Get the free Life Insurance Change of Beneficiary - InstantBenefits.net - mychoice

Show details

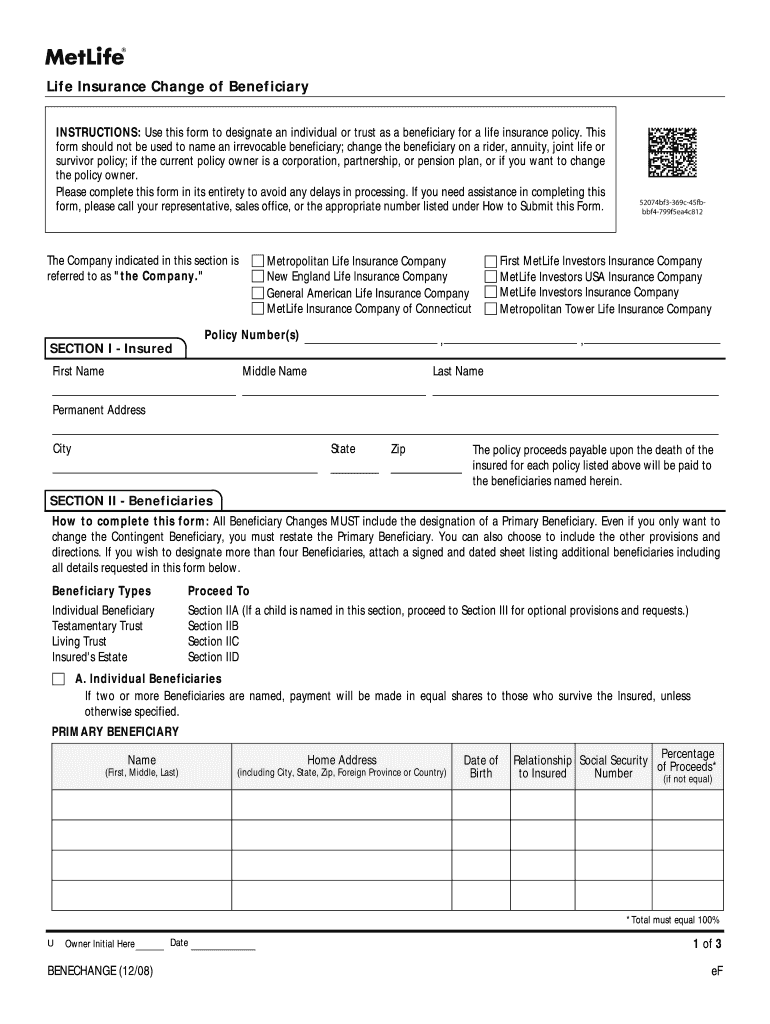

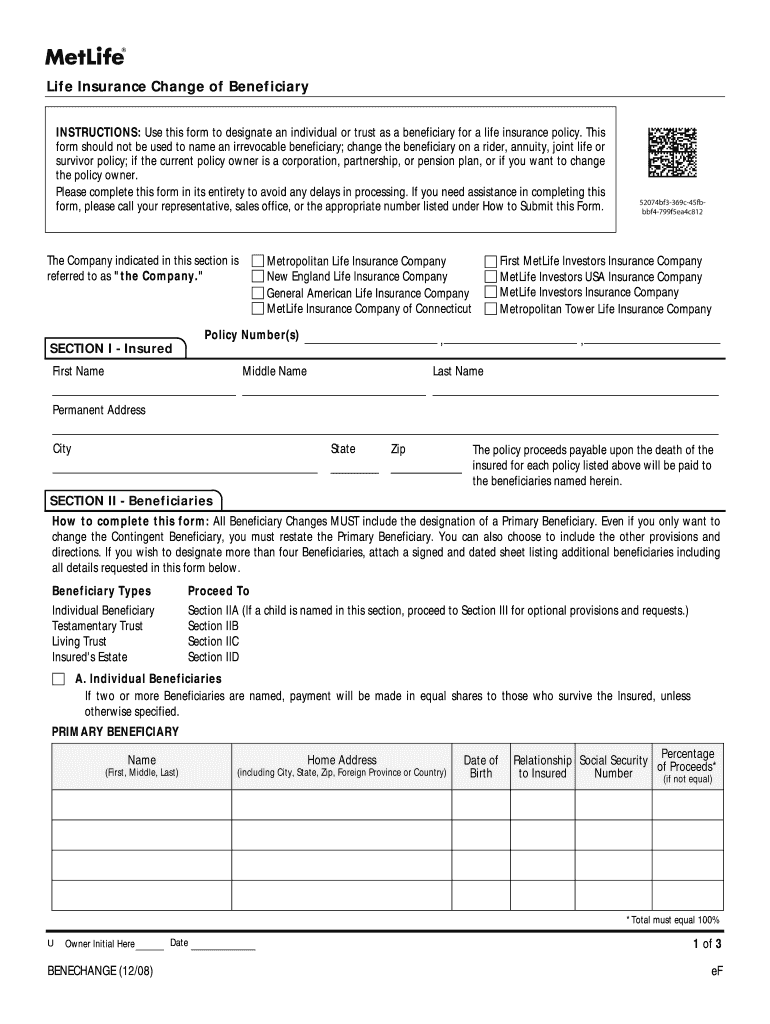

Life Insurance Change of Beneficiary

INSTRUCTIONS: Use this form to designate an individual or trust as a beneficiary for a life insurance policy. This

form should not be used to name an irrevocable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance change of

Edit your life insurance change of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance change of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance change of online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance change of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance change of

Point by point, here is how to fill out a life insurance change of:

01

Start by obtaining the necessary change of form from your life insurance provider. This form is typically available on their website or can be requested directly from their customer service department.

