Get the free Quick Reference Guide: Cash Receipt

Show details

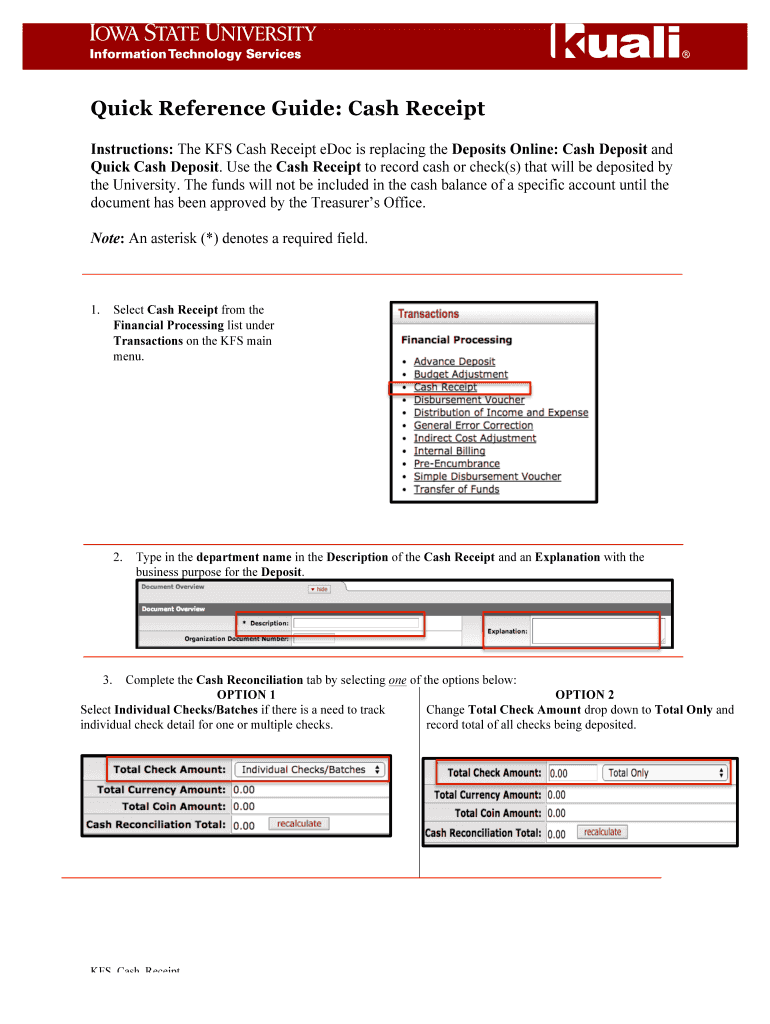

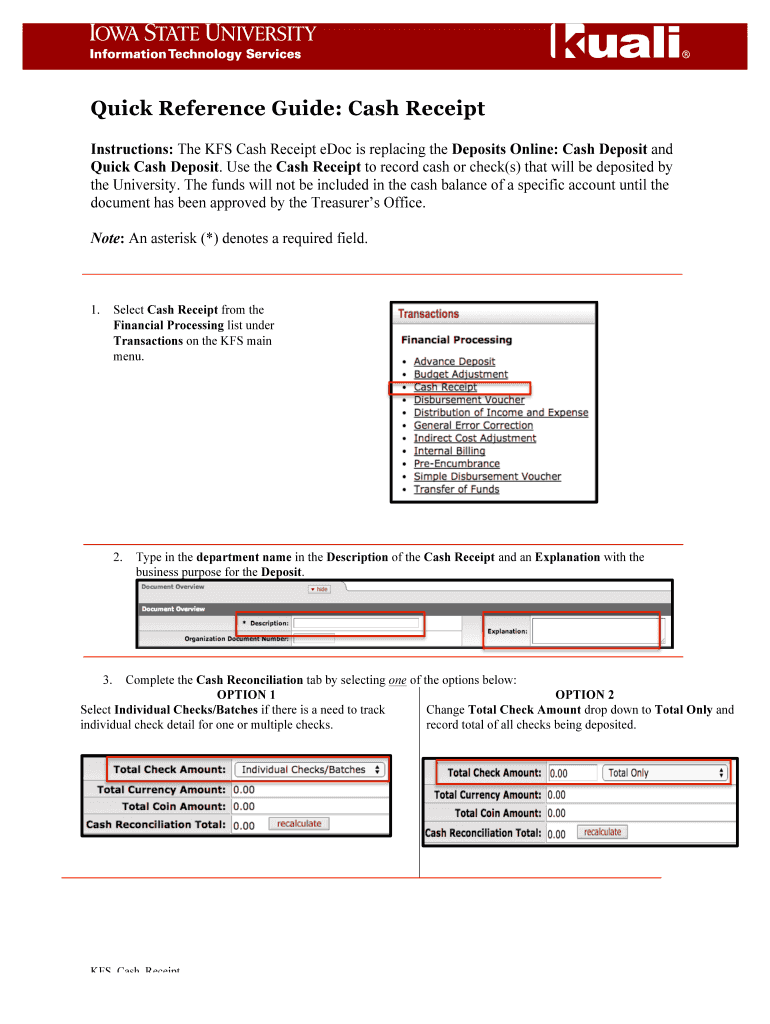

Quick Reference Guide: Cash Receipt

Instructions: The CFS Cash Receipt doc is replacing the Deposits Online: Cash Deposit and

Quick Cash Deposit. Use the Cash Receipt to record cash or check’s)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quick reference guide cash

Edit your quick reference guide cash form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quick reference guide cash form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quick reference guide cash online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quick reference guide cash. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quick reference guide cash

How to Fill Out Quick Reference Guide Cash:

01

Begin by entering the date at the top of the guide. This will help keep track of when the cash transactions are recorded.

02

Write down the starting cash balance in the designated space. This is the amount of cash you have at the beginning of the day or shift.

03

Record all cash transactions throughout the day in the guide. Include details such as the amount received, the source or reason for the cash (e.g., sales, refunds), and any notes or comments related to the transaction.

04

Subtract cash disbursements, such as expenses or payments made, from the running total balance. This will give you an updated cash balance after each transaction.

05

Ensure that all entries are accurate and legible. Double-check the numbers and verify any calculations to avoid errors.

06

At the end of the day or shift, calculate the cash balance. This can be done by adding the total cash received and subtracting any cash disbursed throughout the day.

07

Write down the closing cash balance in the designated space. This will be the ending amount of cash you have at the end of the day or shift.

08

Review the quick reference guide cash for any discrepancies or irregularities. Make sure all entries are accounted for and reconcile any discrepancies before closing the guide.

09

Store the filled-out quick reference guide cash securely for future reference or auditing purposes.

Who needs quick reference guide cash?

01

Cashiers: Cashiers who handle cash transactions on a daily basis can use the quick reference guide to keep track of their cash activities and maintain accurate records.

