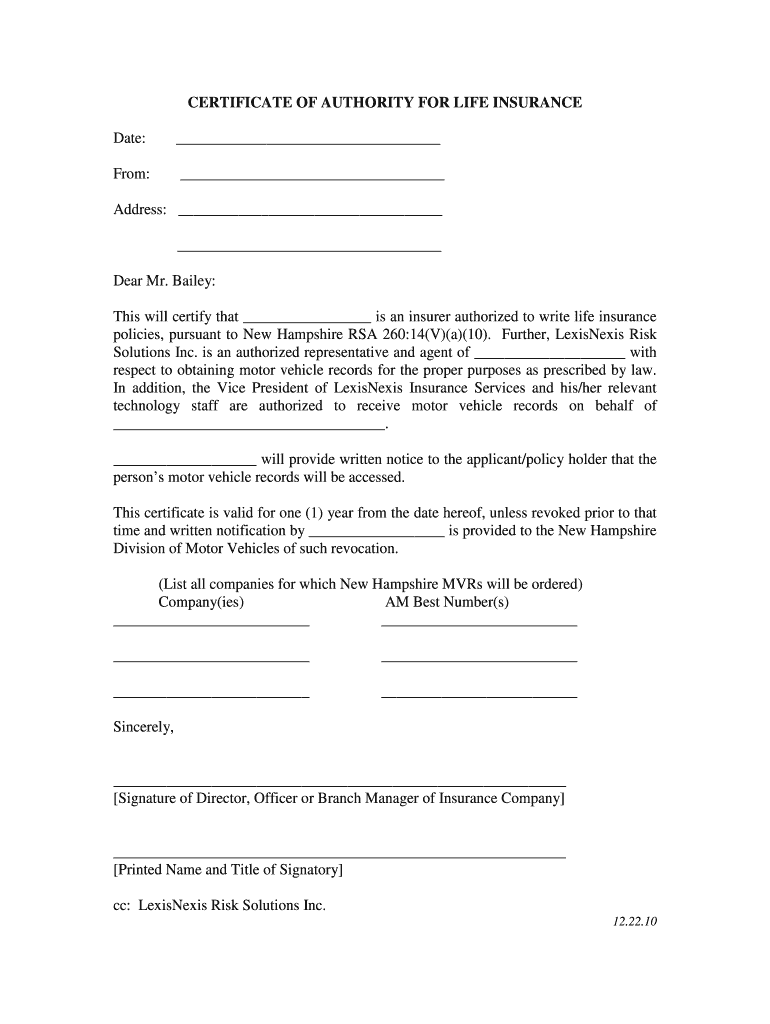

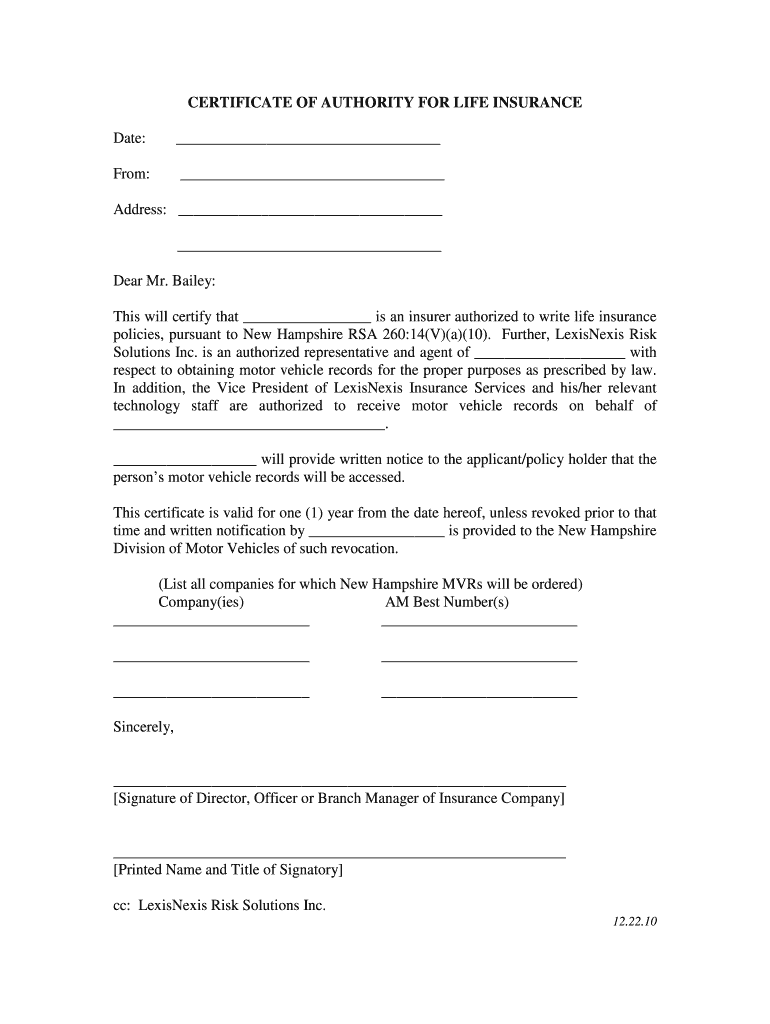

Get the free Certificate of Authority for Life Insurance

Show details

This document certifies that a specified insurer is authorized to write life insurance policies and grants authority for obtaining motor vehicle records for legal purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of authority for

Edit your certificate of authority for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of authority for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of authority for online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit certificate of authority for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of authority for

How to fill out Certificate of Authority for Life Insurance

01

Obtain the Certificate of Authority form from your state's insurance department website.

02

Complete the application form with accurate business information, including legal entity name and address.

03

Provide details about the types of life insurance products you intend to offer.

04

Submit required documentation, such as proof of financial stability and background checks for key personnel.

05

Pay the necessary application fees as specified by your state’s insurance department.

06

Submit the completed application along with all supporting documents to the appropriate state authority.

07

Await processing and any further instructions or requests for additional information from the state.

Who needs Certificate of Authority for Life Insurance?

01

Insurance companies planning to sell life insurance products.

02

New insurance agents seeking to operate within a specific state.

03

Financial institutions offering life insurance as part of their services.

04

Any entity looking to legally provide life insurance and needs state authorization.

Fill

form

: Try Risk Free

People Also Ask about

Who is responsible for issuing certificates of authority to Florida insurers?

The Florida Office of Insurance Regulation (OIR) is responsible for all activities concerning insurers and other risk bearing entities, including licensing, rates, policy forms, market conduct, claims, issuance of certificates of authority, solvency, viatical settlements, premium financing, and administrative

How to obtain a certificate of authority in California?

To obtain your California Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

