Get the free SHORT TERM WORKING CAPITALBUSIN ESS LOAN APPLICATION - magnifycu

Show details

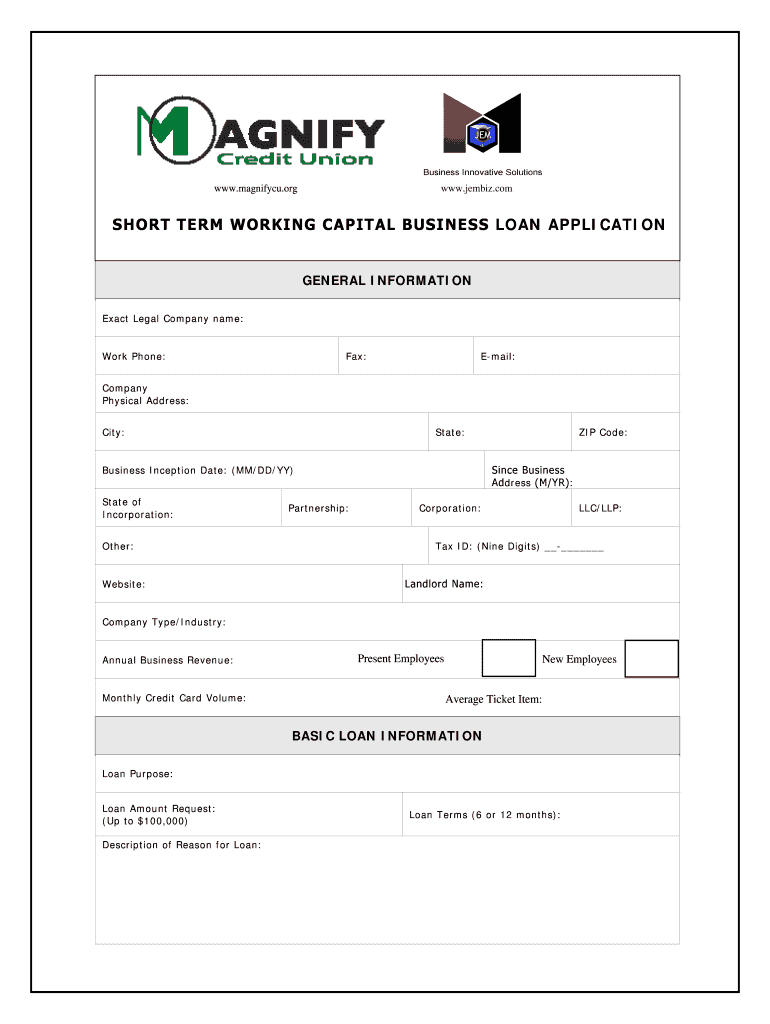

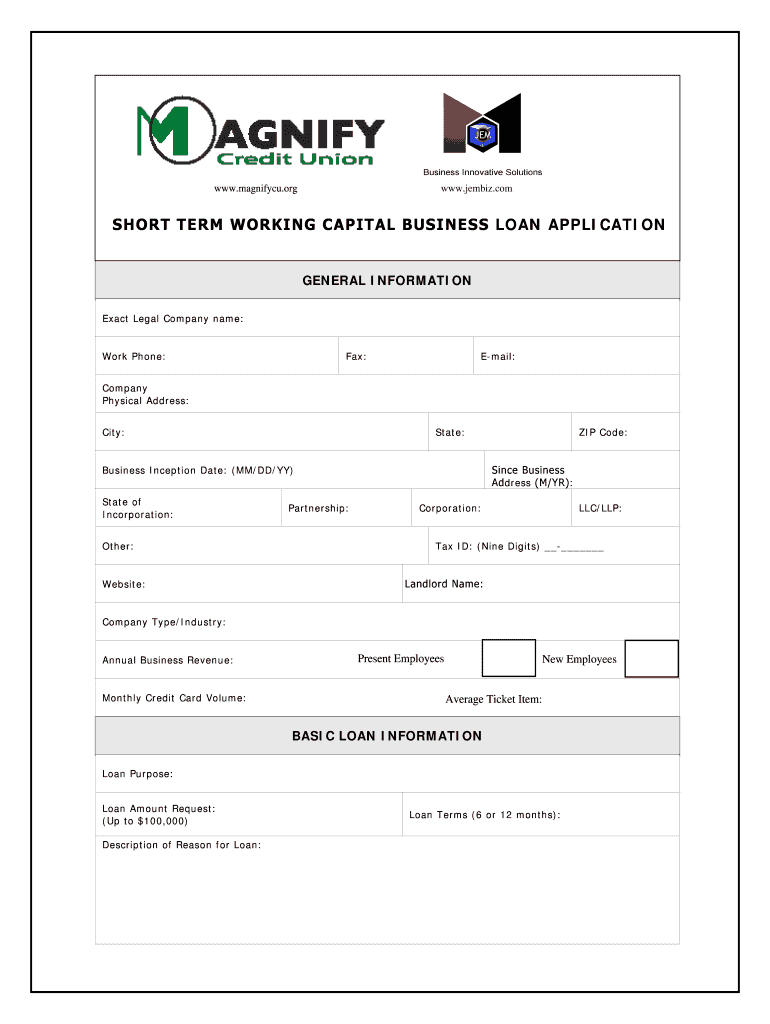

WWW.magnify cu.org www.jembiz.com SHORT TERM WORKING CAPITAL BUSINESS LOAN APPLICATION GENERAL INFORMATION Exact Legal Company name: Work Phone: Fax: Email: Company Physical Address: City: State:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short term working capitalbusin

Edit your short term working capitalbusin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short term working capitalbusin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit short term working capitalbusin online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit short term working capitalbusin. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short term working capitalbusin

How to fill out short term working capital business loan application:

01

Start by gathering all the necessary documents required for the application, such as financial statements, bank statements, tax returns, and any other supporting documentation.

02

Fill in the application form accurately and completely, ensuring that all the required fields are filled in and all necessary information is provided.

03

Provide a detailed explanation of the purpose of the loan and how it will be utilized to improve or support the business operations.

04

Include information about the desired loan amount, repayment terms, and any collateral or security that can be offered for the loan.

05

Clearly outline the projected cash flow of the business, demonstrating how the short term working capital loan will be repaid within the specified timeframe.

06

Attach any additional supporting documents, such as business plans, sales forecasts, or customer contracts, to strengthen the loan application.

07

Review the completed application for accuracy, ensuring that all information is correct and up to date.

08

Submit the application along with all the required documents to the chosen lender or financial institution.

Who needs short term working capital business loan?

01

Startups and small businesses that require immediate funds to cover day-to-day operational expenses, such as payroll, utility bills, inventory purchases, or rent.

02

Businesses experiencing seasonal fluctuations in cash flow, where a short term working capital loan can help bridge the gap during slow periods.

03

