Get the free Professional Indemnity Insurance Proposal Form Insurance

Show details

Professional Indemnity Insurance Proposal Form

Insurance Brokers & Intermediaries

(with addendums for Underwriting Agencies and Authorized Representatives)

IMPORTANTNOTICE

YourDutyofDisclosure

Expiryoftheperiodofinsurance,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional indemnity insurance proposal

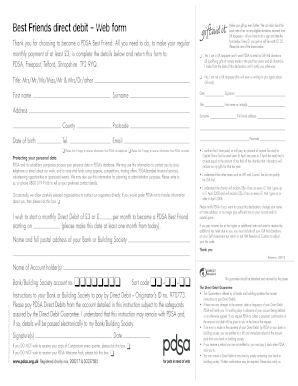

Edit your professional indemnity insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional indemnity insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit professional indemnity insurance proposal online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit professional indemnity insurance proposal. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional indemnity insurance proposal

How to fill out a professional indemnity insurance proposal:

01

Begin by gathering all the necessary information and documents. This may include your name, contact details, business information, and any relevant professional qualifications or certifications.

02

Identify the specific risks and liabilities associated with your profession. This could include potential errors or omissions, breaches of confidentiality, or any other professional negligence.

03

Provide details about your professional experience and the services you offer. Include information about your clients, projects or cases you have worked on, and any relevant accomplishments or achievements.

04

Describe your risk management practices. This may include any measures you have in place to prevent errors or mitigate potential liabilities, such as regular training or quality control procedures.

05

Specify the limit of indemnity you require. This refers to the maximum amount the insurance company will pay out in the event of a claim. Consider the nature of your work and the potential financial impact of any claims to determine an appropriate limit.

06

Review the proposal form carefully before submitting it. Ensure that all the information provided is accurate and complete. If necessary, seek professional advice or consult with an insurance broker to ensure you have included all the necessary details.

Who needs a professional indemnity insurance proposal:

01

Professionals in high-liability industries: Individuals working in professions where mistakes or errors can have significant financial or reputational consequences often require professional indemnity insurance. This includes professions such as doctors, lawyers, architects, engineers, consultants, accountants, and financial advisors.

02

Self-employed individuals or small business owners: Professionals who operate their own businesses or work independently may face greater risks as they are personally liable for any mistakes or negligence. Having a professional indemnity insurance proposal helps protect their assets and provides peace of mind.

03

Professionals working with sensitive information: Those who handle confidential information, such as attorneys or IT consultants, may be more susceptible to claims of breaches of confidentiality or data breaches. Professional indemnity insurance can help cover legal expenses and damages in such situations.

04

Professionals providing advice or services: If your profession involves providing advice, recommendations, or professional services to clients, you may be exposed to claims of professional negligence. Having professional indemnity insurance can safeguard your finances and protect your professional reputation.

05

Businesses with contractual obligations: Many contracts and agreements require professional indemnity insurance coverage. This is to ensure that if a negligent act occurs during the course of providing services, the insurance will cover any resulting damages or claims.

In summary, professionals in high-liability industries, self-employed individuals, professionals handling sensitive information, those providing advice or services, and businesses with contractual obligations are among the individuals who may need a professional indemnity insurance proposal.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit professional indemnity insurance proposal from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including professional indemnity insurance proposal, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send professional indemnity insurance proposal to be eSigned by others?

Once your professional indemnity insurance proposal is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit professional indemnity insurance proposal on an Android device?

You can make any changes to PDF files, such as professional indemnity insurance proposal, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your professional indemnity insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Indemnity Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.