Get the free Investors Choice DIVIDEND REINVESTMENT APPLICATION

Show details

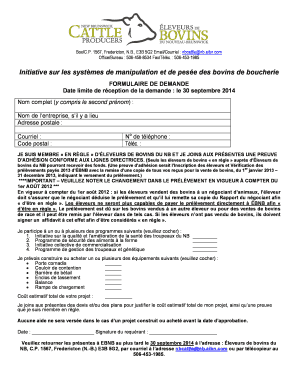

This document serves as an enrollment application for investors to participate in a dividend reinvestment and direct stock purchase plan for shares of The Brink’s Company.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investors choice dividend reinvestment

Edit your investors choice dividend reinvestment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investors choice dividend reinvestment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investors choice dividend reinvestment online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit investors choice dividend reinvestment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investors choice dividend reinvestment

How to fill out Investors Choice DIVIDEND REINVESTMENT APPLICATION

01

Obtain the Investors Choice Dividend Reinvestment Application form from the official website or your financial advisor.

02

Read the instructions carefully to understand the terms and conditions of the dividend reinvestment plan.

03

Fill in your personal information, including your name, address, and contact details in the form.

04

Provide your investor identification number or account number as required.

05

Indicate your election to participate in the dividend reinvestment plan by checking the appropriate box.

06

Select the option for how you want to reinvest your dividends (e.g., reinvest all or a specific percentage).

07

Review your selections and ensure all information is accurate.

08

Sign and date the application form to authorize your participation.

09

Submit the completed form to the designated address provided in the instructions, either by mail or electronically if options are available.

Who needs Investors Choice DIVIDEND REINVESTMENT APPLICATION?

01

Investors who wish to automatically reinvest their dividends into additional shares of a company's stock.

02

Shareholders looking to increase their investment over time without needing to make additional cash purchases.

03

Long-term investors aiming for capital appreciation and compounding growth from dividends.

Fill

form

: Try Risk Free

People Also Ask about

How much to make $500 a month in dividends?

Shares of public companies that split profits with shareholders by paying cash dividends yield between 2% and 6% a year. The math: Putting $250,000 into low-yielding dividend stocks or $83,333 into high-yielding shares will get you $500 a month. However, most dividends are paid quarterly, semi-annually or annually.

How much to make $1000 a month in dividends?

Comparing Dividend Investments Strategy FeatureHigh to Yield Stocks (6% to 12% yields) Investment Needed for $1,000/month $100,000 to $200,000 Risk Level Higher risk of dividend cuts Portfolio Size 5 to 10 high to yield stocks Income Stability More volatile3 more rows • Jan 30, 2025

Is dividend reinvestment a good strategy?

Dividend reinvestment naturally complements a passive investment approach. Automated reinvestment eliminates the need for active management, reducing emotional decisions driven by market volatility. This makes it easier for investors to stay consistent and focused on their long-term goals.

How to activate drip?

Set up dividend reinvestment Select Account → Menu (3 bars) → Investing. In the Dividend Reinvestment section, select Enable Dividend Reinvestment. Toggle the switch On. If prompted, complete the onboarding process.

How to set up DRP in Computershare?

Online. You can sign up to the DRIP via Investor Centre, our secure shareholder website. Using your Shareholder Reference Number (SRN) to register, select 'Dividend Plans' and click 'amend' to change your election choices.

How to invest in a dividend reinvestment plan?

To set up a DRIP, you need at least one DRIP eligible security in your account. If you set up a DRIP for your entire account, any new eligible securities you purchase will automatically be included in the program.

How to start drip investing?

A traditional DRIP is tricky to set up -- it involves buying at least one share in a company and then paying to acquire an actual share certificate (paper form). Then you fill out a form and send it to the company's transfer agent to enroll in the DRIP program.

What is the entry for dividend reinvestment?

Reinvestment transactions will be reported in the Activity section on your regular brokerage statement. A line entry will show the total amount of the dividend payment; a separate line entry will report the number of shares purchased and the purchase price per share.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Investors Choice DIVIDEND REINVESTMENT APPLICATION?

The Investors Choice Dividend Reinvestment Application is a form that allows shareholders to reinvest their cash dividends into additional shares of the company's stock, instead of receiving cash payments.

Who is required to file Investors Choice DIVIDEND REINVESTMENT APPLICATION?

Shareholders who wish to participate in the dividend reinvestment plan and reinvest their dividends into additional shares are required to file the application.

How to fill out Investors Choice DIVIDEND REINVESTMENT APPLICATION?

To fill out the application, shareholders typically need to provide their personal information, including name, address, social security number, and brokerage information, and indicate their choice to enroll in the dividend reinvestment plan.

What is the purpose of Investors Choice DIVIDEND REINVESTMENT APPLICATION?

The purpose of the application is to enable shareholders to automatically reinvest dividends into more shares of the company, facilitating investment growth and compounding returns.

What information must be reported on Investors Choice DIVIDEND REINVESTMENT APPLICATION?

The application must report the shareholder's name, address, social security number or tax identification number, the number of shares held, and the choice to enroll in the dividend reinvestment plan.

Fill out your investors choice dividend reinvestment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investors Choice Dividend Reinvestment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.