Get the free Tax Deductions for Waiters & Waitresses

Show details

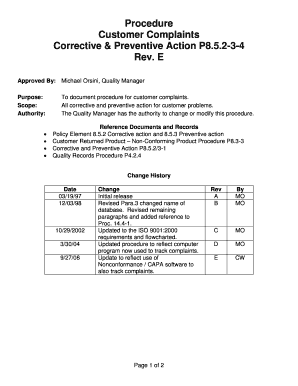

This document outlines the requirements for keeping a good record of tips received by waiters and waitresses for tax purposes, including how to report tips and the associated rules regarding unreported

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deductions for waiters

Edit your tax deductions for waiters form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deductions for waiters form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax deductions for waiters online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax deductions for waiters. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deductions for waiters

How to fill out Tax Deductions for Waiters & Waitresses

01

Gather all relevant documents, such as W-2 forms, pay stubs, and receipts for expenses.

02

Identify the tax deductions applicable to waiters and waitresses, including tips and unreimbursed business expenses.

03

List out all tips received during the tax year, including cash and debit/credit card tips.

04

Document any work-related expenses such as uniforms, cleaning costs, and small tools required for your job.

05

Fill out Schedule C (Form 1040) for self-employed individuals or report tip income on your tax return.

06

Calculate the total deductions by adding all eligible expenses.

07

Complete your tax return accurately, reflecting the deductions on the appropriate lines.

08

Seek assistance from a tax professional if needed, to ensure all deductions are claimed correctly.

Who needs Tax Deductions for Waiters & Waitresses?

01

Waiters and waitresses who receive tips as part of their income.

02

Service industry workers looking to reduce their taxable income.

03

Employees who incur out-of-pocket expenses related to their job.

04

Individuals seeking to maximize their tax refunds or reduce tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What deduction can I claim without receipts?

How to claim business expenses without a receipt Tax deductions you can claim without a receipt. Home office expenses. Eligible retirement plan contributions. Health insurance premiums. Self-employment taxes. Cell phone expenses. Charitable contributions. Vehicle expenses and mileage.

What does it mean if something is fully tax deductible?

Deduction in tax law (referred to as a tax deductible) means an item or expense that can reduce the taxes a person owes in a given year. A deductible item is subtracted from the total taxable income which can substantially reduce taxes owed by an individual or corporation.

What is the $5000 tax credit?

If you're launching a new business, you may have heard about the "$5,000 tax credit" for small businesses. While it's commonly called a tax credit, it's actually a startup cost deduction that allows new businesses to immediately deduct up to $5,000 in startup expenses from their taxable income.

What is 100% deductible?

100% Deductible Expenses: Includes holiday parties, open house meals, and certain business-critical meals. 50% Deductible Expenses: Includes client meals, business travel meals, and food for in-office meetings. Non-Deductible Expenses: Includes entertainment (e.g., sporting events) and club memberships.

What is a 100% deduction?

Meal expense that are 100% deductible: Recreational expenses primarily for employees who are not highly compensated, such as the business holiday party or the company picnic. Office snacks provided to employees at the office.

What deductions can you claim?

Deductions you can claim. How to claim deductions. Work-related deductions. Memberships, accreditations, fees and commissions. Meals, entertainment and functions. Gifts and donations. Investments, insurance and super. Cost of managing tax affairs.

What items are fully tax deductible?

You can deduct these expenses whether you take the standard deduction or itemize: Alimony payments. Business use of your car. Business use of your home. Money you put in an IRA. Money you put in health savings accounts. Penalties on early withdrawals from savings. Student loan interest. Teacher expenses.

What items are 100% deductible?

Small businesses can fully deduct the cost of advertising, employee wages, office supplies and equipment, business travel, and professional services like legal or accounting fees. Business insurance premiums, work-related education expenses, and bank fees are also typically 100% deductible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Deductions for Waiters & Waitresses?

Tax deductions for waiters and waitresses refer to the tax benefits they can claim, specifically regarding their tips and other related expenses incurred in their job. This can include deductions for uniforms, supplies, and business-related travel.

Who is required to file Tax Deductions for Waiters & Waitresses?

Waiters and waitresses who receive tips and have income from their employment are required to file tax deductions. This includes those who earn above a certain income threshold and need to report both their wages and tips.

How to fill out Tax Deductions for Waiters & Waitresses?

To fill out tax deductions for waiters and waitresses, individuals must report their total income from tips and wages on their tax return, as well as any deductible expenses related to their job. They should accurately track their tips and submit IRS forms like Schedule C or Schedule A where applicable.

What is the purpose of Tax Deductions for Waiters & Waitresses?

The purpose of tax deductions for waiters and waitresses is to reduce taxable income by allowing them to claim expenses related to their work, ultimately lowering their overall tax liability and ensuring they are not taxed too heavily on their income.

What information must be reported on Tax Deductions for Waiters & Waitresses?

Waiters and waitresses must report their total income including wages and tips, any business expenses like uniform costs or supplies, and other relevant deductions on their tax return. This ensures all income is accounted for and deductions are properly applied.

Fill out your tax deductions for waiters online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deductions For Waiters is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.