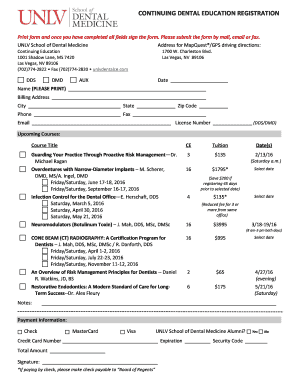

Get the free Transfer on Death Account Application

Show details

Este documento se utiliza para solicitar un cuenta Transfer on Death (TOD), permitiendo a los propietarios designar beneficiarios que recibirán los activos de la cuenta después de su fallecimiento.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death account

Edit your transfer on death account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death account online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit transfer on death account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death account

How to fill out Transfer on Death Account Application

01

Obtain the Transfer on Death (TOD) account application form from your bank or financial institution.

02

Read the instructions provided with the application form carefully.

03

Fill out your personal information, including your name, address, Social Security number, and date of birth.

04

Specify the type of account you wish to designate as a TOD account, such as a checking or savings account.

05

Provide the information of the beneficiary or beneficiaries, including their names, addresses, and relationships to you.

06

Indicate whether you want multiple beneficiaries and, if so, how the assets should be divided among them.

07

Review the information you've entered for accuracy.

08

Sign and date the application form in the designated area.

09

Submit the completed application form to your bank or financial institution, either in person or through their designated submission method.

Who needs Transfer on Death Account Application?

01

Anyone looking to ensure their assets are transferred seamlessly to beneficiaries upon their death without going through probate.

02

Individuals who want to maintain control of their accounts during their lifetime while designating beneficiaries for after they pass away.

03

Parents wanting to provide for their children or other loved ones in a straightforward manner.

Fill

form

: Try Risk Free

People Also Ask about

Are tod accounts a good idea?

TOD accounts have become increasingly popular, largely due to their simplicity and convenience. Here are some reasons people prefer them: Avoids Probate: Probate can be a time-consuming and expensive process. TOD accounts transfer ownership immediately, sparing your beneficiaries from long court proceedings.

How do you write tod?

Filling Out and Recording a TOD deed Locate the Current Deed for the Property. Read the “Common Questions” Listed on Page 3-4 of the TOD Deed. Fill Out the TOD Deed (Do Not Sign) Sign in Front of a Notary; Have Two Witnesses Sign. Record the Deed at the Recorder's Office within 60 Days of Notarizing It.

How to set up a transfer on death account?

A transfer on death is a fairly straightforward strategy to set up. You can head to your bank or other financial institution, fill out the form, and name your assets and beneficiaries. You maintain full control of the assets specified in the TOD form during your lifetime.

How to set up a transfer on a death bank account?

Setting up a TOD account is relatively easy, and it's usually as simple as filling out a TOD designation form provided by your broker or financial institution. This form will ask you to name the beneficiaries and specify the proportions of assets each will receive upon your death.

What is a transfer on a death account?

Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death. This is often accomplished through a transfer-on-death deed.

How does transfer on death work?

Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death.

What are the disadvantages of Tod accounts?

The TOD beneficiary may balk at contributing his/her share of the amount that is needed by the estate's Personal Representative. Thus, the Personal Representative may have to incur legal fees to gain access to some of the TOD assets needed to pay estate debts, taxes, and expenses.

How much is a tod?

Advantages of a transfer on death deed Get started Get started Price (one-time) Will: one-time fee of $199 per individual or $299 for couples. Trust: one-time fee of $499 per individual or $599 for couples. Price (one-time) $149 for estate plan bundle. Promotion: NerdWallet users can save up to $10.4 more rows • Jun 19, 2024

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Transfer on Death Account Application?

The Transfer on Death Account Application is a legal document that allows an individual to designate beneficiaries who will automatically receive the assets in the account upon the account holder's death, avoiding the probate process.

Who is required to file Transfer on Death Account Application?

Any account holder who wishes to ensure their assets are transferred directly to beneficiaries without going through probate can file a Transfer on Death Account Application.

How to fill out Transfer on Death Account Application?

To fill out the Transfer on Death Account Application, the account holder needs to provide personal information, specify the account type, identify the beneficiaries, and sign the form, sometimes requiring notarization.

What is the purpose of Transfer on Death Account Application?

The purpose of the Transfer on Death Account Application is to streamline the inheritance process by allowing beneficiaries to directly claim the account's assets upon the account owner's death, thus avoiding probate.

What information must be reported on Transfer on Death Account Application?

The information that must be reported includes the account holder's details, account number, beneficiary names and contact information, and any specific conditions for the transfer if applicable.

Fill out your transfer on death account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.