Get the free AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION

Show details

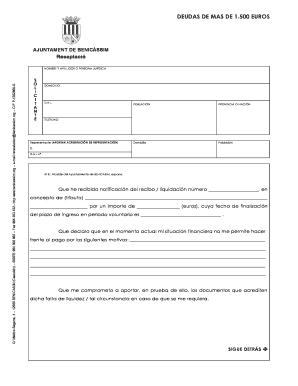

Este formulario es para solicitar una exención de impuestos ad valorem, que requiere que se complete el formulario de solicitud y se adjunten documentos necesarios. Se aplican condiciones y definiciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ad valorem tax exemption

Edit your ad valorem tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ad valorem tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ad valorem tax exemption online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ad valorem tax exemption. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ad valorem tax exemption

How to fill out AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION

01

Obtain the AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION form from your local tax office or online.

02

Read the instructions provided on the form carefully to understand the eligibility criteria.

03

Fill out your personal information including name, address, and contact details in the designated sections.

04

Provide information about the property for which you are seeking tax exemption, including its address and parcel number.

05

Indicate the specific reason for the exemption request, citing applicable laws or reasons as necessary.

06

Attach any required documentation that supports your exemption claim, such as proof of eligibility.

07

Review your application for completeness and accuracy to ensure all required fields are filled out.

08

Sign and date the application at the bottom as required.

09

Submit the completed application to the appropriate office either in person or via mail by the given deadline.

Who needs AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION?

01

Individuals or businesses that own property and believe they qualify for a tax exemption due to specific criteria, such as non-profit organizations, veterans, or certain types of businesses.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay ad valorem tax in Georgia every year?

Payment of ad valorem tax is a prerequisite to receiving a tag or renewal decal. Ad valorem taxes are due each year on all vehicles whether they are operational or not, even if the tag or registration renewal is not being applied for.

How do you calculate ad valorem tax in Florida?

To determine the ad valorem tax, multiply the taxable value (assessed value less any exemptions) by the millage rate and divide by 1,000. For example, $100,000 in taxable value with a millage rate of 5.0000 would generate $500 in taxes. The Property Appraiser certifies the values and exemptions on the tax roll.

What is ad valorem tax exemption in Florida?

The Ad-Valorem Tax Exemption is an incentive that is provided by state and County law that is intended to encourage the rehabilitation and maintenance of historic structures.

What is an example of an ad valorem tax in the UK?

Ad valorem tax examples An ad valorem tax is expressed as a percentage. For example, VAT is charged at a rate of 20% in the UK. A 20% ad valorem tax increases production costs by 20% at each level of output, if you consider the supply curve to be the same as a cost curve in an ad valorem tax diagram.

What is the meaning of ad valorem?

Ad valorem translated directly from Latin, means "according to [the] value [of something].” In practical use, the term is used in taxation to designate taxes levied against property, real or personal, at a certain rate based upon the property's value.

What is a non-ad valorem tax Florida example?

Examples of non-ad valorem taxes are storm water utility, solid waste, security and fire and rescue.

Who qualifies for tax exemption in Florida?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

What is the ad valorem tax exemption in Florida?

The Ad-Valorem Tax Exemption is an incentive that is provided by state and County law that is intended to encourage the rehabilitation and maintenance of historic structures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION?

The AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION is a form that property owners use to apply for additional exemptions on their property taxes based on certain qualifying criteria, such as ownership or use of the property.

Who is required to file AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION?

Property owners who wish to claim additional tax exemptions for their properties must file the AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION. This may include owners of properties used for charitable, religious, or educational purposes.

How to fill out AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION?

To fill out the AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION, property owners need to provide necessary information such as property details, ownership status, and the specific exemption being claimed, along with any required supporting documents.

What is the purpose of AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION?

The purpose of the AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION is to allow property owners to formally request additional exemptions on their property taxes, thereby reducing their overall tax liability under qualifying conditions.

What information must be reported on AD VALOREM TAX EXEMPTION - SUPPLEMENTAL APPLICATION?

The information that must be reported includes the property's identification details, ownership information, the type of exemption being sought, the use of the property, and any necessary documentation that supports the claim for the exemption.

Fill out your ad valorem tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ad Valorem Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.