Get the free Central Business District Tax Abatement Application

Show details

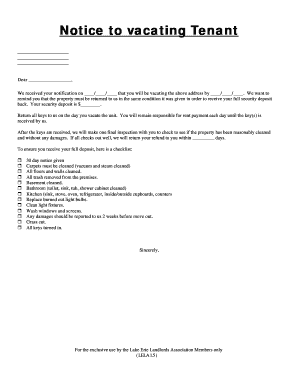

Application form for tax abatement in the central business district of Pascagoula, allowing businesses to apply for tax exemptions based on renovation or construction.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign central business district tax

Edit your central business district tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central business district tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit central business district tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit central business district tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out central business district tax

How to fill out Central Business District Tax Abatement Application

01

Download the Central Business District Tax Abatement Application form from the official website.

02

Read the application instructions carefully to understand eligibility requirements.

03

Gather all necessary documentation, including proof of business location and financial statements.

04

Fill out the application form completely, ensuring all required fields are completed accurately.

05

Provide detailed information about your business, including the nature of your business and its economic impact.

06

Attach all required supporting documents as specified in the application guidelines.

07

Review the completed application for accuracy and completeness.

08

Submit the application by the specified deadline, either online or in person as instructed.

Who needs Central Business District Tax Abatement Application?

01

Businesses located within the Central Business District seeking tax incentives to promote growth and development.

02

New businesses looking to establish themselves in the Central Business District.

03

Existing businesses that plan to expand or renovate facilities within the district.

04

Property owners looking to encourage investment and revitalization in their properties.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property tax in DC?

When a property owner turns 65 years of age or older, or when he or she is disabled, he or she may file an application immediately for disabled or senior citizen property tax relief.

What is tax abatement in DC?

The DC Tax Abatement Program was designed by the District of Columbia to help lower income residents purchase property. Homebuyers who qualify for DC Tax Abatement are exempt from paying DC Recordation Tax at settlement.

What is the NYC Coop tax abatement?

The Cooperative and Condominium Property Tax Abatement reduces the property taxes of eligible condominium and co-op owners. Individual unit owners do not apply for the abatement. Instead, managing agents and boards apply on behalf of their entire development.

Does DC have a first time penalty abatement?

The First-Time Penalty Abatement Program This policy states that the IRS may waive penalties resulting from many tax controversies if a taxpayer can demonstrate that: They have filed tax returns for the previous three years, or were not required under the law to do so.

How to avoid DC income tax?

You do not need to file a DC state tax return if: You were not required to file a 2024 federal income tax return; You were not considered a resident of DC during 2024; You were an elected member of the US government who was not domiciled in DC;

What is a local tax abatement?

What is a tax abatement? A tax abatement is a reduction in how much tax you may owe. They typically relate to property taxes. Cities and other municipalities use tax abatements as a perk to attract residential home buyers, landlords, and businesses to the area.

What is the tax abatement in the city of Hartford?

A tax abatement agreement is a contract between the City of Hartford and the owner of a rental property that fixes taxes on an annual basis at a rate less than the full tax amount. Tax abatement can be used with residential properties that is occupied solely by low or moderate-income persons or families.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Central Business District Tax Abatement Application?

The Central Business District Tax Abatement Application is a formal request submitted by property owners or developers to receive tax incentives for improvements or developments within the Central Business District.

Who is required to file Central Business District Tax Abatement Application?

Property owners or developers who intend to undertake new construction or significant renovations within the Central Business District are typically required to file this application.

How to fill out Central Business District Tax Abatement Application?

To fill out the application, applicants must provide detailed information about the property, the nature of the improvements, estimated costs, and anticipated benefits, often accompanied by required documentation and a completion timeline.

What is the purpose of Central Business District Tax Abatement Application?

The purpose of the application is to incentivize development and rehabilitation in the Central Business District by offering tax relief to qualifying projects, stimulating economic growth and attracting investment.

What information must be reported on Central Business District Tax Abatement Application?

Applicants must report information such as property details, project description, estimated costs, financing methods, timelines for completion, and any other relevant financial data as specified by the local governing body.

Fill out your central business district tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Business District Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.