Get the free FIDELITY GUARANTEE INSURANCE PROPOSAL FORM - balliedbbmvb

Show details

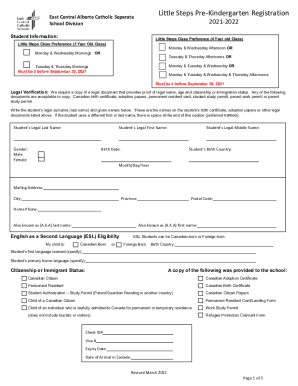

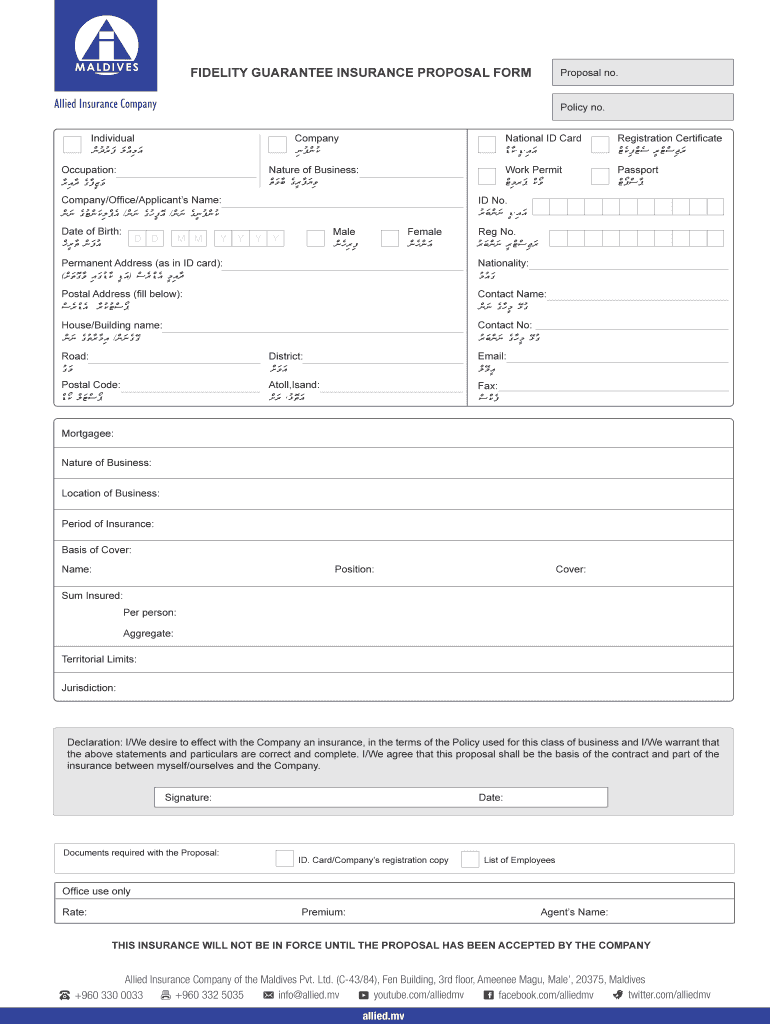

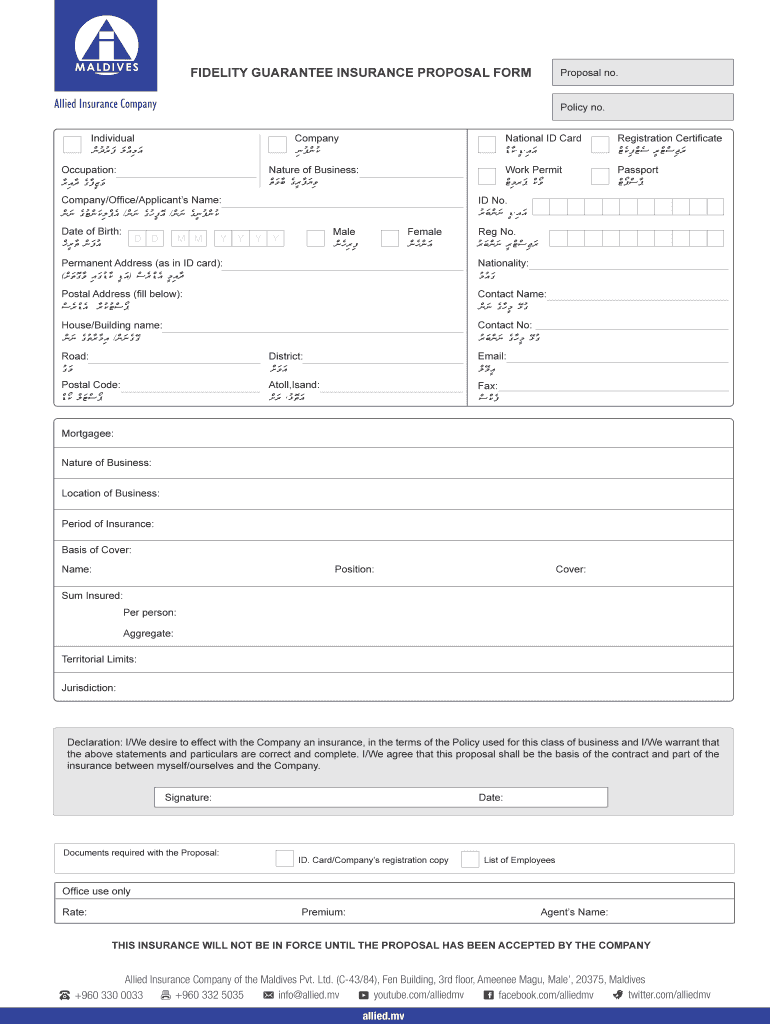

FIDELITY GUARANTEE INSURANCE PROPOSAL FORM Proposal no. Policy no. Individual Company National ID Card Registration Certificate cnudurwf wlcaimwa inufcnuk CDK.ID. Iowa cTekifcTes IrcTcsijwr Nature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity guarantee insurance proposal

Edit your fidelity guarantee insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity guarantee insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fidelity guarantee insurance proposal online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fidelity guarantee insurance proposal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity guarantee insurance proposal

How to fill out a fidelity guarantee insurance proposal:

01

Start by gathering all the necessary information: Before filling out the proposal, make sure you have all the relevant details about the company or organization who needs the insurance. This includes their name, address, contact information, and any other important data.

02

Understand the scope of coverage: Familiarize yourself with the different types of coverage offered under fidelity guarantee insurance. This may include loss due to employee dishonesty, theft, forgery, fraud, or other types of financial losses. Understanding the scope of coverage will help you accurately complete the proposal.

03

Provide details about the insured entity: In the proposal, clearly state the name, nature of business, and any related financial information of the entity that requires fidelity guarantee insurance. This will help the insurance provider assess the risk and determine the premium.

04

Include employee information: Specify the number of employees within the organization, their roles, and any relevant information regarding their background checks, training, or security measures in place. This information will assist the insurance provider in assessing the potential risk.

05

Outline the insurance coverage required: Clearly define the amount of coverage needed and the specific risks that should be covered under the policy. This will help the insurance provider tailor the proposal to meet the organization's requirements.

06

Provide claims history: If applicable, disclose any previous claims made by the organization regarding employee dishonesty or other related issues. This information will assist the insurance provider in evaluating the risk and determining the premium.

07

Include any additional information: If there are any specific requirements, endorsements, or additional information that need to be included, make sure to clearly state them in the proposal. This may include any specific provisions or exclusions the organization requires.

Who needs fidelity guarantee insurance proposal?

01

Companies handling large sums of money: Organizations dealing with significant cash flow, such as banks, financial institutions, or companies involved in payroll management, may need fidelity guarantee insurance to protect against the risk of employee dishonesty or fraud.

02

