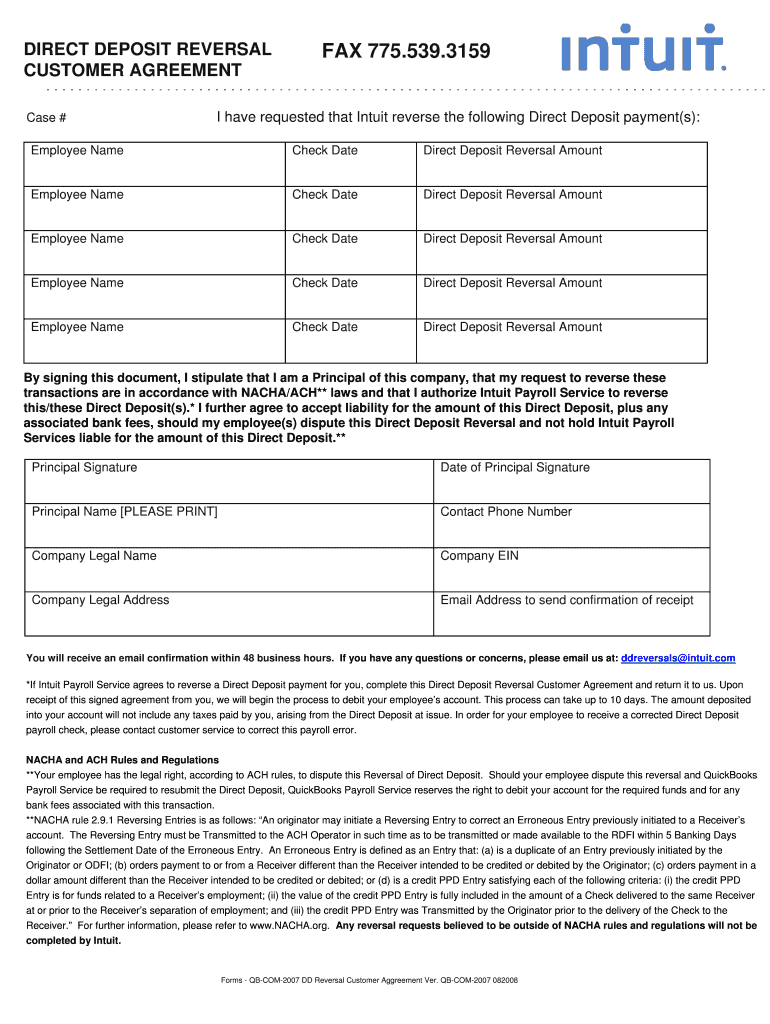

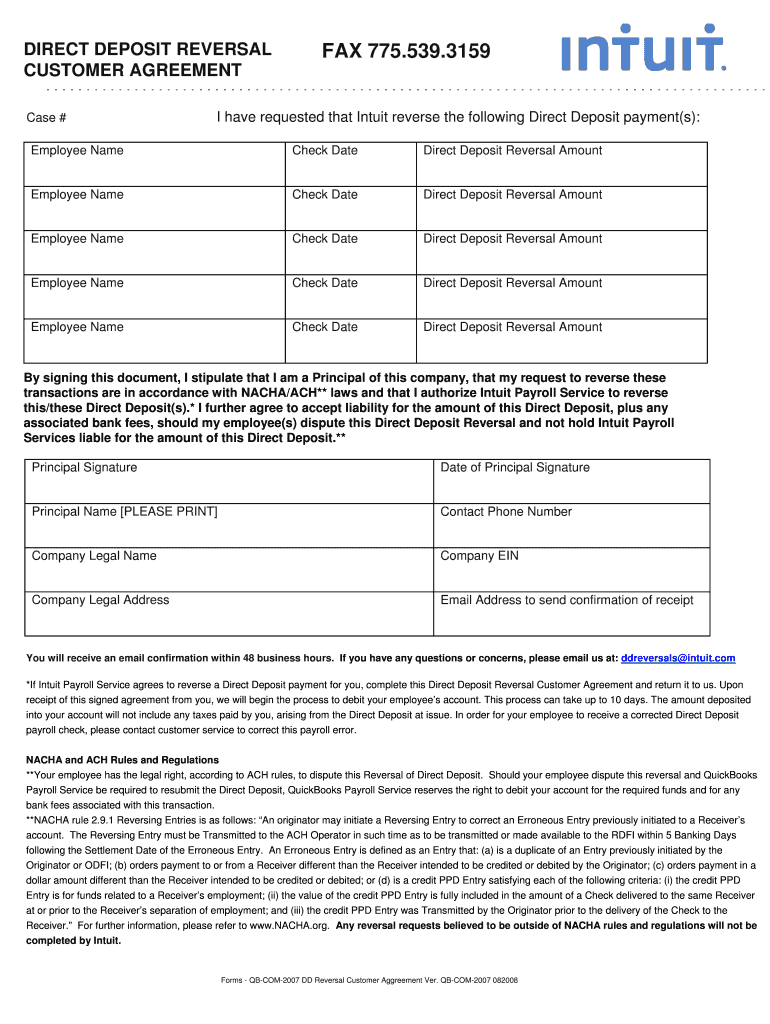

Get the free DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT

Show details

This document serves as an agreement for reversing direct deposit transactions and outlines the responsibilities and liabilities of the company principal.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct deposit reversal customer

Edit your direct deposit reversal customer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct deposit reversal customer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct deposit reversal customer online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit direct deposit reversal customer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct deposit reversal customer

How to fill out DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT

01

Obtain the DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT form from your bank or financial institution.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide details of the direct deposit you wish to reverse, including the amount and the date of the deposit.

04

Sign and date the form to authorize the reversal.

05

Submit the completed form to your bank or financial institution either in person, by mail, or electronically, as per their guidelines.

Who needs DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT?

01

Individuals who have received a direct deposit payment that they believe is incorrect or unauthorized.

02

Businesses that have mistakenly received funds through direct deposit and need to reverse the transaction.

Fill

form

: Try Risk Free

People Also Ask about

What happens when a direct deposit is returned?

Direct Deposit Will Be Returned to the Sender In many cases when someone tries to send money to a closed bank account, the bank will simply return the funds to the sender or decline the transaction. It can take about five to 10 days for funds to be returned to the sender.

What is a bank reversal payment?

Payment reversal (also "credit card reversal or "reversal payment") is when the funds a cardholder used in a transaction are returned to the cardholder's bank. This can be initiated by the cardholder, merchant, issuing bank, acquiring bank, or card association.

Why would a bank do a deposit reversal?

Reversals are when the Monetary Contribution deposit is not fully completed. An example is an NSF (Non-Sufficient Funds) when a deposited check is returned for insufficient funds.

How long after a direct deposit can it be reversed?

While a payroll direct deposit can be reversed, the reversal must occur within five business days of the original payment's settlement date. This urgency is to allow the employee's financial institution to act before the employee spends the funds. If you miss the five-day window, you cannot use the reversal method.

