Get the free DE-174

Show details

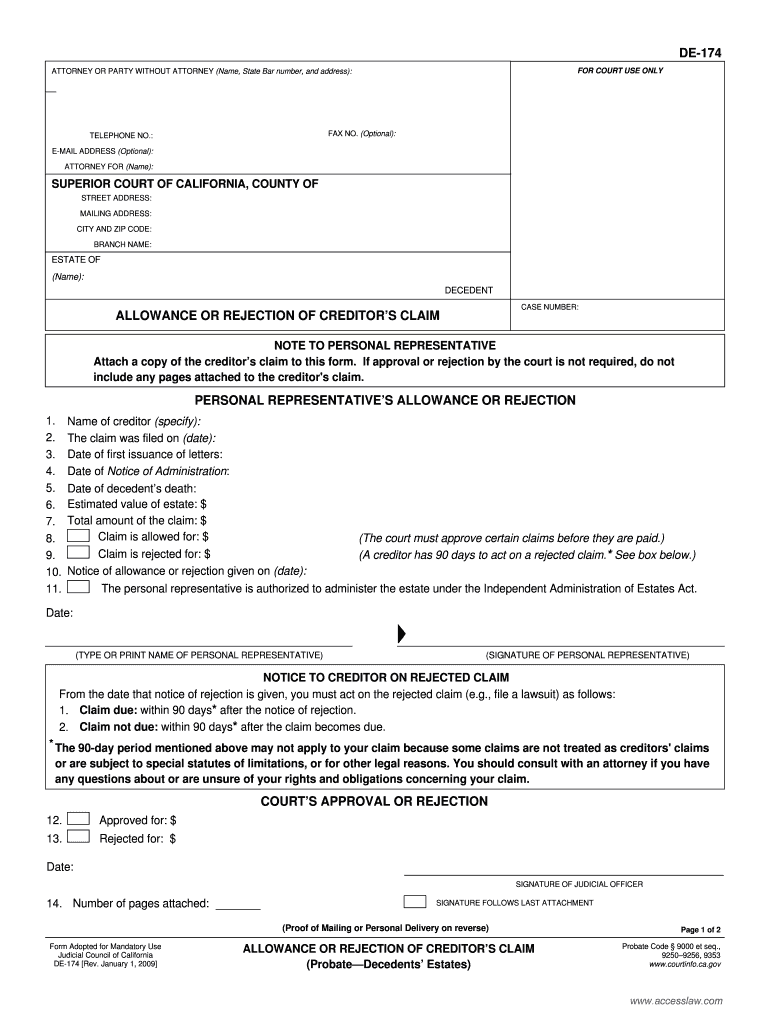

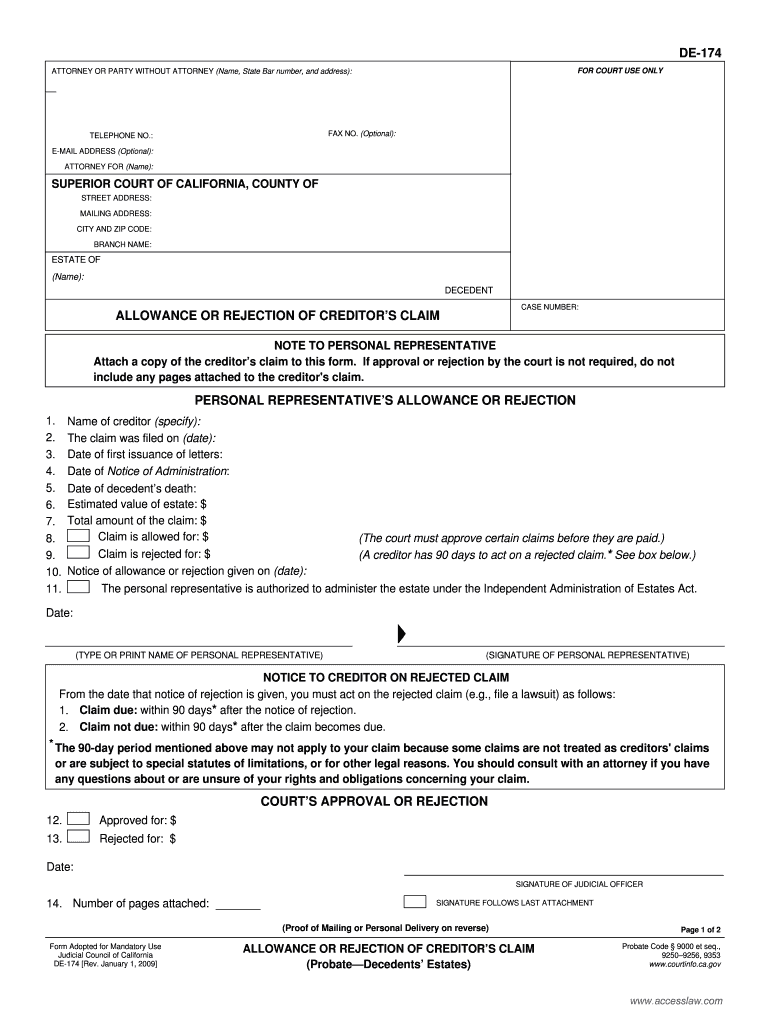

This form is used for the allowance or rejection of a creditor's claim in the probate process of decedents' estates in California.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign de-174

Edit your de-174 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de-174 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit de-174 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit de-174. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out de-174

How to fill out DE-174

01

Obtain the DE-174 form from the appropriate legal or court website.

02

Read the instructions carefully to understand the purpose of each section.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide detailed information regarding the case or issue related to the DE-174.

05

Check all entries for accuracy and completeness.

06

Sign and date the form as required.

07

Submit the form according to the provided submission guidelines.

Who needs DE-174?

01

Individuals involved in a legal case who need to request specific court actions or information.

02

Attorneys representing clients in legal matters requiring the completion of DE-174.

03

Parties who are appealing a court decision or seeking modifications in ongoing cases.

Fill

form

: Try Risk Free

People Also Ask about

What is a letter of testamentary in Santa Clara County?

Letter of Testamentary California. Issued when the person died with a Will and the person named as the Executor in the will is the person who petitions the court.

How long does probate take in Santa Clara County?

In Santa Clara County, all probate filings must get filed electronically. It can take up to 10 days, or longer, to receive filed documents back from the court. The hearing date could be 2.5 to 3 months from the time a petition is filed. There are local court rules and procedures that must get followed.

Who is entitled to letters of administration in California?

