Get the free RTF-1

Show details

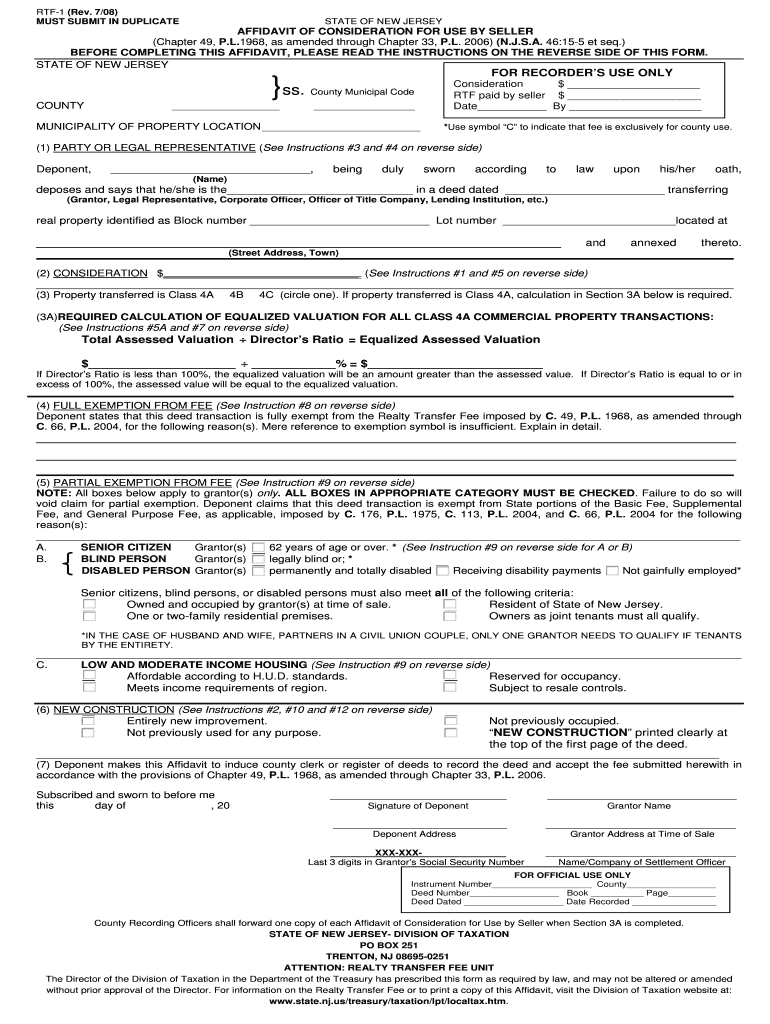

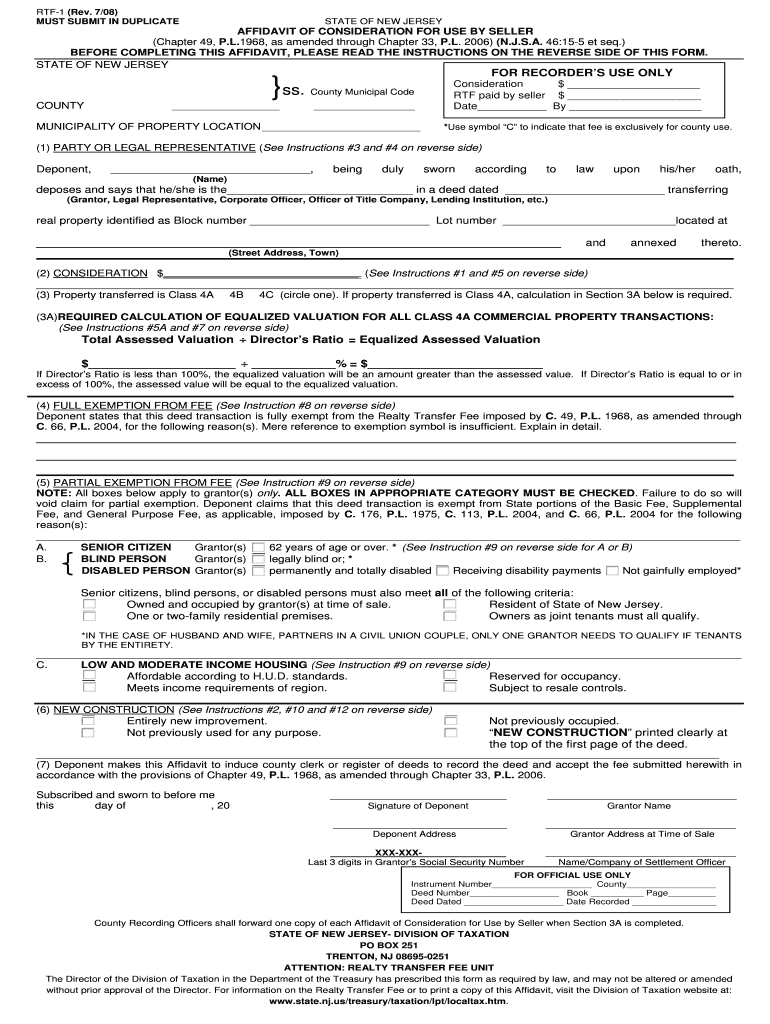

This document is an affidavit that must be submitted in duplicate for realty transfer fee purposes in the state of New Jersey, detailing the consideration for the deed transfer and allowing for exemptions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rtf-1

Edit your rtf-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rtf-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rtf-1 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rtf-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rtf-1

How to fill out RTF-1

01

Gather all necessary personal and financial information.

02

Obtain a copy of the RTF-1 form from the relevant authority.

03

Fill in your name and contact information at the top of the form.

04

Provide your Social Security Number or taxpayer identification number.

05

Enter any applicable income information, such as wages or business income.

06

Document any deductions you plan to claim, like mortgage interest or educational expenses.

07

Complete any additional sections specific to your situation.

08

Review the form for accuracy and completeness.

09

Sign and date the form before submission.

Who needs RTF-1?

01

Individuals applying for a tax refund.

02

Taxpayers seeking to report financial information.

03

Residents who need to verify eligibility for certain programs.

04

Anyone required to submit financial documentation for government purposes.

Fill

form

: Try Risk Free

People Also Ask about

How is RTF calculated in NJ?

The RTF is calculated based on the amount of consideration recited in the deed, or in certain instances, the assessed valuation of the property conveyed, divided by the Director's Ratio.

Does buyer pay transfer tax in NJ?

The Realty Transfer Fee (RTF) was established in New Jersey in 1968 to offset the costs of tracking real estate transactions. Upon the transfer of the deed to the buyers the seller pays the RTF, which is based on their property's sales price.

What is exempt from the mansion tax in New Jersey?

Sales involving government entities or qualified affordable housing programs may be exempt. Other property types not covered by the mansion tax include vacant land, farms with no residences, industrial properties, churches, schools and properties owned by charities.

