit, etc.).

05

Choose the deposit amount and tenure that suits your financial goals.

06

Provide the required KYC documents along with the application form.

07

Submit the form and documents to the bank representative or upload them online.

08

Make the initial deposit payment as per the chosen deposit scheme.

09

Receive the deposit receipt and keep it for your records.

Who needs HDFC DEPOSITS FOR INDIVIDUALS?

01

Individuals looking to save money while earning interest.

02

People seeking a secure place to invest their savings.

03

Those wanting to plan for future financial goals such as education, marriage, or retirement.

04

Individuals preferring guaranteed returns over market-linked investments.

Fill

form

: Try Risk Free

People Also Ask about

What is the interest of 1 lakh FD in HDFC?

Frequently Asked Questions. What is the interest of Rs 1 lakh FD in HDFC? The HDFC Bank FD rates for a deposit of Rs 1 lakh range from 3.00% to 7.20% per annum, depending on the tenor chosen.

Which fixed deposit is best in HDFC Bank?

Domestic / NRO / NRE FIXED DEPOSIT RATE Tenor Bucket>=3 Crore to < 5 Crores Interest Rate (per annum)**Senior Citizen Rates (per annum) 30 - 45 days 4.75% 5.25% 46 - 60 days 5.00% 5.50% 61 - 89 days 5.25% 5.75%17 more rows

How much interest for 1 lakh FD in HDFC?

Frequently Asked Questions. What is the interest of Rs 1 lakh FD in HDFC? The HDFC Bank FD rates for a deposit of Rs 1 lakh range from 3.00% to 7.20% per annum, depending on the tenor chosen.

What is the best FD in HDFC Bank?

Tenor Bucket< 3 Crore Interest Rate (per annum)**Senior Citizen Rates (per annum) 18 months to < 21 months 6.60% 7.10% 21 months - 2 years 6.45% 6.95% 2 Years 1 day to < 2 Year 11 Months 6.45% 6.95%16 more rows

Which bank gives 9.5 interest on FD?

Unity Bank continues to offer 9.5% interest to senior citizens on a tenure of 1001 days. The customer can start the deposit with even ₹1,000. Monthly, quarterly, or cumulative payment of interest is available.

What is the 7% interest for 1 lakh?

₹1 Lakh Fixed Deposit Interest Per Month Deposit AmountInterest Rate (p.a.)Monthly Interest Payout ₹1 Lakh 6.50% ₹541 ₹1 Lakh 7.00% ₹583 ₹1 Lakh 7.50% ₹625 ₹1 Lakh 8.00% ₹6665 more rows

Which bank is giving 8% on FD?

Highest bank FD interest rate for senior citizens Utkarsh Small Finance Bank is offering 8.25% interest rate on FD of 2 years (730 Days) upto 3 years (1095 Days). Jana Small Finance Bank is offering 8.25% interest rate on FD for tenure between 1year to 3 years.

Which bank gives 7% interest on fixed deposits?

FD Interest Rates – Tax Saving FD BanksInterest Rates (p.a.) DCB Bank 7.00% 7.25% Federal Bank 6.25% 6.75% HDFC Bank 6.40% 6.90% ICICI Bank 6.60% 7.10%31 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HDFC DEPOSITS FOR INDIVIDUALS?

HDFC Deposits for Individuals refers to fixed deposits and recurring deposits offered by HDFC Bank specifically tailored for individual customers to save money and earn interest over a predefined period.

Who is required to file HDFC DEPOSITS FOR INDIVIDUALS?

Individuals looking to invest their savings in fixed or recurring deposits with HDFC Bank are required to file for HDFC Deposits for Individuals.

How to fill out HDFC DEPOSITS FOR INDIVIDUALS?

To fill out HDFC Deposits for Individuals, one needs to visit the HDFC Bank website or a branch, select the type of deposit, provide personal and banking details, choose the deposit amount and tenure, and then submit the application along with necessary documents.

What is the purpose of HDFC DEPOSITS FOR INDIVIDUALS?

The purpose of HDFC Deposits for Individuals is to provide a safe investment option for individual customers where they can save money while earning a higher interest rate compared to regular savings accounts.

What information must be reported on HDFC DEPOSITS FOR INDIVIDUALS?

Information that must be reported on HDFC Deposits for Individuals includes the depositor's name, contact information, PAN number, deposit amount, chosen tenure, and the type of deposit (fixed or recurring).

Fill out your hdfc deposits for individuals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc Deposits For Individuals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.