02

Carefully read the instructions provided with the form to ensure you understand the required information and any supporting documentation that may be needed. This will help you gather all the necessary details before beginning the process.

03

Begin by providing your personal details, including your full name, contact information, and policy number. This information is essential for the insurance company to identify your policy accurately.

04

Specify the changes you want to make to your life insurance policy. Common changes include updating beneficiary information, changing the coverage amount, or modifying the policy's payment details.

05

If you are changing the beneficiary, provide the full name, contact information, and relationship to the insured individual. Ensure that the information is accurate and up-to-date to avoid any complications in the future.

06

When modifying the coverage amount, clearly state the new coverage amount you wish to have. If necessary, provide an explanation for the change, such as a change in financial circumstances or a life event that warrants an adjustment in the policy.

07

If you are updating the payment details, include the new payment method or account information. This may involve providing your bank account details, credit card information, or any other payment method accepted by your insurance provider.

08

Carefully review the information you entered to ensure accuracy. Any errors or omissions may lead to delays in processing your request or potential issues with your policy. Double-check all spellings, dates, and numbers before submitting the form.

09

Once you have completed the form, sign and date it as required. Ensure that you have filled out all the necessary fields and attached any requested supporting documentation. This may include identification documents, legal paperwork, or other relevant materials, depending on the nature of your change request.

10

Submit the completed form and any supporting documents to your life insurance provider. Follow their instructions regarding submission methods, such as mailing, faxing, or uploading the documents through their online portal. Retain a copy of the submitted form and supporting documents for your records.

Who needs a life insurance change of?

Individuals who may need a life insurance change of include policyholders who experience significant life events such as marriage, divorce, the birth or adoption of a child, the death of a beneficiary, or any other circumstances that warrant a modification to their policy. Additionally, individuals who wish to update their beneficiaries, increase or decrease their coverage amount, or adjust the payment details of their policy may also need a life insurance change of. It is important to review your policy regularly and make changes as needed to ensure your coverage aligns with your current circumstances and financial goals.

Fill

form

: Try Risk Free

People Also Ask about

What is the SF 2808 for CSRS?

Abstract: SF 2808 is used by persons covered by Civil Service Retirement System to designate a beneficiary to receive the lump sum due from the Civil Service Retirement and Disability Fund in the event of their death.

Who is an example of a designated beneficiary?

a surviving spouse. a disabled or chronically ill person. a child who hasn't reached the age of majority. a person not more than 10 years younger than the IRA account owner.

What is the SF 2808 form?

This Designation of Beneficiary form is used to designate who is to receive a lump-sum payment which may become payable after your death. It does not affect the right of any person who is eligible for survivor annuity benefits.

What is benefit beneficiary form?

This is the person that receives the benefit upon death. The beneficiary designation on file at the time of death is binding in the payment of your benefits. Whenever you have a life event, such as a marriage, divorce or birth of a child, review and update your beneficiary designations.

When can the beneficiary be changed in a life insurance policy?

A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent. You can name as many beneficiaries as you want, subject to procedures set in the policy. The beneficiary to whom the proceeds go first is called the primary beneficiary.

Who has the right to change a life insurance policy's beneficiary?

Only the policyholder can change a life insurance policy's beneficiaries, with rare exceptions. Here's how and when to make a beneficiary change, and when you might need another person's sign-off. The policy owner is the only person who can change the beneficiary designation in most cases.

Who has the right to change a life insurance policy's beneficiary quizlet?

A policyowner may change a beneficiary at any time. However, consent may be needed by the current beneficiary if designated as irrevocable. A policyowner would like to change the beneficiary on a Life insurance policy and make the change permanent.

Can you change beneficiary without consent?

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent.

Can the insured change the beneficiary on a life insurance policy?

You can change the beneficiary at any time, depending on the terms of the policy, without any penalty or fee. The policyholder should also be able to name a contingent beneficiary who will receive the death benefit payout if the primary beneficiary is deceased or unable to receive the funds.

What is a beneficiary change form?

Your original designation remains in force whether it still reflects your wishes or not, until you submit another form to cancel prior designations or to designate a new beneficiary. A designation of beneficiary form outlines your desire to have the funds due upon your death paid out in a particular way.

How do I fill out a beneficiary change form?

General Instructions Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write “children” on one of the lines; instead write the full names of each of your children on separate lines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life insurance change of?

Life insurance change of typically refers to updating the details or beneficiary information in a life insurance policy.

Who is required to file life insurance change of?

The policyholder or the insured individual is typically required to file a life insurance change of.

How to fill out life insurance change of?

To fill out a life insurance change of, the policyholder usually needs to contact their insurance company and provide the necessary information or documentation.

What is the purpose of life insurance change of?

The purpose of life insurance change of is to ensure that the policy details are up to date and accurate, including any changes in beneficiaries or coverage.

What information must be reported on life insurance change of?

The information reported on a life insurance change of may include changes in personal details, beneficiary information, coverage amount, or payment method.

How can I edit life insurance change of from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your life insurance change of into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the life insurance change of in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my life insurance change of in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your life insurance change of right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your life insurance change of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Change Of is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.