Get the free HDFC Fixed Maturity Plans - Series XVII

Show details

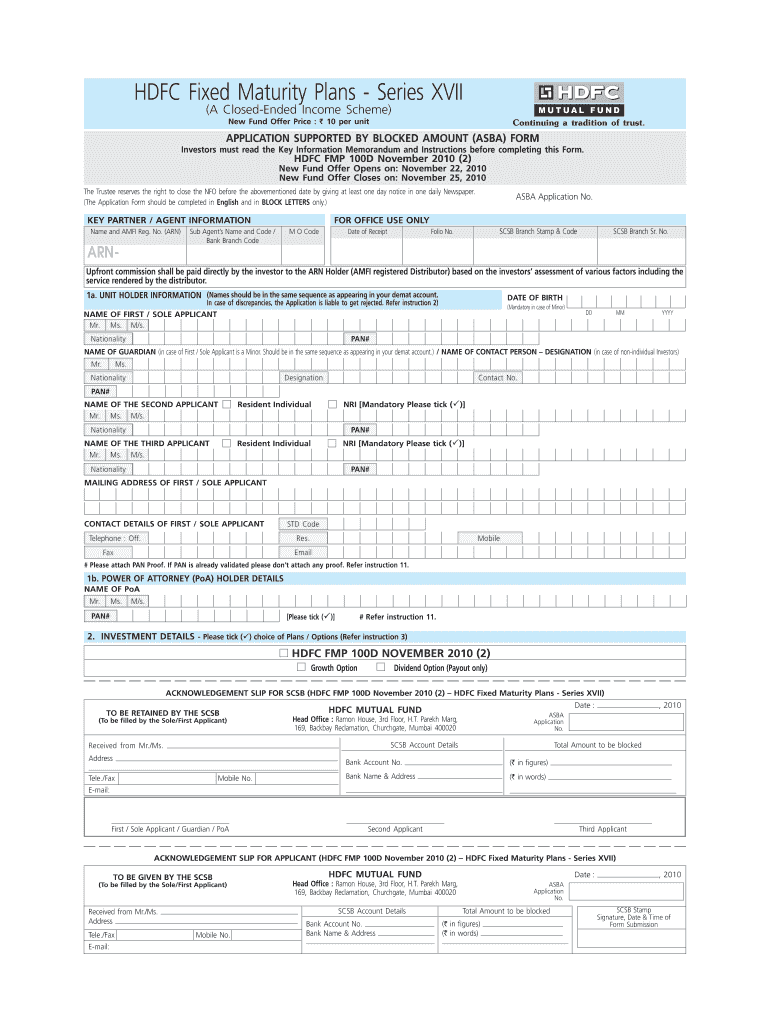

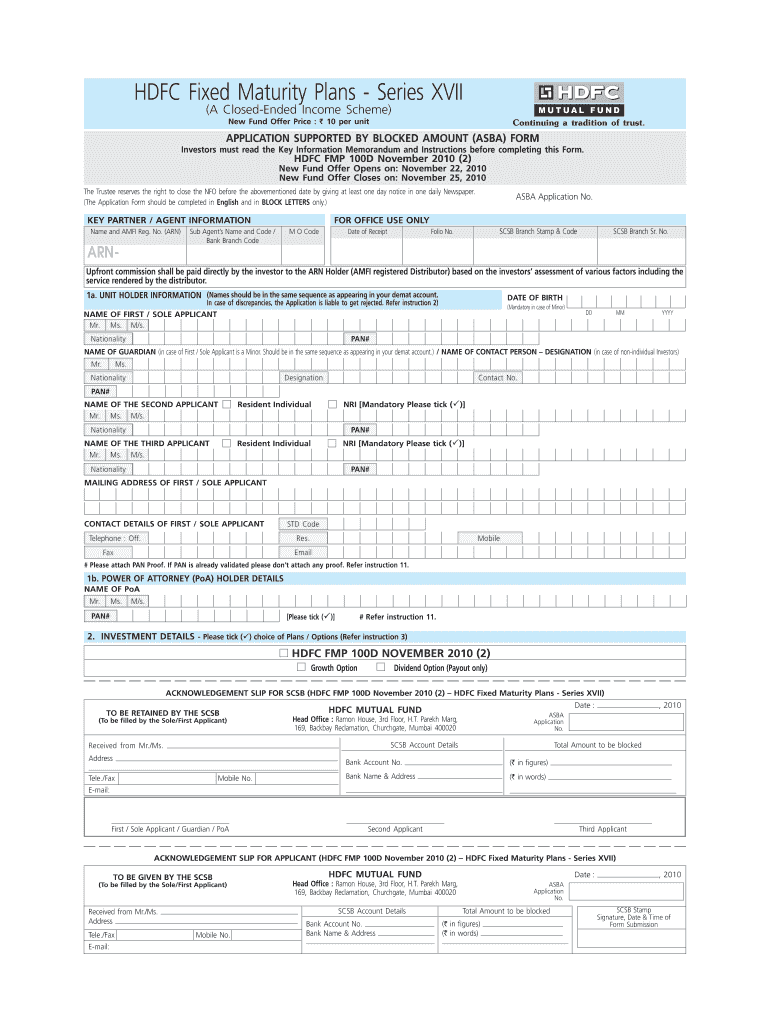

This document is an application form for investing in the HDFC Fixed Maturity Plans - Series XVII, providing details on the investment process, key partner information, and necessary declarations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hdfc fixed maturity plans