Who is entitled to Letters of Administration? A surviving spouse, or a domestic partner as defined in Section 37, which specifies one or two persons who have a Declaration of Domestic Partnership filed with the California Secretary of State's office. Children of the deceased. Grandchildren of the deceased.

What is a letter of Testamentary in California?

Letters Testamentary are legal documents issued by the probate court that empower the executor (or personal representative) named in the will to handle the deceased's estate. This includes managing assets, settling debts, and distributing remaining funds according to the will.

Can you settle an estate without probate in California?

A: In California, estates totaling less than $184,500 can avoid probate. A small estate affidavit is a less complicated process for estates valued at less than $166,250. You can determine your estate's value by taking an inventory of your personal property and real estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DE-174?

DE-174 is a form used in California for reporting wages and employee information for payroll taxes.

Who is required to file DE-174?

Employers in California who have employees and are required to report payroll information must file DE-174.

How to fill out DE-174?

To fill out DE-174, employers need to provide details about their employees, wages paid, and any applicable deductions based on the specific instructions provided on the form.

What is the purpose of DE-174?

The purpose of DE-174 is to report employee wages to the California Employment Development Department (EDD) for tax and benefit purposes.

What information must be reported on DE-174?

Information that must be reported includes the employer's information, employee names, Social Security numbers, wages earned, and any deductions or withholdings.

Fill out your de-174 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De-174 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.