Get the free Schedule P (540)

Show details

Estas instrucciones son para el Schedule P (540), que trata sobre el Impuesto Mínimo Alternativo y las limitaciones de créditos para residentes en California.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule p 540

Edit your schedule p 540 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule p 540 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule p 540 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schedule p 540. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

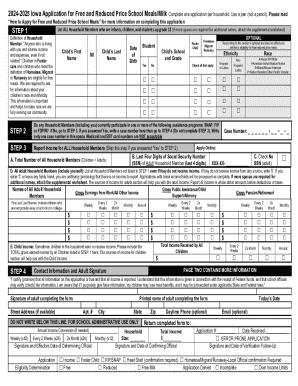

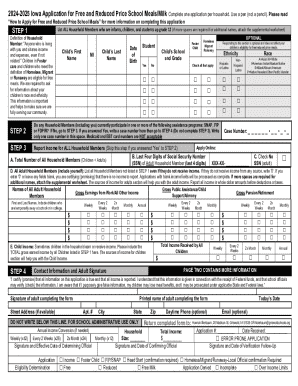

How to fill out schedule p 540

How to fill out Schedule P (540)

01

Obtain a copy of Schedule P (540) from the California Franchise Tax Board website or your tax preparation software.

02

Fill in your personal information at the top of the form, including your name, Social Security number, and address.

03

Provide the details of your California tax return, such as your adjusted gross income and any other relevant financial information.

04

Complete the specific sections of the form as applicable to you, which may include income adjustments, deductions, and credits.

05

Double-check your entries for accuracy, ensuring that figures are correctly calculated.

06

Sign and date the form once completed.

07

Submit Schedule P (540) along with your California tax return to the appropriate tax authority.

Who needs Schedule P (540)?

01

California residents who have a capital gain or loss that must be reported on their tax return.

02

Taxpayers who are calculating the alternative minimum tax (AMT) for California.

03

Individuals who have itemized deductions or certain credits that require detailed reporting on Schedule P (540).

Fill

form

: Try Risk Free

People Also Ask about

Who must file a 540NR in California?

Nonresidents or part-year residents with a filing requirement must file: Nonresidents or Part-Year Residents (540NR)

What does form 540 mean?

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

What is a 540 work schedule?

Schedule CA 540 Schedule CA (California Adjustments) is used to report any adjustments to your federal adjusted gross income based on the differences between California and federal tax rules.

What triggers AMT in California?

California's AMT applies to individuals whose income exceeds certain thresholds and who have certain types of deductions and credits. Taxpayers with high itemized deductions, such as those for mortgage interest, state and local taxes, and miscellaneous deductions, are more likely to trigger the AMT.

What is a 540 schedule?

Purpose. Use Schedule CA (540) to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

How to fill out a 540 tax form?

How To Complete Form 540: A Step-by-Step Guide Step 1: Gather required information and documents. Step 2: Provide basic information. Step 3: Report income. Step 4: Calculate adjustments and deductions. Step 5: Determine tax liability and credits. Step 6: Withholdings and payments. Step 7: Review and sign.

What is an example of a 5 4 9 work schedule?

a. 5/4/9 Schedule: In each pay period employees will work eight 9 hour days and one 8 hour day not including lunch breaks. Five days must be worked during one regularly established workweek of the pay period and four days must be worked during the other regularly established workweek of the pay period.

What is schedule P used for?

Fiduciaries must use Schedule P (541), Alternative Minimum Tax and Credit Limitations – Fiduciaries, to figure the following: Income distribution deduction on an AMT basis. Estate's or trust's alternative minimum taxable income (AMTI) Estate's or trust's AMT.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule P (540)?

Schedule P (540) is a form used by California taxpayers to report their income and claims for a tax year, particularly for those individuals subject to the state's personal income tax.

Who is required to file Schedule P (540)?

Taxpayers who have income that needs to be allocated among different sources or those who are applying for certain tax credits related to resident and non-resident income must file Schedule P (540).

How to fill out Schedule P (540)?

To fill out Schedule P (540), taxpayers need to provide their identifying information, report their income sources, allocate the income between California and non-California income, and explain any adjustments or credits that apply.

What is the purpose of Schedule P (540)?

The purpose of Schedule P (540) is to determine the correct amount of California tax liability by detailing income sources and applying appropriate credits, thereby ensuring compliance with state tax regulations.

What information must be reported on Schedule P (540)?

Schedule P (540) requires reporting of total income, California-source income, adjustments, tax credits, and any other relevant financial details that pertain to the taxpayer's California tax liability.

Fill out your schedule p 540 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule P 540 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.