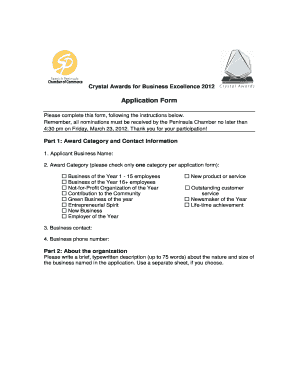

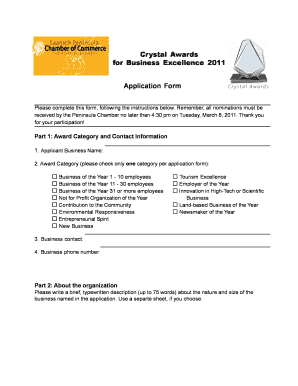

Get the free EARNED INCOME TAX REGISTRATION FORM

Show details

A registration form for local income taxes required for residents of Canonsburg Borough, to be completed for each employed person.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign earned income tax registration

Edit your earned income tax registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your earned income tax registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing earned income tax registration online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit earned income tax registration. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out earned income tax registration

How to fill out EARNED INCOME TAX REGISTRATION FORM

01

Obtain the EARNED INCOME TAX REGISTRATION FORM from the relevant tax authority's website or office.

02

Fill in your personal information, including your name, address, and social security number.

03

Indicate your occupation and the type of income you earn.

04

Provide any additional details required, such as business information if you are self-employed.

05

Review the form for accuracy and completeness.

06

Submit the form to the appropriate tax authority, either electronically or by mail.

Who needs EARNED INCOME TAX REGISTRATION FORM?

01

Individuals who earn income and are required to report it for tax purposes.

02

Self-employed individuals and freelancers who must register their earned income.

03

Businesses that need to report employee earnings and other income sources.

Fill

form

: Try Risk Free

People Also Ask about

How do I report foreign earned income to the IRS?

Form 2555. You must attach Form 2555, Foreign Earned Income, to your Form 1040 or 1040X to claim the foreign earned income exclusion, the foreign housing exclusion or the foreign housing deduction.

What is an eIC file?

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children.

How to file an income tax return online in English?

How to File ITR Online? Step 1: Log in to the Income Tax Portal. Step 2: Select the relevant Assessment Year and mode of filing ITR. Step 3: Select your filing status. Step 4: Select the applicable ITR Form. Step 5: Choose the Reason For Filing ITR. Step 6: Fill in all the Information, Validate, Confirm, and Submit.

Which form to use for foreign income?

The SA106 form is a supplementary document used for your Self Assessment Tax Return (SA100). It is specifically designed to record foreign income and gains, such as interest from overseas savings, rental income from foreign properties, or dividends from investments held abroad.

What is a Form 1116 foreign income?

Purpose of Form File Form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: You are an individual, estate, or trust; and. You paid or accrued certain foreign taxes to a foreign country or U.S. territory.

What is the difference between Form 1040 and 1040NR?

Form 1040 is for US residents (or resident aliens) and citizens to report worldwide income. Form 1040NR is for non resident aliens to report income made in the US only. For reporting purposes, you will only include income made in 2024, do not include income made in 2025.

What is the full form of EA in income tax?

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee.

What is the form for foreign earned income?

Form 2555. This form allows an exclusion of up to $112,000 of your foreign earned income if you are a U.S. citizen or a U.S. resident alien living and working in a foreign country. All foreign earned income (for the individual taxpayer) should be combined on to one Form 2555.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EARNED INCOME TAX REGISTRATION FORM?

The Earned Income Tax Registration Form is a document required by tax authorities for individuals or entities to declare their earned income, allowing proper taxation and compliance with tax regulations.

Who is required to file EARNED INCOME TAX REGISTRATION FORM?

Individuals or businesses that earn income and are subject to local, state, or federal taxation are typically required to file this form.

How to fill out EARNED INCOME TAX REGISTRATION FORM?

To fill out the form, you need to provide personal or business information, including identification details, types of income, and other relevant financial data as instructed on the form.

What is the purpose of EARNED INCOME TAX REGISTRATION FORM?

The purpose of the form is to register earned income for tax purposes, ensuring that individuals and businesses comply with tax laws and accurately report their earnings.

What information must be reported on EARNED INCOME TAX REGISTRATION FORM?

Information typically includes the taxpayer's identification details, type of income earned, tax identification number, and any applicable deductions or credits.

Fill out your earned income tax registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Earned Income Tax Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.