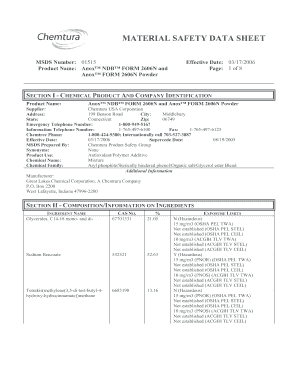

Get the free Form 5405

Show details

This form is used to claim the First-Time Homebuyer Credit or report the repayment of the credit for first-time homebuyers during the tax years 2008 and 2009.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 5405

Edit your form 5405 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5405 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 5405 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 5405. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 5405

How to fill out Form 5405

01

Obtain Form 5405 from the IRS website or a tax office.

02

Begin by entering your name and Social Security number at the top of the form.

03

Fill in the address of the home for which you are claiming the credit.

04

Complete Part I by providing details about the purchase date and price of the home.

05

If applicable, answer questions about any prior purchases and how they relate to the current claim.

06

Fill out Part II if you are claiming the credit as a first-time homebuyer.

07

Review all the completed information for accuracy.

08

Sign and date the form before submitting it with your tax return.

09

Keep a copy of the form for your records.

Who needs Form 5405?

01

Individuals who purchased a home in 2008 and are claiming the first-time homebuyer credit.

02

Taxpayers who are seeking to report a home purchased prior to closing or in cases where a repayment is required.

03

First-time homebuyers who received a credit in the past and are now selling their home.

Fill

form

: Try Risk Free

People Also Ask about

What is the $8,000 homebuyer tax credit?

The $8000 IRS Tax Credit was part of the Housing and Economic Recovery Act of 2008 and was expanded under the American Recovery and Reinvestment Act of 2009. It provided first-time home buyers with a refundable tax credit of up to $8000, helping them offset the costs associated with purchasing a home.

What is the Obama first time home buyer grant?

The Obama administration enacted the federal first-time homebuyer tax credit in 2008. Created as a response to the 2008 financial crisis, the Housing and Economic Recovery Act (HERA) allowed new homebuyers to get a tax credit of up to $7,500 during the first year of the initiative.

How much do you get back in taxes for first time home buyers?

Tax Credit in General For first time homebuyers, there is a refundable credit equal to 10 percent of the purchase price up to a maximum of $8,000 ($4,000 if married filing separately).

What is the IRS form 5405 used for?

Each of you must file a separate Form 5405 to notify the IRS that you disposed of the home or ceased to use it as your main home and figure the amount of the repayment.

Do I have to repay my 2008 first time homebuyer credit?

Repayment of the credit. General repayment rules for 2008 purchases. If you were allowed the first-time homebuyer credit for a qualifying home purchase made between April 9, 2008, and December 31, 2008, you generally must repay the credit over 15 years.

Do I have to repay my 2008 first-time homebuyer credit?

Repayment of the credit. General repayment rules for 2008 purchases. If you were allowed the first-time homebuyer credit for a qualifying home purchase made between April 9, 2008, and December 31, 2008, you generally must repay the credit over 15 years.

What is a 4506 form used for?

If you need a copy of your return, use Form 4506, Request for Copy of Tax Return. There is a fee to get a copy of your return. 5 If the transcript or tax information is to be mailed to a third party (such as a mortgage company), enter the third party's name, address, and telephone number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 5405?

Form 5405 is a form used by taxpayers to claim a first-time homebuyer credit. This credit is designed to promote home ownership by providing financial assistance to qualifying first-time homebuyers.

Who is required to file Form 5405?

Taxpayers who purchased their first home between specific dates and want to claim the first-time homebuyer credit are required to file Form 5405.

How to fill out Form 5405?

To fill out Form 5405, taxpayers must provide their personal information, details of the home purchased, and the date of purchase, ensuring they meet all eligibility requirements for the credit.

What is the purpose of Form 5405?

The purpose of Form 5405 is to allow eligible first-time homebuyers to claim a tax credit on their federal income tax returns, which can reduce tax liability.

What information must be reported on Form 5405?

Form 5405 requires reporting the taxpayer's name, Social Security number, address of the home bought, purchase date, and any other relevant information related to the homebuyer credit.

Fill out your form 5405 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5405 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.