What does a certificate of authority allow in the US?

A certificate of authority is a legal document that allows an entity to legally conduct business in a state — other than where it was initially registered as an S Corp, non-profit, C Corp, or LLC. The document's name can vary based on a state.

How to get a certificate of authority in California?

To obtain your California Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

How to obtain proof of authority?

How to obtain a Certificate of Authority Determine if the business name is available. Appoint a registered agent in that state. Order a certificate of existence or certificate of good standing from your home state. File qualification documents.

What is an Ohio certificate of authority?

Businesses that are incorporated in another state will typically apply for an Ohio certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate of Authority for Life Insurance?

A Certificate of Authority for Life Insurance is a legal document issued by a state insurance department that permits an insurance company to operate and provide life insurance policies within that state.

Who is required to file Certificate of Authority for Life Insurance?

Insurance companies looking to offer life insurance products in a specific state are required to file a Certificate of Authority.

How to fill out Certificate of Authority for Life Insurance?

To fill out a Certificate of Authority, an insurance company must complete the designated application form provided by the state insurance department, including details such as company name, type of business, and financial information.

What is the purpose of Certificate of Authority for Life Insurance?

The purpose of the Certificate of Authority is to regulate and ensure that only qualified and financially stable insurance companies can offer life insurance products to consumers in that state, thereby protecting policyholders.

What information must be reported on Certificate of Authority for Life Insurance?

The information reported typically includes the insurer's name, address, business structure, financial data, ownership, and details of the officers and directors, as well as the intended types of life insurance products to be offered.

Fill out your certificate of authority for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Authority For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.