Get the free Cumberland Property Tax Assistance

Show details

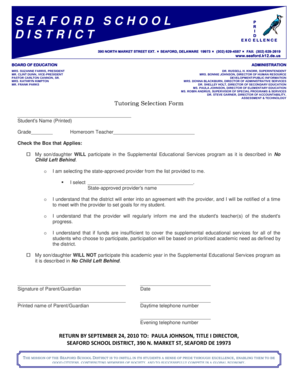

Application for the Senior Circuit Breaker Program to assist property tax relief for seniors in the Town of Cumberland.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cumberland property tax assistance

Edit your cumberland property tax assistance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cumberland property tax assistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cumberland property tax assistance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cumberland property tax assistance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cumberland property tax assistance

How to fill out Cumberland Property Tax Assistance

01

Obtain the Cumberland Property Tax Assistance application form from the local government website or office.

02

Fill out personal information including your name, address, and contact information.

03

Provide details about your property, including the parcel number and property description.

04

Indicate your income level and provide any necessary documentation, such as tax returns or pay stubs.

05

Review the application for accuracy and completeness before submission.

06

Submit the application by the specified deadline, either online or in person at the designated office.

Who needs Cumberland Property Tax Assistance?

01

Homeowners in Cumberland who are experiencing financial hardship.

02

Individuals who are elderly or disabled and have difficulty paying property taxes.

03

Residents with low income who need assistance in managing their property tax bills.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying taxes in North Carolina?

At What Age Do Seniors Stop Paying Property Taxes in NC? North Carolia offers property tax relief programs for qualifying individuals including older adults. The Homestead Exemption provides some relief for residents who are 65 and older or who are totally and permanently disabled.

At what age do seniors stop paying property taxes in NC?

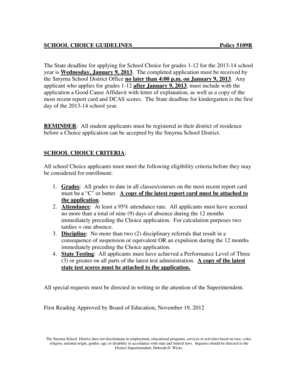

Circuit Breaker Property Tax Deferment Requirements: Must be 65 or older or totally and permanently disabled.

What happens if you miss the local property tax deadline?

If unpaid property taxes are left unaddressed, it could accumulate additional fees and penalties, and the County could ultimately auction the property to recover taxes owed. This process takes some time, but if you act quickly, you have a better chance of saving your home.

Who is exempt from property tax in NC?

North Carolina General Statutes for Property Tax Relief includes Elderly and Disabled Exclusion, Disabled Veteran Exclusion and Circuit Breaker Tax Deferment Program. Property Tax Exemption or Exclusion includes Non-Profit Organizations for religious, scientific, charitable and educational purposes.

At what age do seniors stop paying property taxes in Arkansas?

Age 65 or Disabled Homeowner Property Tax Relief If a person who is age 65 or older or who is disabled purchases a homestead property, the taxable assessed value of the residence can be frozen at the next assessment date after purchasing the homestead.

How can I lower my property taxes in North Carolina?

Programs Senior and Disabled Program: Reduce the Taxable Value of Your Home. Tax Deferment: Pay Only a Percentage of Your Income. Disabled Veteran Program: Get a Veteran Discount.

Is there a senior discount on property taxes in North Carolina?

North Carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of your residence (whichever is greater).

What is the homestead exemption in Cumberland County?

Residents who qualify for the Homestead Exclusion receive an exclusion of the greater of $25,000 or 50% of the qualifying, assessed value of their permanent residence. Must be a minimum of 65 years of age or totally and permanent disabled (no minimum age) and meet income requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cumberland Property Tax Assistance?

Cumberland Property Tax Assistance is a program designed to provide financial relief to eligible property owners in Cumberland County by offering assistance with property taxes.

Who is required to file Cumberland Property Tax Assistance?

Property owners in Cumberland County who meet specific eligibility criteria, such as income limits or age requirements, are required to file for Cumberland Property Tax Assistance.

How to fill out Cumberland Property Tax Assistance?

To fill out the Cumberland Property Tax Assistance application, property owners should gather required documents, complete the application form with the necessary information, and submit it to the appropriate local tax office.

What is the purpose of Cumberland Property Tax Assistance?

The purpose of Cumberland Property Tax Assistance is to alleviate the financial burden of property taxes for qualified residents, particularly seniors, low-income families, and individuals with disabilities.

What information must be reported on Cumberland Property Tax Assistance?

The information that must be reported on the Cumberland Property Tax Assistance includes personal identification details, property information, income levels, and any other relevant financial information required by the application.

Fill out your cumberland property tax assistance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cumberland Property Tax Assistance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.