Get the free BOE-230

Show details

This document is a resale certificate used in California for businesses to certify that they are purchasing items for resale, thereby exempting them from paying sales tax at the time of purchase.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe-230

Edit your boe-230 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe-230 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing boe-230 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit boe-230. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe-230

How to fill out BOE-230

01

Obtain the BOE-230 form from the California State Board of Equalization website or your local office.

02

Fill in the identifying information, including your name, address, and contact details.

03

Provide the account number associated with your business or property.

04

Indicate the period for which you are reporting, as specified in the form.

05

Complete all relevant sections based on the specific information requested, such as sales tax details or property tax assessment.

06

Double-check all entries for accuracy.

07

Sign and date the form at the designated location.

08

Submit the completed form by the due date specified by the Board of Equalization, either online or via postal mail.

Who needs BOE-230?

01

Businesses that collect sales tax in California.

02

Property owners looking to report property tax information.

03

Individuals or entities required to report specific tax information to the California State Board of Equalization.

Fill

form

: Try Risk Free

People Also Ask about

How much does a resale certificate cost in California?

Seller's Permit Information. There is no charge for a seller's permit, but sometimes security deposits are required. You can apply at a nearby CDTFA location or use online registration.

How to apply for a California reseller permit?

To register for your Seller's Permit, you can use the California Department of Tax and Fee Administration online registration tool or apply in person at one of the field offices. In order to complete your registration, you will need: Your social security number (corporate officers excluded) Your date of birth.

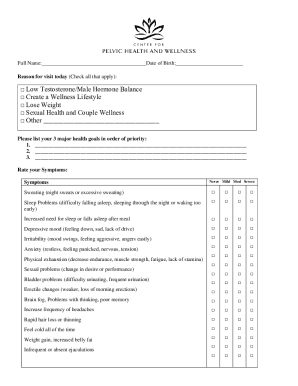

How do I fill out a California resale certificate?

Resale Certificates The name and address of the purchaser. The purchaser's seller's permit number (unless they are not required to hold one1). A description of the property to be purchase. An explicit statement that the described property is being purchased for resale. The date of the document.

What is a California resale number?

In order to have a California resale certificate, you must first apply for a California sales tax permit. This sales permit will provide you with a California Tax ID number (sales tax number) which will be a necessary field on the California resale certificate.

What is a California tax exemption certificate?

But for those directly related to the exempted business activities. It is important to note that notMoreBut for those directly related to the exempted business activities. It is important to note that not all purchases are eligible for exemption. And misuse of the certificate.

How to verify a resale certificate in California?

Verifying a seller's permit number on a resale certificate Select Verify a permit, license, or account. A seller can also call our automated toll-free number at 1-888-225-5263, available 24 hours a day, seven days a week.

What is the difference between a seller's permit and a resale certificate in California?

A seller's permit is a state license that allows you to sell items at the wholesale or retail level and to issue resale certificates to suppliers. Issuing a resale certificate allows you to buy items you will sell in your business operations without paying amounts for tax to your suppliers.

How to verify a California resale certificate?

There are two ways to verify that a customer holds a valid seller's permit: Select Verify a permit, license, or account. A seller can also call our automated toll-free number at 1-888-225-5263, available 24 hours a day, seven days a week.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOE-230?

BOE-230 is a form used in California to report transactions involving the sale of certain tangible personal property, particularly for tax purposes.

Who is required to file BOE-230?

Businesses that sell or lease tangible personal property in California may be required to file BOE-230, particularly those that make sales subject to sales tax.

How to fill out BOE-230?

To fill out BOE-230, businesses should provide details on sales, including the description of goods sold, dates of transactions, and the total amount of sales tax collected.

What is the purpose of BOE-230?

The purpose of BOE-230 is to ensure compliance with California's sales tax laws and to collect accurate information regarding sales transactions for auditing and revenue purposes.

What information must be reported on BOE-230?

Information that must be reported on BOE-230 includes the seller's information, buyer's details, item description, sales price, sales tax collected, and dates of transactions.

Fill out your boe-230 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe-230 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.