Get the free Tax Filing Agreement and Electronic Debit Authorization

Show details

This document outlines the agreement between the Client and BeyondPay regarding payroll tax filing and electronic debit authorization for tax liabilities and service fees.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax filing agreement and

Edit your tax filing agreement and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax filing agreement and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

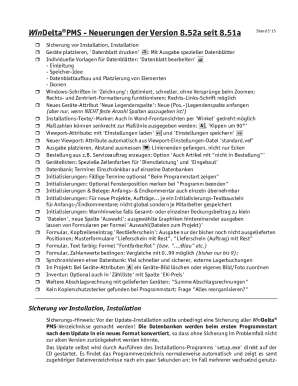

Editing tax filing agreement and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax filing agreement and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

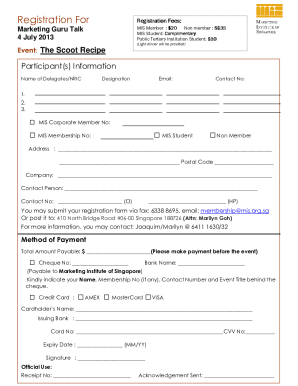

How to fill out tax filing agreement and

How to fill out Tax Filing Agreement and Electronic Debit Authorization

01

Obtain the Tax Filing Agreement and Electronic Debit Authorization forms from the relevant tax authority or your accounting software.

02

Fill in your personal information, including your name, address, and Social Security number or Tax Identification Number.

03

Specify the type of tax services you are authorizing by providing details of the tax return to be filed.

04

Review the authorization section and include any additional agents or representatives if required.

05

Read the terms and conditions carefully to understand your obligations and rights.

06

Sign and date the forms where indicated.

07

Make a copy of the completed forms for your records before submission.

08

Submit the forms to the tax authority or your tax preparer as instructed.

Who needs Tax Filing Agreement and Electronic Debit Authorization?

01

Individuals who hire tax professionals to prepare their tax returns.

02

Business owners who require assistance with business tax filings.

03

Anyone who wants to authorize direct debit payments for tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS USA tax payment on my bank statement?

"IRS USA Tax Payment," "IRS USA Tax Pymt" or something similar will be shown on your bank statement as proof of payment. If the payment date requested is a weekend or bank holiday, the payment will be withdrawn on the next business day.

What is an efile authorization?

IRS e-file Signature Authorization">Form 8879, IRS e-file Signature Authorization, authorizes an ERO to enter the taxpayers' PINs on Individual Income Tax Returns and IRS e-file Authorization for Application of Extension of Time to File">Form 8878, IRS e-file Authorization for Application of Extension of Time to File,

What is an e-file confirmation?

Taxpayers can e-file from a computer, or by using a tax preparer who is an approved Electronic Return Originator (ERO). The state return is transmitted to the IRS along with the federal return. When the federal return is accepted, an acknowledgment (electronic confirmation) is sent from the IRS.

What does efile stand for?

By. Definition. Electronic filing (e-file) is the process of submitting tax returns online using software or a tax professional rather than mailing paper forms.

What is e-file authorization?

IRS e-file Signature Authorization">Form 8879, IRS e-file Signature Authorization, authorizes an ERO to enter the taxpayers' PINs on Individual Income Tax Returns and IRS e-file Authorization for Application of Extension of Time to File">Form 8878, IRS e-file Authorization for Application of Extension of Time to File,

Can form 9465 be filed electronically?

When you enter your information for Form 9465, you'll be prompted to enter your banking information. Proceed through the e-filing steps and select mail a check on the e-filing - federal balance due options screen.

Can anyone use efile?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

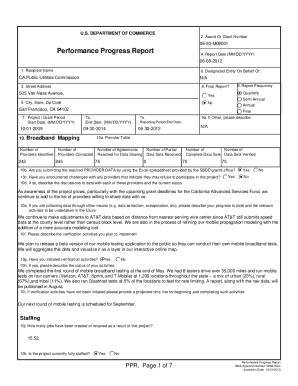

What is Tax Filing Agreement and Electronic Debit Authorization?

A Tax Filing Agreement is a formal arrangement that allows a tax professional to file tax returns on behalf of an individual or business. An Electronic Debit Authorization allows the IRS or state tax authority to withdraw funds directly from a taxpayer's bank account for payments due.

Who is required to file Tax Filing Agreement and Electronic Debit Authorization?

Anyone seeking to have their taxes filed by a tax professional or who wants to set up automatic payments for their tax liabilities is required to file these agreements.

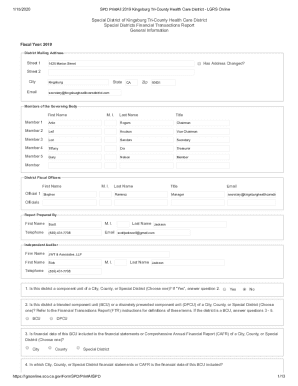

How to fill out Tax Filing Agreement and Electronic Debit Authorization?

To fill out the Tax Filing Agreement, provide personal or business information, sign the agreement, and indicate your consent for the tax professional to file on your behalf. To fill out the Electronic Debit Authorization, provide your bank account details and authorize automatic withdrawals for tax payments.

What is the purpose of Tax Filing Agreement and Electronic Debit Authorization?

The purpose of the Tax Filing Agreement is to authorize a tax professional to file your tax returns, while the Electronic Debit Authorization is intended to facilitate prompt payment and reduce the risk of late payments by allowing automatic deductions.

What information must be reported on Tax Filing Agreement and Electronic Debit Authorization?

On the Tax Filing Agreement, you must report your name, address, tax identification number, and the tax professional's details. On the Electronic Debit Authorization, you must provide bank account information, including account number and routing number.

Fill out your tax filing agreement and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Filing Agreement And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.