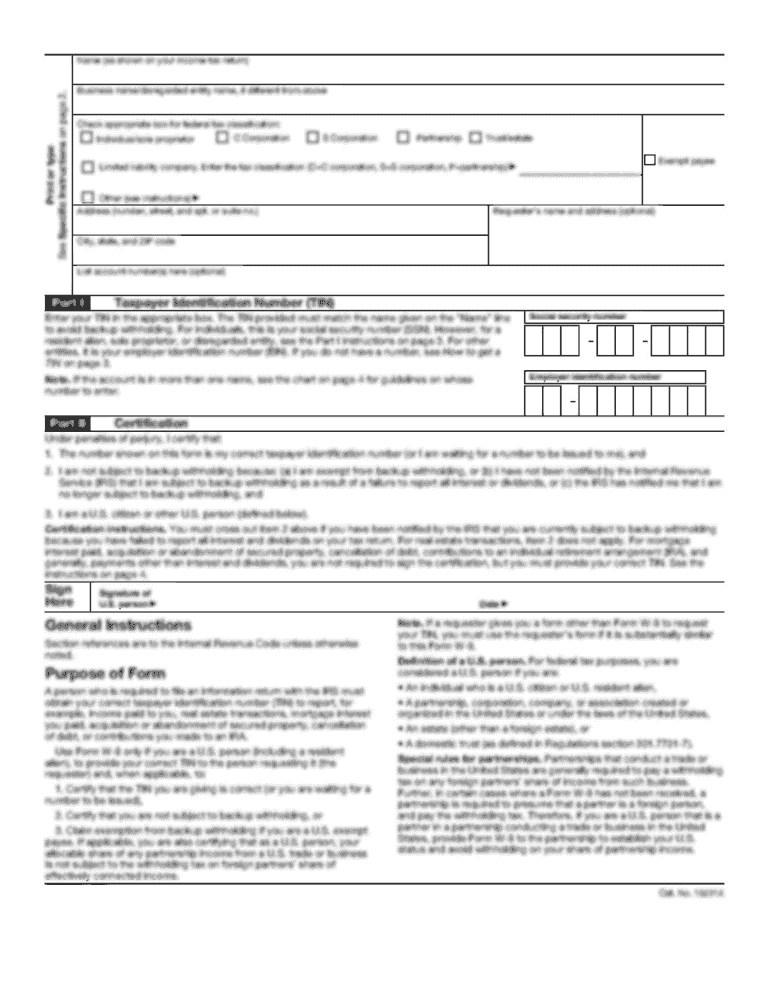

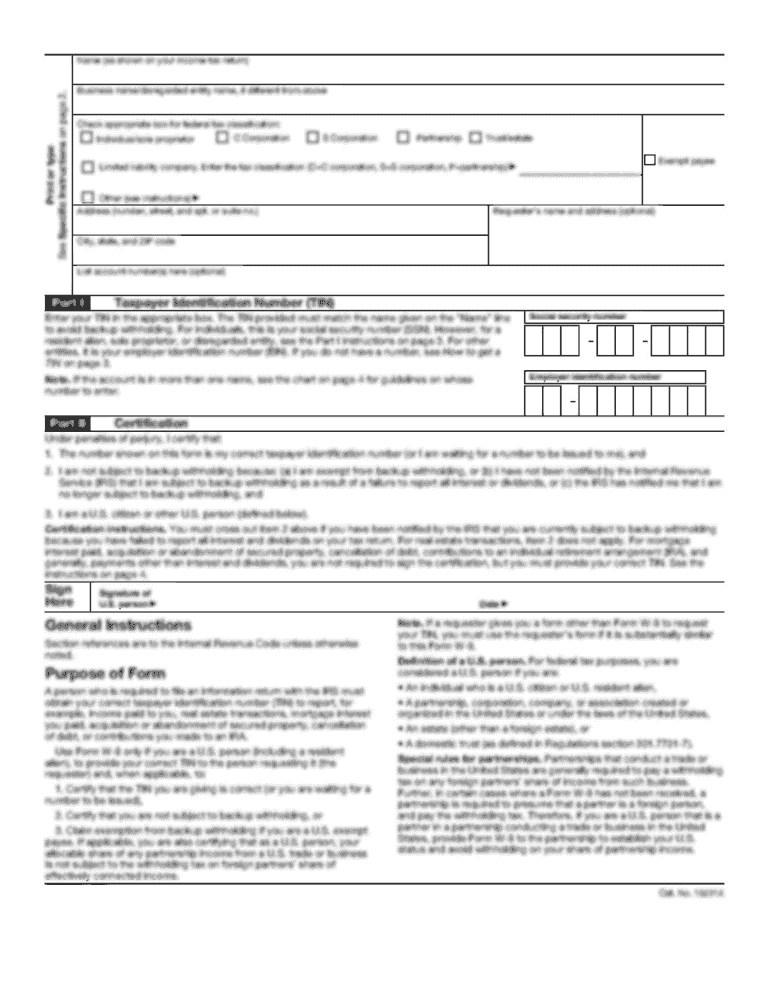

Get the free Economic Injury Loans for Small Businesses - sba

Show details

DISASTER NEWS Economic Injury Loans for Small Businesses SBA Disaster Assistance Field Operations Center East 101 Marietta Street NW Suite 700 Atlanta GA 30303 Release Date December 31 2009 Release Number 10-166 SC 11729 Contact Michael Lampton Phone 404-331-0333 January 29 is Deadline to Apply for SBA Economic Injury Disaster Loans ATLANTA - The U*S* Small Business Administration is reminding small businesses affected by severe storms and tornadoes that occurred April 10 - 11 2009 that...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign economic injury loans for

Edit your economic injury loans for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your economic injury loans for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit economic injury loans for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit economic injury loans for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out economic injury loans for

How to fill out Economic Injury Loans for Small Businesses

01

Gather necessary documentation, including financial statements, tax returns, and business plans.