Businesses with high staff turnover: Companies with frequent turnover or a large number of employees may have an increased risk of employee fraud. Fidelity guarantee insurance can provide protection against financial losses arising from such dishonesty.

03

Non-profit organizations: Non-profit organizations depend heavily on funding and donations. Fidelity guarantee insurance can safeguard their assets and funds from potential misappropriation or fraud by employees.

04

Businesses with valuable assets: Companies that possess valuable assets, intellectual property, or sensitive data may benefit from fidelity guarantee insurance. This coverage helps mitigate risks associated with theft, forgery, or fraud committed by employees.

05

Any organization concerned about employee dishonesty: Fidelity guarantee insurance is suitable for any organization that wants to safeguard itself against financial losses arising from employee dishonesty, irrespective of the industry or sector.

In conclusion, filling out a fidelity guarantee insurance proposal requires gathering necessary information, understanding the coverage, providing details about the insured entity and employees, outlining the required coverage, disclosing claims history, and including any additional information. Companies handling large sums of money, businesses with high staff turnover, non-profit organizations, businesses with valuable assets, and any organization concerned about employee dishonesty can benefit from fidelity guarantee insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fidelity guarantee insurance proposal for eSignature?

Once you are ready to share your fidelity guarantee insurance proposal, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit fidelity guarantee insurance proposal straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing fidelity guarantee insurance proposal, you need to install and log in to the app.

Can I edit fidelity guarantee insurance proposal on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fidelity guarantee insurance proposal from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is fidelity guarantee insurance proposal?

A fidelity guarantee insurance proposal is a type of insurance coverage that protects a company from losses caused by the dishonest acts of its employees.

Who is required to file fidelity guarantee insurance proposal?

Companies that want to protect themselves from employee theft or fraud are required to file a fidelity guarantee insurance proposal.

How to fill out fidelity guarantee insurance proposal?

To fill out a fidelity guarantee insurance proposal, you will need to provide information about your company, the type of coverage you are seeking, and details about your employees.

What is the purpose of fidelity guarantee insurance proposal?

The purpose of a fidelity guarantee insurance proposal is to provide financial protection to a company in case of employee dishonesty.

What information must be reported on fidelity guarantee insurance proposal?

Information such as the names of covered employees, the maximum coverage amount, and any past claims history must be reported on a fidelity guarantee insurance proposal.

Fill out your fidelity guarantee insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Guarantee Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.