Get the free GST Certification Claim Form

Show details

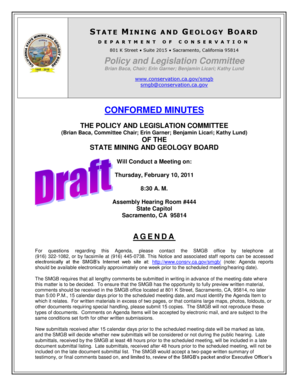

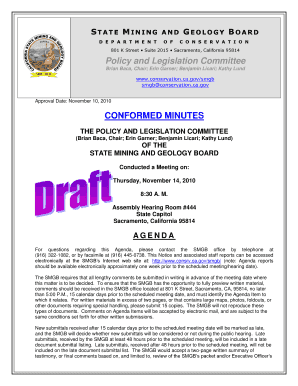

This document is a claim form used by the Special Olympics Ontario Inc. for claiming a GST rebate for expenditures incurred during a specified period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst certification claim form

Edit your gst certification claim form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst certification claim form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gst certification claim form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gst certification claim form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gst certification claim form

How to fill out GST Certification Claim Form

01

Obtain the GST Certification Claim Form from the official GST website or your local tax office.

02

Fill in your personal details including name, address, and GST number.

03

Provide details of the expenses for which you are claiming GST reimbursement.

04

Attach necessary documentation such as receipts and invoices.

05

Ensure all required fields are accurately filled out.

06

Review the form for any errors or missing information.

07

Submit the completed form to the appropriate tax authority either online or in person.

Who needs GST Certification Claim Form?

01

Businesses that are registered for GST and have incurred GST-inclusive expenses.

02

Individuals who are eligible for GST refunds due to overpayment.

03

Non-profit organizations that have paid GST on operational expenses.

04

Any entity that has made a claim for GST credits or refunds.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for claiming GST refund?

Form GST RFD-02 The proper officer has to review and scrutinise the refund application. If the application is complete as per CGST Rules, an acknowledgement in Form GST RFD-02 should be issued within 15 days of the date of claiming the refund.

What is the GST refund in Canada?

The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. It may also include payments from provincial and territorial programs.

What is required to claim GST?

How to claim GST refund? The application for a GST refund must be submitted using form RFD 01 within two years from the relevant date. The form also requires approval from a Chartered Accountant.

What is GST return filing in English?

Navigate to: Services → Returns → Returns Dashboard. Choose the financial year and the specific month or quarter for which you're filing. Click "Prepare Online" (or use upload options if you have one): For GSTR-1, enter invoice details (B2B, B2C, exports, credit/debit notes, etc.)

How to claim GST refund in Canada?

Form RC66: If you have children, fill out and sign form RC66 — Canada Child Benefits application to apply for all child and family benefits, including the GST/HST credit. Form RC151: If you do not have children, fill out and sign form RC151 — GST/HST Credit Application for individuals who become residents of Canada.

What is the full form of GST?

The full form of GST is Goods and Services Tax. It is payable when goods or services are bought or sold in India, replacing multiple indirect taxes.

What is needed to claim GST?

You must have a tax invoice to claim a GST credit for purchases that cost more than A$82.50 (including GST). Your supplier has 28 days to provide you with a tax invoice after you request one. Wait until you receive it before you claim the GST credit, even if this is in a later reporting period.

What form do I need to claim GST?

The taxpayer shall file the refund application in Form GST RFD-01 on GST portal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GST Certification Claim Form?

The GST Certification Claim Form is a document that businesses must complete to claim refunds or corrections related to the Goods and Services Tax (GST) they have paid.

Who is required to file GST Certification Claim Form?

Businesses and individuals who have overpaid GST or are eligible for a refund must file the GST Certification Claim Form.

How to fill out GST Certification Claim Form?

To fill out the GST Certification Claim Form, you need to provide your GST registration details, details of the claim, and any relevant supporting documentation, ensuring that all information is accurate and complete.

What is the purpose of GST Certification Claim Form?

The purpose of the GST Certification Claim Form is to facilitate the process of claiming refunds or adjustments for excess GST payments made by a business.

What information must be reported on GST Certification Claim Form?

The GST Certification Claim Form must include details such as the claimant's GST registration number, the amount of GST claimed, the reasons for the claim, and any relevant invoices or transaction references.

Fill out your gst certification claim form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst Certification Claim Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.