Edit your hdfc fixed maturity plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hdfc fixed maturity plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hdfc fixed maturity plans online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hdfc fixed maturity plans. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hdfc fixed maturity plans

How to fill out HDFC Fixed Maturity Plans - Series XVII

01

Gather all necessary documents such as your identification, address proof, and income details.

02

Visit the HDFC bank website or your nearest HDFC branch to access information about the Fixed Maturity Plans - Series XVII.

03

Fill out the application form for the Fixed Maturity Plan - Series XVII with the required personal and financial information.

04

Select your investment amount and tenure based on your financial goals.

05

Choose the mode of payment for the investment (online transfer, cheque, etc.).

06

Review all the details provided in the application to ensure accuracy.

07

Submit the completed application form along with any required documents to the bank.

08

Once processed, keep a record of the transaction or receipt for your future reference.

Who needs HDFC Fixed Maturity Plans - Series XVII?

01

Individuals looking for a fixed-income investment option for a specific period.

02

Investors seeking to diversify their portfolio with low-risk investment instruments.

03

Those who want to enjoy a preset maturity benefit without market volatility.

04

People preparing for short to medium-term financial goals and want assured returns.

Fill

form

: Try Risk Free

People Also Ask about

How does a fixed maturity plan work?

How do FMPs work? FMPs invest in debt securities having maturities that correspond to the scheme's maturity date. These securities are held to maturity, thus there is no interest rate risk. Interest rate risk refers to variations in a scheme's NAV as a result of interest rate changes.

What is HDFC Life Fixed maturity Plan?

The “HDFC Life Sanchay Fixed Maturity Plan” from HDFC Life is a life insurance policy that offers assured returns in the form of a lump sum benefit to assist you in reaching your goals while also protecting the future of your loved ones in case of unforeseen circumstances.

How is HDFC Life Sanchay fixed maturity plan?

HDFC Life Sanchay Fixed Maturity is one of many savings plans from HDFC Life Insurance. It is a non-linked, non-participating individual savings plan, meaning that the returns are independent of market fluctuations and does not include any kind of bonus or dividend declared from company profits.

What is a fixed maturity plan?

Fixed Maturity Plan (FMP) is a tenure-specific mutual fund scheme that aligns its investments in debt instruments with the scheme's duration. Spanning from months to years, FMPs suit investors seeking predictable returns over a defined investment horizon.

What are the benefits of HDFC Life maturity?

Advantages of a Term Insurance with Maturity Benefits While the nominee gets a death benefit if the policyholder dies during the policy, the money invested is not lost either if he survives. At the maturity of the policy, the total premium amount and bonus are paid to the policyholder as a consolidated amount.

Can I break my HDFC Life policy before maturity?

Surrender value allows policyholders to cancel their insurance policies before maturity and receive a partial refund of their premiums.

Is FMP tax free?

The tax treatment of FMPs is similar to that of debt mutual funds: If you sell your FMP units within 3 years, the gains are treated as short-term capital gains (STCG) and taxed according to your applicable income tax slab.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HDFC Fixed Maturity Plans - Series XVII?

HDFC Fixed Maturity Plans - Series XVII is a type of close-ended debt mutual fund offered by HDFC Mutual Fund, which primarily invests in fixed-income securities to provide returns over a predetermined period.

Who is required to file HDFC Fixed Maturity Plans - Series XVII?

Investors who wish to participate in HDFC Fixed Maturity Plans - Series XVII need to fill out the application form and submit it along with the necessary documents required for investing in the fund.

How to fill out HDFC Fixed Maturity Plans - Series XVII?

To fill out the HDFC Fixed Maturity Plans - Series XVII application form, investors need to provide personal details, choose the investment amount, select the plan option, and submit identity and address proof as per the guidelines.

What is the purpose of HDFC Fixed Maturity Plans - Series XVII?

The purpose of HDFC Fixed Maturity Plans - Series XVII is to provide investors with a fixed return over a specified term, aiming for capital preservation and predictable returns through investments in debt securities.

What information must be reported on HDFC Fixed Maturity Plans - Series XVII?

Investors must report details such as investment amount, investor personal information, bank account details for transactions, tax implications, and any other relevant information as required by HDFC Mutual Fund.

Fill out your hdfc fixed maturity plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc Fixed Maturity Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.