Get the free ICICI Pru LifeStage Wealth II

Show details

This document outlines the features, benefits, and details of the ICICI Pru LifeStage Wealth II unit linked insurance plan, which allows policyholders to invest their savings according to their financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign icici pru lifestage wealth

Edit your icici pru lifestage wealth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your icici pru lifestage wealth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit icici pru lifestage wealth online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit icici pru lifestage wealth. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

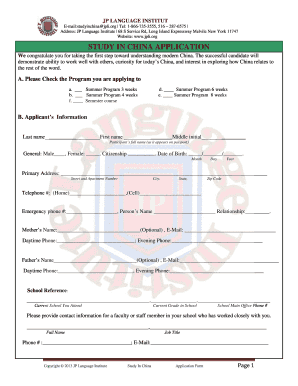

How to fill out icici pru lifestage wealth

How to fill out ICICI Pru LifeStage Wealth II

01

Visit the ICICI Prudential Insurance website or your nearest branch.

02

Select the 'ICICI Pru LifeStage Wealth II' product from the list of available policies.

03

Review the policy details, including the benefits and coverage.

04

Fill out the application form with necessary personal information like name, age, address, and contact details.

05

Provide details about your income and financial status.

06

Choose the premium payment frequency (monthly, quarterly, annually).

07

Select the sum assured amount based on your financial goals.

08

Review and submit the application form along with necessary documents, such as identity proof, address proof, and income proof.

09

Make the initial premium payment as instructed.

10

Wait for confirmation and policy issuance from ICICI Prudential.

Who needs ICICI Pru LifeStage Wealth II?

01

Individuals looking for a combination of life insurance and investment.

02

People planning for long-term financial goals like children's education or retirement.

03

Those who prefer a planned approach to wealth accumulation over time.

04

Investors seeking a structured product with potential market-linked returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the return of ICICI Prudential last 5 years?

Fund Performance: The fund's annualized returns for the past 3 years & 5 years has been around 18.83% & 22.26%. The ICICI Prudential Large Cap Fund comes under the Equity category of ICICI Prudential Mutual Funds.

Can I surrender my ICICI Prudential policy after 5 years?

ICICI Prudential Life Insurance Surrender Value Most insurance companies have a three-year completion period to surrender a policy, from where the policyholder is entitled to avail of 30% amount of all the premiums he has paid to date. And this surrender value keeps increasing with the passing years.

Is ICICI Prudential Life Insurance good or bad?

4.5 / 5(Based on 110 Reviews)

What is the lock in period of ICICI Prudential Life Insurance?

ULIPs have a mandatory lock-in period of five years. Partial or complete withdrawals are usually permitted only after this period is over. In addition to completing the ULIP lock-in period, you must have paid all premium payments for the first five policy years to be eligible for partial withdrawals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ICICI Pru LifeStage Wealth II?

ICICI Pru LifeStage Wealth II is a life insurance product offered by ICICI Prudential that focuses on wealth accumulation through systematic investment strategies tailored to different life stages.

Who is required to file ICICI Pru LifeStage Wealth II?

Individuals or entities who have purchased the ICICI Pru LifeStage Wealth II policy need to file it for record-keeping and tax purposes, as well as for claiming benefits under the policy.

How to fill out ICICI Pru LifeStage Wealth II?

To fill out ICICI Pru LifeStage Wealth II, you typically need to provide personal information, choose an investment option based on your financial goals, and submit necessary documents as required by the insurer.

What is the purpose of ICICI Pru LifeStage Wealth II?

The purpose of ICICI Pru LifeStage Wealth II is to provide policyholders with a systematic investment plan that helps build wealth over time while also offering life insurance coverage.

What information must be reported on ICICI Pru LifeStage Wealth II?

Required information generally includes personal details of the policyholder, premium payment details, chosen investment options, and beneficiary information.

Fill out your icici pru lifestage wealth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Icici Pru Lifestage Wealth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.