Get the free Standards for Annual Return Submissions

Show details

This document outlines the standards and requirements for companies to submit their annual returns, detailing necessary information and acceptable formats.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standards for annual return

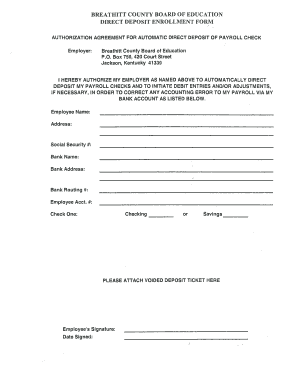

Edit your standards for annual return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standards for annual return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standards for annual return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit standards for annual return. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standards for annual return

How to fill out Standards for Annual Return Submissions

01

Begin by gathering all necessary financial documents for the year.

02

Review the guidelines provided for the Standards for Annual Return Submissions.

03

Fill in the required fields accurately, ensuring all figures match your financial records.

04

Provide detailed explanations for any deviations from the expected standards.

05

Double-check all entries for accuracy and completeness.

06

Submit the completed form by the specified deadline.

Who needs Standards for Annual Return Submissions?

01

Organizations and businesses required to report financial information annually.

02

Non-profit organizations that must adhere to regulatory standards.

03

Public entities that are accountable to stakeholders and the government.

Fill

form

: Try Risk Free

People Also Ask about

How to file an annual return of a company?

Its financial statements must be filed in Form AOC-4 within 180 days from the closure of the financial year, as per Section 137(1). The annual return in Form MGT-7A must be filed within sixty days from the date on which the AGM would have been due (i.e., 30th September). Therefore, the due date is November 29th.

How to submit an annual return?

You file the return digitally through the Malaysian Business Reporting System (MBRS) portal, the official platform for all annual return submissions. The Company Secretary, who manages the company's records, must digitally sign and submit the return to the SSM.

When should we file an annual return?

Annual return filing deadline: The deadline is strict: within 7 months of your company's Financial Year End (FYE). Audited financial statements: Your company may need audited financial statements if it meets 2 of 3 criteria: S$10M revenue, S$10M assets, or over 50 employees.

Where to file an annual return?

The annual return provides critical information that helps the company's stakeholders to make informed decisions. The appointed officer of your company (e.g. a director or company secretary) can file the annual return on ACRA's online filing portal Bizfile.

What is the BVI accounting standard?

BVI's Accounting Regulations Requirement to keep proper accounting records: Every BVI company must maintain accurate accounting records of its transactions adequate enough to reflect its financial position and to enable a reasonable judgment to be made. They should be kept for a period of five years.

How to lodge an annual return?

The Company Secretary will digitally sign and lodge Annual Return (AR) to the SSM via the Malaysian Business Reporting System (MBRS) portal.

What must be declared for you to file in your annual return?

For an individual his/her salary income, etc. must be declared on the ITR12, and. For a company that has other income not allowed in the turnover tax regime or a company that was taxed as a turnover tax taxpayer for part of the tax year, and the rest of the tax year as a normal company must complete the ITR14.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Standards for Annual Return Submissions?

Standards for Annual Return Submissions refer to the set of guidelines and requirements established for organizations to submit their annual return documents to regulatory authorities, ensuring compliance with legal and operational norms.

Who is required to file Standards for Annual Return Submissions?

Organizations, including companies, non-profits, and other entities that operate under legal frameworks that mandate annual reporting are required to file Standards for Annual Return Submissions.

How to fill out Standards for Annual Return Submissions?

To fill out Standards for Annual Return Submissions, organizations must gather required information, complete the designated forms accurately, and ensure that all financial and operational data is up to date before submitting to the relevant authorities.

What is the purpose of Standards for Annual Return Submissions?

The purpose of Standards for Annual Return Submissions is to promote transparency, uphold corporate governance, and ensure that stakeholders have access to accurate and timely information about an organization's performance and compliance.

What information must be reported on Standards for Annual Return Submissions?

The information that must be reported typically includes the organization's financial statements, details of directors and officers, disclosures related to governance practices, and any material changes that occurred during the reporting period.

Fill out your standards for annual return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standards For Annual Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.