02

Visit the official U.S. Small Business Administration (SBA) website to access the loan application.

03

Complete the application form with accurate information about your business and the economic injury suffered.

04

Specify the amount of loan you are requesting and provide detailed explanations for the necessity of the funds.

05

Submit the application along with the required documentation either online or by mail.

06

Await confirmation of receipt from the SBA and be prepared for a follow-up if further information is needed.

07

If approved, review the loan terms and conditions carefully before accepting the loan.

Who needs Economic Injury Loans for Small Businesses?

01

Small businesses that have suffered significant economic losses due to disasters.

02

Businesses that are temporarily unable to meet their financial obligations due to unforeseen circumstances.

03

Entrepreneurs looking for financial assistance to maintain operations during challenging times.

04

Businesses that have a viable plan to recover and need temporary financial support.

Fill

form

: Try Risk Free

People Also Ask about

Does everyone get approved for an SBA disaster loan?

If you have bad credit, or your small business credit score isn't stellar, the SBA will still consider other factors, such as recent income and your history of rent, utilities, insurance, and other payments, to determine whether you qualify for an SBA disaster loan.

Is Eidl grant money still available?

As of January 1, 2022, SBA stopped accepting applications for new COVID-19 EIDL loans or advances. As of May 6, 2022, SBA is no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications.

What happens to Eidl loan upon death?

This program allows certain small businesses to receive either (i) an advance of $10,000 for businesses that did not receive an EIDL advance under the CARES Act funding, or (ii) the difference between the EIDL advance maximum $10,000 and the advance the business received under the CARES Act.

Is the SBA EIDL grant still available?

Notice: the COVID-19 EIDL program is not accepting new applications, increase requests, or reconsiderations.

What is the approval rate for the SBA disaster loan?

Of the 312,916 applications SBA accepted in the first stage of its application review, SBA approved 42 percent and declined 38.6 percent. Applications were declined primarily due to insufficient credit score or lack of repayment ability.

What is the SBA Economic Injury disaster loan?

SBA can provide loans to help cover the costs and expenses that your business would have been able to handle if the disaster did not happen. The EIDL amount will depend on how much financial impact you have experienced and your company's financial needs, even if you didn't suffer any property damage.

Will Eidl ever be forgiven?

No EIDL forgiveness Whether COVID-related or traditional, EIDL loans are not forgivable. Borrowers must repay them over 30 years, but there are no prepayment penalties for paying them off early.

Why would I get denied for an SBA disaster loan?

As a new business owner with no prior experience in applying for funding, completing all the necessary paperwork for your loan application can be daunting. One common reason for SBA disaster loan denials is incomplete or insufficient documentation, requiring further clarification, or missing necessary forms.

What credit score is needed for an SBA disaster loan?

Generally, to qualify for any type of SBA loan—disaster loan or otherwise—you'll need to have a credit score between 640 and 670, or higher. This being said, for any of the four loans in the official SBA disaster loan program, it will be up to the SBA to verify your credit and determine your eligibility.

What disqualifies you from getting an SBA loan?

What Disqualifies You From Getting an SBA Loan? The three primary disqualifiers for an SBA loan include a poor credit history, insufficient collateral or equity investment, and lack of a solid business plan. These factors can signal to lenders a high risk of default, making loan approval less likely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Economic Injury Loans for Small Businesses?

Economic Injury Loans for Small Businesses are low-interest loans provided by the Small Business Administration (SBA) to help small businesses that are suffering substantial economic injury as a result of a disaster. These loans are intended to cover the operating expenses and other necessary expenses that the business cannot cover due to the loss of revenue.

Who is required to file Economic Injury Loans for Small Businesses?

Small businesses, including sole proprietorships and certain nonprofit organizations, that have suffered economic injury due to a declared disaster are required to file for Economic Injury Loans. Eligibility may depend on the business's size and the nature of the disaster.

How to fill out Economic Injury Loans for Small Businesses?

To fill out Economic Injury Loans for Small Businesses, applicants must complete the SBA's loan application form, provide necessary financial information, including income statements and balance sheets, and furnish any required documentation that proves the economic injury and the impact of the disaster on the business.

What is the purpose of Economic Injury Loans for Small Businesses?

The purpose of Economic Injury Loans is to provide financial assistance to small businesses affected by disasters, allowing them to maintain their operations, pay employees, and cover other essential expenses while they recover from the economic impact of the disaster.

What information must be reported on Economic Injury Loans for Small Businesses?

Information that must be reported includes the business's financial statements, tax returns, details about the economic injury suffered, a projection of future revenue, and a description of how the disaster has affected the business operations.

Fill out your economic injury loans for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Economic Injury Loans For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.