Get the free pdffiller

Show details

Business Interruption Insurance

Fact Finder

Sunshine Coast

Phone 1800 072 114

North & Central Queensland

Phone 1800 629 701

www.steelpacific.com.au

Date:

Brokers please note: this form should

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out business interruption insurance fact?

01

Start by gathering all the necessary information about your business, including its name, address, and contact details. This will ensure that all the relevant details are included in the form.

02

Provide a brief description of your business, including the industry it operates in and any unique features or services it offers. This will give the insurance company a better understanding of your business and its operations.

03

Specify the coverage period for which you are seeking business interruption insurance. This could be a specific date range or an open-ended period, depending on your needs.

04

Calculate your business's gross earnings or revenue for the previous year. This can usually be found in your financial statements or tax records. If your business has been operational for less than a year, provide an estimate based on your projected earnings.

05

Determine your business's fixed expenses, including rent, utilities, salaries, and any other expenses that would continue even if your business operations were interrupted. These expenses are crucial in assessing the potential financial impact of an interruption.

06

Evaluate your business's variable expenses, such as inventory costs, raw material expenses, or other costs that fluctuate based on your business's level of activity. This information will help the insurance company understand the potential additional costs incurred during an interruption.

07

Consider any other factors that could impact your business's interruption risk, such as reliance on specific suppliers, the location of your business, or any unique circumstances that make it more vulnerable to interruptions. These details can provide valuable insights into your business's risk profile.

Who needs business interruption insurance fact?

01

Any business that relies heavily on its physical location, equipment, or inventory should consider obtaining business interruption insurance. This includes retail stores, manufacturing facilities, restaurants, and other businesses with a significant physical presence.

02

Businesses that have a long recovery period or a high risk of interruption should also strongly consider this coverage. For example, businesses located in areas prone to natural disasters, such as hurricanes or earthquakes, may face prolonged interruptions that can severely impact their financial stability.

03

Small businesses that may not have significant financial reserves or backup plans in place could greatly benefit from the protection provided by business interruption insurance. This coverage can help them quickly recover and resume operations after an unforeseen event.

In summary, filling out a business interruption insurance fact involves providing accurate and detailed information about your business's financials, expenses, and risk profile. This information helps insurance companies assess the potential impact of interruptions and determine the appropriate coverage and premium for your business. It is essential for businesses that heavily rely on their physical assets or face high interruption risks to consider obtaining this coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form online?

The editing procedure is simple with pdfFiller. Open your pdffiller form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the pdffiller form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign pdffiller form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete pdffiller form on an Android device?

Use the pdfFiller mobile app to complete your pdffiller form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

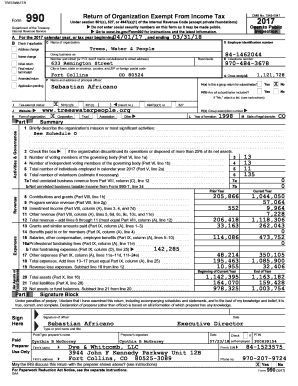

What is business interruption insurance fact?

Business interruption insurance fact provides coverage for financial losses incurred as a result of a covered event that disrupts normal business operations.

Who is required to file business interruption insurance fact?

Business owners or policyholders who have a business interruption insurance policy are required to file the business interruption insurance fact form.

How to fill out business interruption insurance fact?

To fill out a business interruption insurance fact form, respondents must provide detailed information about their business, the covered event, and the financial losses incurred.

What is the purpose of business interruption insurance fact?

The purpose of business interruption insurance fact is to accurately report financial losses incurred due to a covered event and to facilitate the claims process with the insurance provider.

What information must be reported on business interruption insurance fact?

Information such as the date and details of the covered event, the financial impact on the business, and any supporting documentation must be reported on the business interruption insurance fact form.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.