What is an affidavit of consideration for use?

An affidavit of consideration for use by sellers serves as a sworn statement detailing the purchase price of a property during a real estate transaction. This document includes crucial information such as the buyer's and seller's names, the property address, and the specific sale price.

Who pays NJ transfer tax, buyer or seller?

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

Who is exempt from transfer tax in NJ?

There are a few exemptions from the RTF. The first is between family members. The sale of a property between parent and child, husband and wife, and siblings are exempt. The transfer of a deed from a stepparent to a step-child is only 50% exempt unless the stepparent has adopted that child.

How to avoid the exit tax in New Jersey?

Exemptions to avoid the New Jersey exit tax Those who continue to reside in New Jersey after selling a home are required to submit a GIT/REP-3 form at closing, exempting them from paying estimated taxes on the sale; instead, any taxes on capital gains are reported on their New Jersey Gross Income Tax return.

Who pays transfer tax in me?

The tax is imposed ½ on the grantor (seller), and ½ on the grantee (buyer). Sale of Real Estate - RETT is imposed on each deed by which any real property in Maine is transferred.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RTF-1?

RTF-1 is a form used for reporting specific tax-related information to the relevant tax authority.

Who is required to file RTF-1?

Businesses and individuals who meet certain financial criteria and are subject to specific tax regulations are required to file RTF-1.

How to fill out RTF-1?

To fill out RTF-1, follow the instructions provided with the form, ensure all sections are completed accurately, and submit it to the appropriate tax authority by the deadline.

What is the purpose of RTF-1?

The purpose of RTF-1 is to ensure compliance with tax regulations by providing necessary financial information to the tax authority.

What information must be reported on RTF-1?

RTF-1 must include information such as income, expenses, tax liabilities, and any other financial data required by the tax authority.

Fill out your rtf-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rtf-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.