Companies that need to seize growth opportunities quickly, such as expanding into new markets or launching new products, and require additional funds to support these initiatives.

04

Businesses facing unexpected emergencies or unforeseen expenses, such as equipment breakdowns or natural disasters, where a short term working capital loan can provide the much-needed financial support.

05

Entrepreneurs or business owners who aim to take advantage of supplier discounts or bulk purchasing opportunities that require immediate cash availability.

By understanding how to fill out a short term working capital business loan application and identifying who can benefit from such loans, individuals and business owners can better navigate the borrowing process and make informed decisions to support their financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in short term working capitalbusin?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your short term working capitalbusin to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit short term working capitalbusin on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing short term working capitalbusin.

How do I edit short term working capitalbusin on an iOS device?

Create, modify, and share short term working capitalbusin using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is short term working capitalbusin?

Short term working capitalbusin refers to the amount of funds a business needs to cover its day-to-day operations.

Who is required to file short term working capitalbusin?

Businesses of all sizes may be required to file short term working capitalbusin, depending on their financial needs and obligations.

How to fill out short term working capitalbusin?

Short term working capitalbusin can be filled out by providing accurate financial information regarding the business's current assets and liabilities.

What is the purpose of short term working capitalbusin?

The purpose of short term working capitalbusin is to assess the financial health and liquidity of a business in the short term.

What information must be reported on short term working capitalbusin?

Information such as cash on hand, accounts receivable, accounts payable, and short term loans must be reported on short term working capitalbusin.

Fill out your short term working capitalbusin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Term Working Capitalbusin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.