Get the free Form 1099

Show details

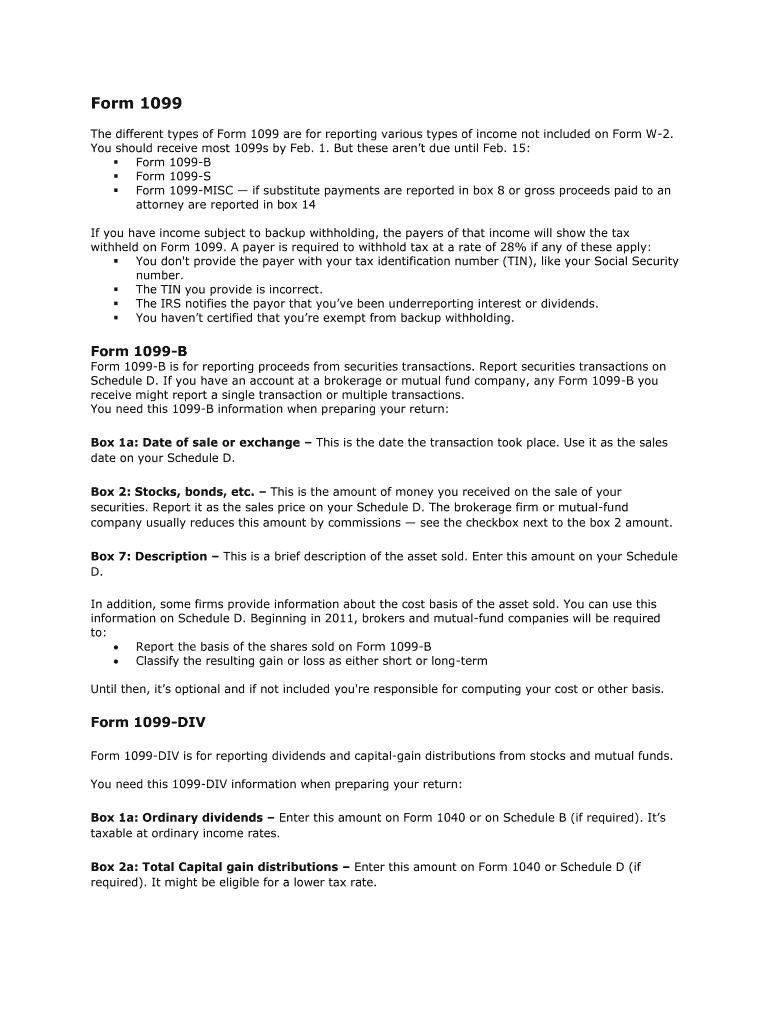

This document provides an overview of various types of Form 1099 used for reporting income not included on Form W-2, detailing the purposes of individual forms such as 1099-B, 1099-DIV, 1099-INT,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 1099

Edit your form 1099 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1099 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1099 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1099. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1099

How to fill out Form 1099

01

Gather the necessary information, including the payee's name, address, and Social Security Number or Tax Identification Number.

02

Determine the type of income being reported and the appropriate box on the form.

03

Fill in your name, address, and Tax Identification Number in the 'Payer' section.

04

Enter the total amount paid to the payee in the correct income box.

05

Indicate if any federal income tax was withheld from the payments.

06

Complete any additional boxes applicable to the specific type of payment.

07

Review the completed form for accuracy and ensure all required fields are filled.

08

Provide the payee with a copy of the form by January 31st, and submit the form to the IRS by the required deadline.

Who needs Form 1099?

01

Businesses or individuals who have paid $600 or more to a non-employee, such as an independent contractor or freelancer, for services rendered.

02

Landlords who receive $600 or more in rental income.

03

Financial institutions that pay interest of $10 or more.

04

Certain other payments, like prizes or awards, totaling $600 or more.

Fill

form

: Try Risk Free

People Also Ask about

What does a 1099 do to your tax return?

There are different 1099 forms that report various types of income and how they were earned. These payments might be for interest, dividends, nonemployee compensation, retirement plan distributions. If you receive a 1099 form, it's your responsibility to report the income earned on your tax return.

What is the English of 1099?

1099 in English words is read as “One thousand ninety-nine.”

How much taxes would you pay on a 1099?

Small-business owners, contractors, freelancers, gig workers, and others who make more than a $400 profit must pay self-employment tax. Self-employed workers are taxed at 15.3% of their net profit. This percentage is a combination of Social Security (12.4%) and Medicare (2.9%) taxes, also known as FICA taxes.

How badly does a 1099 affect my taxes?