02

Store Managers: Store managers or supervisors can use the quick reference guide to oversee cash handling procedures, monitor cash balances, and ensure proper accountability.

03

Small Business Owners: Small business owners without sophisticated accounting systems may rely on the quick reference guide cash to track their daily cash transactions and maintain financial control.

04

Auditors: Auditors may refer to the quick reference guide cash as part of their examination of a business's financial records to ensure accuracy and compliance with regulations.

05

Bookkeepers or Accountants: Bookkeepers or accountants may use the quick reference guide cash as a reference to match against other financial records and verify the accuracy of reported cash transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my quick reference guide cash directly from Gmail?

quick reference guide cash and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I edit quick reference guide cash on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share quick reference guide cash from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit quick reference guide cash on an Android device?

With the pdfFiller Android app, you can edit, sign, and share quick reference guide cash on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is quick reference guide cash?

A quick reference guide cash is a document that provides a summarized overview of cash transactions.

Who is required to file quick reference guide cash?

Any individual or business entity that deals with cash transactions is required to file a quick reference guide cash.

How to fill out quick reference guide cash?

To fill out a quick reference guide cash, you need to include details of all cash transactions within a specific period, including the amount, date, and source or recipient.

What is the purpose of quick reference guide cash?

The purpose of a quick reference guide cash is to keep track of all cash transactions and ensure transparency and accountability.

What information must be reported on quick reference guide cash?

All cash transactions including the amount, date, source, and recipient must be reported on a quick reference guide cash.

Fill out your quick reference guide cash online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quick Reference Guide Cash is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.