Get the free TIF Business Loan Fund Application

Show details

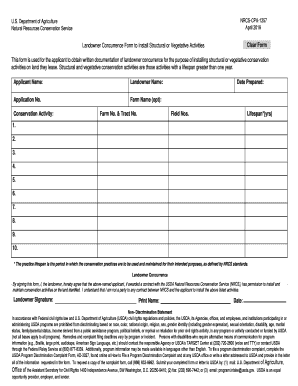

This document serves as an application for the TIF Business Loan Fund offered by the Town of Richmond, detailing requirements for personal information, business history, project descriptions, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tif business loan fund

Edit your tif business loan fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tif business loan fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tif business loan fund online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tif business loan fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tif business loan fund

How to fill out TIF Business Loan Fund Application

01

Gather necessary documents including your business plan, financial statements, and tax returns.

02

Visit the official TIF Business Loan Fund website to download the application form.

03

Complete the application form, ensuring all sections are filled accurately.

04

Attach all required supporting documents as specified in the application instructions.

05

Review the application thoroughly for any errors or missing information.

06

Submit your completed application to the designated TIF administration office, either online or via mail.

Who needs TIF Business Loan Fund Application?

01

Small business owners seeking financial assistance for growth or development.

02

Entrepreneurs looking to start a new business venture.

03

Established businesses aiming to expand operations or invest in new projects.

04

Non-profit organizations that require funding for business-related initiatives.

Fill

form

: Try Risk Free

People Also Ask about

What does TIF stand for in banking?

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in the United States.

What is the downside to a TIF?

TIFs raise the value of the tax base, granting local and regional governments larger budgets (once the TIF is retired, i.e., when the bonds are repaid). TIF CONS: • TIFs may set different urban areas and different levels of government in competition with one another over funding.

How to monetize a TIF?

The TIF Monetization Process Negotiate With the Investor. The developer negotiates with investors on acceptable terms and pricing levels. A Due Diligence Period. Investors will look to analyze the real estate project, the taxing authority, and tax history. Memorialize Bond/Note Documents. Close and Fund on a Specific Date.

Is TIF a good thing?

Pro: TIFs can alleviate some of the burden on developers TIF's can reduce what the developer pays for the development by providing a capital infusion, reducing the amount of equity the developer must bring to the table or by recouping development costs over a period of time.

Can you sell a TIF?

By selling your TIF bond, you can convert it into immediate capital, enhancing your project's returns while reducing contributed equity. Utilize our free online tool to estimate your TIF's value based on your development specifications today.

Why is TIF controversial?

The main controversy is that TIF funding prevents the various taxing bodies (such as schools and parks) from getting what might be a natural increase in tax revenue, or one that keeps up with inflation. The money is also ``off-budget,'' under pretty much direct mayoral control with little oversight.

What is a TIF and how does it work?

A TIF allows the increase in assessed value (increment) of an improvement to real property to be exempt from real property taxation (the “exempted taxes”) and instead have those funds assist with costs necessary for a project to move forward.

What are the negatives of TIF?

TIF CONS: • TIFs may set different urban areas and different levels of government in competition with one another over funding. Cities can obtain revenues that would otherwise have flowed to overlying government levels or school districts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TIF Business Loan Fund Application?

The TIF Business Loan Fund Application is a request form for financial assistance from the Tax Increment Financing (TIF) program, which aims to support small businesses in specific districts.

Who is required to file TIF Business Loan Fund Application?

Businesses operating within the designated TIF districts that seek financial assistance for growth or improvement projects are required to file the TIF Business Loan Fund Application.

How to fill out TIF Business Loan Fund Application?

To fill out the TIF Business Loan Fund Application, applicants must provide detailed information about their business, the purpose of the loan, financial statements, and project plans as specified in the application guidelines.

What is the purpose of TIF Business Loan Fund Application?

The purpose of the TIF Business Loan Fund Application is to facilitate the funding of projects that improve economic conditions, create jobs, and promote development within TIF districts.

What information must be reported on TIF Business Loan Fund Application?

The application must report business details, loan purpose, financial projections, project budgets, and any other required documentation as outlined in the application instructions.

Fill out your tif business loan fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tif Business Loan Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.