When you work on a 1099 contract basis, the IRS considers you to be self-employed. That means that in addition to income tax, you'll need to pay self-employment tax. As of 2024, the self-employment tax is 15.3% of the first $168,600 in net profits, plus 2.9% of anything earned over that amount.

Can I make my own 1099 form?

First, you can download the form from the IRS website or order an official paper copy if filing by mail. Alternatively, businesses can create 1099 online using trusted tax software. This reduces manual errors and ensures compliance with IRS requirements.

Does a 1099 increase the refund?

It depends. It may have increased your income to qualify for credits. If it was only adding income, then the amount of tax withheld may have been larger than necessary and increased your refund. Otherwise, just adding money, no credit and no tax withheld, your refund should go down.

What is a Form 1099 used for?

A 1099 form reports income from self-employment, freelance work, investment, or other non-employee sources. A W-2 form reports wages, salaries, and taxes withheld for employees by their employer.

Does a 1099 hurt your taxes?

While 1099 contractors face higher self-employment taxes, the ability to deduct business expenses can offset these costs. In some cases, this can lead to a lower overall tax burden compared to W-2 employees. However, the complexity of tax filings and the need to manage quarterly payments can make it more challenging.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

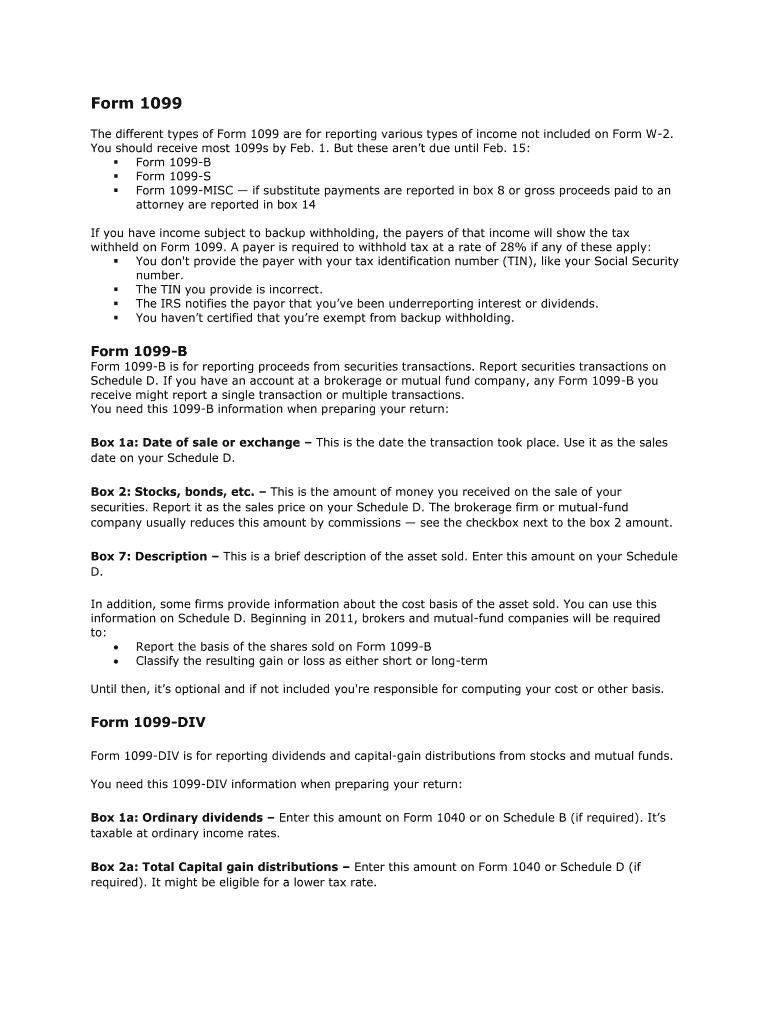

What is Form 1099?

Form 1099 is an information return used to report various types of income other than wages, salaries, and tips to the Internal Revenue Service (IRS).

Who is required to file Form 1099?

Businesses, including sole proprietorships, partnerships, and corporations, are required to file Form 1099 if they have paid $600 or more to non-employees for services, rents, or other types of income during the tax year.

How to fill out Form 1099?

To fill out Form 1099, you must include the payer's and recipient's identification information, such as names, addresses, and taxpayer identification numbers (TINs), and report the total amount paid in the appropriate box.

What is the purpose of Form 1099?

The purpose of Form 1099 is to provide the IRS with information about taxable income that individuals and businesses have received, allowing for proper tax reporting and compliance.

What information must be reported on Form 1099?

The information that must be reported on Form 1099 includes the recipient's name, address, TIN, the amount paid, the type of payment, and the payee’s identification information.

Fill out your form 1099 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1099 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.