Get the free Schedule S 2010

Show details

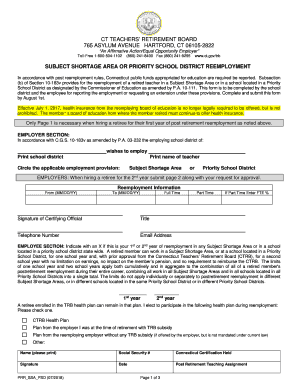

This form is used by individuals, estates, and trusts filing California personal income tax returns to claim a credit against California tax for net income taxes imposed by and paid to another state

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule s 2010

Edit your schedule s 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule s 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule s 2010 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule s 2010. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule s 2010

How to fill out Schedule S 2010

01

Obtain a copy of Schedule S 2010 from the relevant tax authority's website.

02

Identify the specific purpose of filling out Schedule S, such as reporting specific income, expenses, or deductions.

03

Gather all necessary documents, including income statements, receipts, and any other supporting documentation.

04

Start filling out the form by entering your personal information in the designated fields.

05

Complete each section of the schedule as per the instructions, ensuring accuracy in reporting numbers.

06

Review the completed form for any errors or omissions before submitting.

07

Submit Schedule S 2010 along with your main tax return by the specified deadline.

Who needs Schedule S 2010?

01

Individuals or entities that have specific income or expenses that need to be reported separately on Schedule S.

02

Taxpayers who are required to disclose sources of income not reported elsewhere in the main tax return.

03

Businesses or self-employed persons that need to report information relevant to their specific financial activities.

Fill

form

: Try Risk Free

People Also Ask about

What should I put for personal exemption?

Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax Cuts and Jobs Act (TCJA) set the amount at zero for 2018 through 2025. TCJA increased the standard deduction and child tax credits to replace personal exemptions.

What is IRS schedule S?

Purpose of Schedule Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

What is a Schedule E for 2010?

Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources.

Is the personal exemption 0 or 6000?

The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits.

What is the personal exemption for 2010?

For 2010, each personal exemption you can claim is worth $3,650, the same as in 2009. For 2010, the Standard Deduction for married taxpayers filing a joint return is $11,400, the same as in 2009. For Single filers, the amount is $5,700 in 2010, up by $250 over 2009.

What is Schedule S on tax return?

If you are an individual filing a California personal income tax return or an estate or trust filing a California fiduciary income tax return, use Schedule S to claim a credit against California tax for net income taxes imposed by and paid to another state or U.S. possession.

What is the standard deduction for 2010?

For 2010, each personal exemption you can claim is worth $3,650, the same as in 2009. For 2010, the Standard Deduction for married taxpayers filing a joint return is $11,400, the same as in 2009. For Single filers, the amount is $5,700 in 2010, up by $250 over 2009.

What is the estate exemption for 2010?

There was no estate tax in 2010. The 2010 tax laws limited the capital gains step-up in cost basis to assets with appreciation of less than $1.3 million, or $4.3 million for inheriting spouses. The 2011 tax law, enacted in December 2010, reinstated the estate tax, with an exemption of $5 million per person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule S 2010?

Schedule S 2010 is a form used in tax filings for reporting specific information related to the income, deductions, and credits of S corporations in the tax year 2010.

Who is required to file Schedule S 2010?

S corporations that are required to report their financial information to the IRS must file Schedule S 2010, along with their corporate tax return.

How to fill out Schedule S 2010?

To fill out Schedule S 2010, gather the necessary financial information, including the corporation's income, deductions, and credits, and complete the form according to the instructions provided by the IRS.

What is the purpose of Schedule S 2010?

The purpose of Schedule S 2010 is to provide the IRS with detailed information about the financial activities of S corporations, ensuring compliance with tax regulations.

What information must be reported on Schedule S 2010?

Information that must be reported on Schedule S 2010 includes gross receipts, cost of goods sold, various deductions, credits, and individual shareholder details for the distribution of income.

Fill out your schedule s 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule S 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.