Get the free APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT

Show details

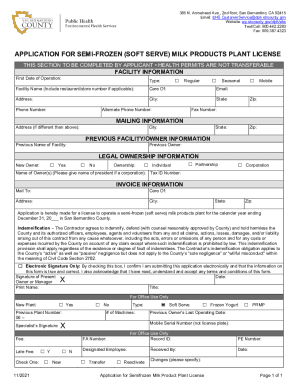

This document serves as an application for a municipal non-property tax permit as required under Sandpoint City Code, specifically for the collection of tax on short term room occupancy charges.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for a municipal

Edit your application for a municipal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for a municipal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for a municipal online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for a municipal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for a municipal

How to fill out APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT

01

Obtain the APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT form from your local municipality office or their website.

02

Fill out your personal information, including name, address, and contact details in the designated fields.

03

Specify the type of non-property tax permit you are applying for and provide any necessary details related to your application.

04

Attach any required supporting documents as outlined in the application instructions.

05

Review the filled-out application form for accuracy and completeness.

06

Submit the application form and any accompanying documents to the relevant municipal office, either in person or online if available.

07

Pay any required application fees, if applicable, as instructed by the municipality.

Who needs APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT?

01

Businesses that engage in activities subject to non-property taxes, such as sales tax or service tax.

02

Individuals who operate independent contracting or freelance services that require tax permits.

03

Organizations planning community events that may be subject to local taxation.

04

Any entity seeking clarification or approval for specific non-property tax-related operations within the municipality.

Fill

form

: Try Risk Free

People Also Ask about

How do I register for local property tax?

Click LPT online. Enter your Personal Public Service Number (PPSN), Property ID and PIN. Click 'Login' Select the 'Register New Property' option from the list of options provided.

What is the best evidence to protest property taxes?

Gather Comparable Sales Data and Assess the Market A great argument when protesting your property tax assessment is showing that your home is overvalued compared to properties in your community with similar features to your own. This is known as finding “comps”, or comparable sales.

Who qualifies for property tax exemption in Massachusetts?

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

What is the best evidence for property tax protest?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

How can I lower my local property taxes?

Ask for Your Property Tax Card. Don't Build. Limit Curb Appeal. Research Neighboring Homes. Allow the Assessor Access to Your Home. Walk the Home With the Assessor. Look for Exemptions. Appeal Your Tax Bill.

What is the best way to win a property tax appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT?

The APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT is a formal request submitted to a local government to obtain permission for conducting business activities that do not involve property taxes.

Who is required to file APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT?

Individuals or businesses engaging in certain activities, such as selling goods or services within a municipality, without being subject to property tax, are required to file this application.

How to fill out APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT?

To fill out the application, applicants should provide their personal information, business details, nature of the activities, and any other required documentation as specified by the municipal guidelines.

What is the purpose of APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT?

The purpose of the application is to ensure that local governments can regulate business activities, collect necessary information for tax purposes, and ensure compliance with local laws.

What information must be reported on APPLICATION FOR A MUNICIPAL NON-PROPERTY TAX PERMIT?

The application typically requires information such as the applicant's name, contact details, business name, type of business activity, duration of operations, and any relevant licenses or permits.

Fill out your application for a municipal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For A Municipal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.