Get the free HDFC Long Term Equity Fund

Show details

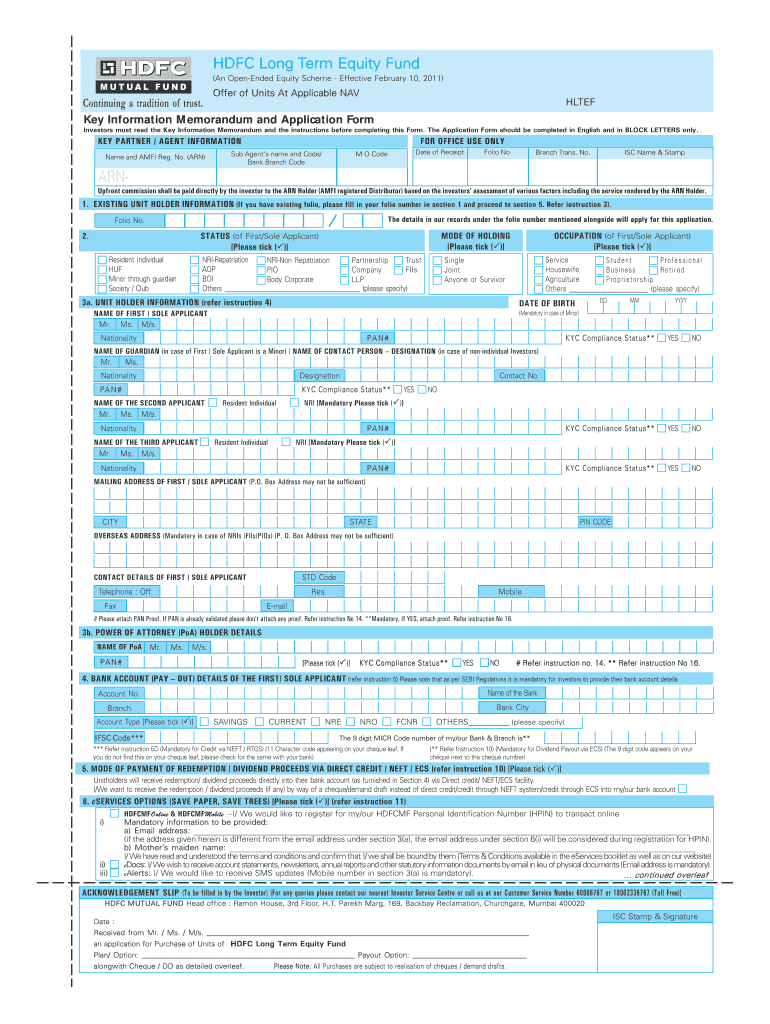

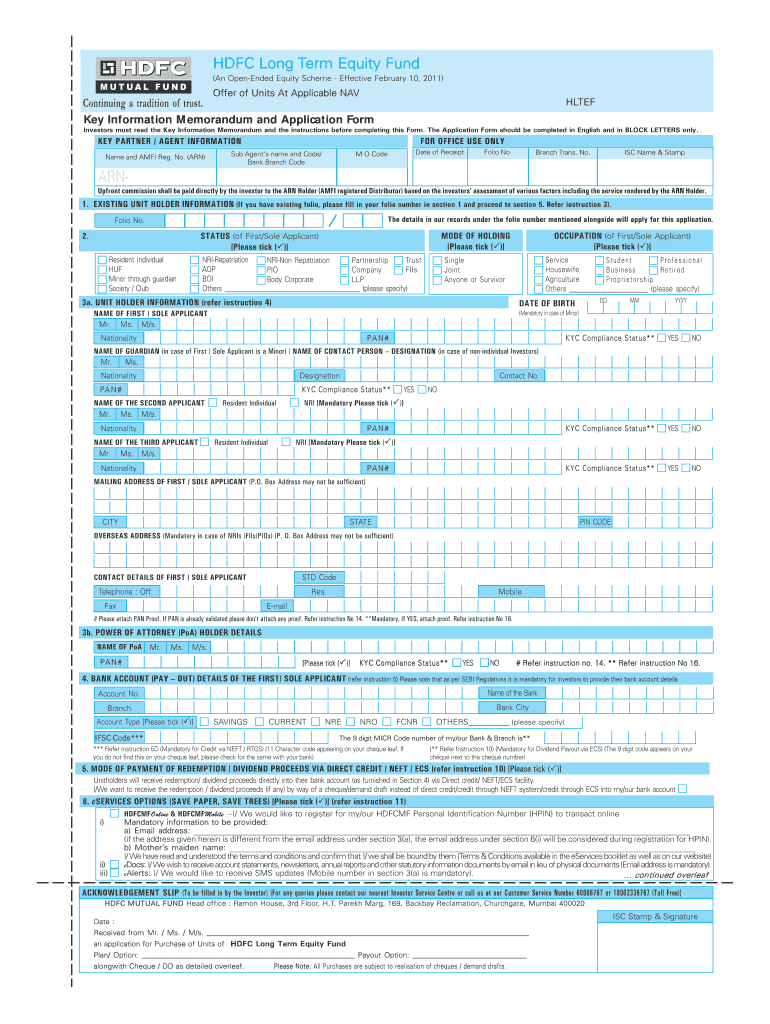

This document serves as a key information memorandum and application form for prospective investors wishing to invest in the HDFC Long Term Equity Fund, detailing terms, conditions, and information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hdfc long term equity

Edit your hdfc long term equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hdfc long term equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hdfc long term equity online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hdfc long term equity. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hdfc long term equity

How to fill out HDFC Long Term Equity Fund

01

Step 1: Visit the official HDFC Mutual Fund website or download the HDFC Mutual Fund app.

02

Step 2: Register or log in to your account.

03

Step 3: Navigate to the 'Invest' section and select 'HDFC Long Term Equity Fund'.

04

Step 4: Choose the investment option (SIP or lump sum) based on your preference.

05

Step 5: Enter the investment amount and select the frequency if choosing SIP.

06

Step 6: Fill in your personal details, including PAN and KYC information.

07

Step 7: Review your application and confirm the details.

08

Step 8: Make the payment through the available payment options.

09

Step 9: Receive your confirmation email along with the transaction reference number.

Who needs HDFC Long Term Equity Fund?

01

Investors looking for long-term capital appreciation.

02

Individuals seeking to invest in a diversified equity portfolio.

03

Retirement planners aiming for wealth accumulation over a long duration.

04

Those with a higher risk appetite who can withstand market volatility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HDFC Long Term Equity Fund?

HDFC Long Term Equity Fund is an open-ended equity scheme offered by HDFC Mutual Fund, designed to provide long-term capital appreciation by primarily investing in equity and equity-related instruments.

Who is required to file HDFC Long Term Equity Fund?

Investors interested in participating in the fund are required to file an application form to invest in HDFC Long Term Equity Fund.

How to fill out HDFC Long Term Equity Fund?

To fill out the application for HDFC Long Term Equity Fund, investors need to provide their personal details, investment amount, bank details, and KYC documentation, and submit the completed form to the designated authority.

What is the purpose of HDFC Long Term Equity Fund?

The purpose of HDFC Long Term Equity Fund is to generate wealth for investors over the long term by investing primarily in a diversified portfolio of equities, aimed at long-term capital growth.

What information must be reported on HDFC Long Term Equity Fund?

Investors must report details such as their personal information, investment amount, risk profile, and any relevant KYC documentation during the application process for HDFC Long Term Equity Fund.

Fill out your hdfc long term equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc Long Term Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.