Get the free NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO

Show details

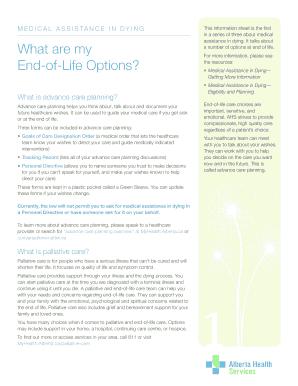

This document provides instructions and requirements for employers in Ohio regarding the reporting of newly hired and independent contractor information as mandated by federal and state laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new hire and independent

Edit your new hire and independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new hire and independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new hire and independent online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new hire and independent. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new hire and independent

How to fill out NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO

01

Obtain the New Hire and Independent Contractor Reporting form from the Ohio Department of Job and Family Services website.

02

Fill out the employer information including name, address, and contact details.

03

Provide the new hire or independent contractor's personal information including their name, Social Security number, address, and date of birth.

04

Indicate the date the individual started working or the contract date.

05

Include details about the individual's employment status and type of work they will be performing.

06

Review all entered information for accuracy and completeness.

07

Submit the completed form electronically or via mail to the appropriate state agency.

Who needs NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO?

01

Employers who hire new employees in Ohio.

02

Businesses that engage independent contractors in Ohio.

03

State agencies that require reporting for compliance and tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the laws regarding employment verification in Ohio?

Ohio employers are required to conduct background checks on potential employees as part of the employment verification process. Background checks are conducted to verify the accuracy of candidate information provided on their resumes, applications, and during interviews.

How to report new hires in Ohio?

You may contact: Ohio New Hire Reporting Center 800-872- 1490. days a week.

How do I report a new hire in Ohio?

You may contact: Ohio New Hire Reporting Center 800-872- 1490. days a week.

What new hire paperwork is needed in Ohio?

I-9 Form. One of the most important forms you have to give to a new hire that walks into your office is an I-9 form. W-4 Form. The next form you will have to give a new employee is the W-4 form. W-9 Form. New Hire Reporting. Ohio State Income Tax. Unemployment Insurance. Workers' Compensation. Final Thoughts.

How to report a business in Ohio?

Answers. How do I file a complaint against a business? You can choose to file a complaint at the Ohio Attorney General's Consumer Protection Section online; by phone at 800-282-0515; or through the postal mail after requesting and receiving a hard copy of the office's complaint form.

Can child support be taken from a 1099 employee in Ohio?

Independent Contractors, Subcontractors and 1099 Employees You are required to withhold from the income of the parent who is paying child support.

Can independent contractors get unemployment in Ohio?

By Kristen M. Kraus: In Ohio, unemployment benefits are designed to provide workers with temporary income when a worker loses his job through no fault of his own. Because these benefits are provided for by taxes paid by employers, only employees and not independent contractors were eligible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO?

The New Hire and Independent Contractor Reporting Information for Ohio is a system used to report newly hired employees and independent contractors to the state. This information is necessary for the enforcement of child support and to ensure compliance with federal and state laws.

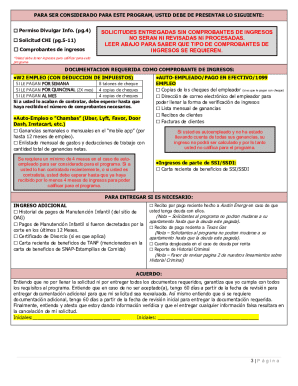

Who is required to file NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO?

All employers in Ohio who hire new employees or independent contractors are required to file this report, including public and private sector employers.

How to fill out NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO?

To complete the reporting, employers must provide accurate information about the employee or contractor, including Social Security number, name, address, and date of hire. This can be done using paper forms or electronically through the Ohio New Hire Reporting System.

What is the purpose of NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO?

The purpose of the reporting is to assist in locating parents who are delinquent in child support payments, to streamline the enforcement of child support laws, and to provide relevant data for workforce statistics.

What information must be reported on NEW HIRE AND INDEPENDENT CONTRACTOR REPORTING INFORMATION FOR OHIO?

The information that must be reported includes the employee or contractor's name, address, Social Security number, date of hire, and the employer's name, address, and Federal Employer Identification Number (FEIN).

Fill out your new hire and independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hire And Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.