What is a direct deposit agreement?

A direct deposit authorization form allows an employer to electronically transfer an employee's paycheck into their bank account.

What is a direct payment reversal?

Payment reversal is an umbrella term describing when transactions are returned to a cardholder's bank after making a payment. They can occur for the following reasons: Item sold out before it could be delivered. The purchase was made fraudulently.

What is a direct deposit reversal?

A reversal is an attempt to retrieve the funds; it is not a guarantee the funds will be recovered. Each agency is required to process its own reversal requests via the Direct Deposits – Reversals and Reclamations (DDEP) web application. See Instructions for the DDEP Web Application for complete information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT?

The Direct Deposit Reversal Customer Agreement is a document that outlines the terms and conditions under which a customer can reverse a direct deposit transaction. It typically includes information about the circumstances that justify a reversal, any fees associated, and the customer's rights and responsibilities.

Who is required to file DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT?

Customers who wish to reverse a direct deposit transaction are required to file the Direct Deposit Reversal Customer Agreement. This may include individuals or entities that have received funds mistakenly or that need to reverse an unauthorized transaction.

How to fill out DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT?

To fill out the Direct Deposit Reversal Customer Agreement, customers must provide personal identification information, details of the original direct deposit, reasons for the reversal, and any other required information as specified by the financial institution.

What is the purpose of DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT?

The purpose of the Direct Deposit Reversal Customer Agreement is to ensure a formal process is followed when reversing a direct deposit, protecting both the customer and the financial institution by establishing clear guidelines and responsibilities.

What information must be reported on DIRECT DEPOSIT REVERSAL CUSTOMER AGREEMENT?

The information that must be reported on the Direct Deposit Reversal Customer Agreement typically includes the customer's name, account number, details of the transaction being reversed, reason for the reversal, and any relevant dates and signatures.

Fill out your direct deposit reversal customer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Deposit Reversal Customer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.