Get the free TP-584 (11/04)

Show details

This form is used for reporting the transfer of real estate in New York State, including tax calculations and certifications regarding exemptions from personal income tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tp-584 1104

Edit your tp-584 1104 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tp-584 1104 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tp-584 1104 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tp-584 1104. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tp-584 1104

How to fill out TP-584 (11/04)

01

Begin by obtaining the TP-584 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill out the property owner's name and complete address in the designated fields.

03

Provide the name and address of the purchaser in the appropriate section.

04

Indicate the details of the property transaction, such as date of transfer, the type of transfer, and the reason for the transfer.

05

Include the sale price and any exemptions that may apply.

06

Sign and date the form where indicated, certifying the information is correct.

07

Submit the completed TP-584 form to the county clerk's office or recording authority as per your local requirements.

Who needs TP-584 (11/04)?

01

Individuals or companies involved in the sale or transfer of real property in New York State.

02

Sellers and buyers during the property transaction for tax reporting purposes.

03

Real estate professionals assisting in the closing process of property transfers.

Fill

form

: Try Risk Free

People Also Ask about

How to avoid transfer tax in NYC?

When selling a house or condo with a mortgage, your buyer can utilize a CEMA. Most of the CEMA savings will come from the buyer avoiding the mortgage recording tax but the seller also saves on the NYS transfer taxes.

Is NY transfer tax deductible?

Transfer taxes (or stamp taxes). You cannot deduct transfer taxes and similar taxes and charges on the sale of a personal home. If you are the buyer and you pay them, include them in the cost basis of the property.

What is the continuing lien deduction in NY?

In a sale/purchase transaction, a CEMA allows (1) the seller to pay NYS transfer tax on only the difference between the purchase price and the unpaid principal balance of the seller's existing loan (known as a “continuing lien deduction”); (2) the buyer to pay NYS mortgage tax on only the difference between the buyer's

What is NYS TP 584?

File and pay tax File Form TP-584-NYC, Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of Estimated Personal Income Tax for the Conveyance of Real Property Located in New York City, for all real property conveyances in New York City.

Who pays NYS transfer tax?

Who pays the tax. The base tax and additional base tax are paid by the grantor (seller), and such tax shall not be paid directly or indirectly by the grantee (buyer) except as provided in a contract between seller and buyer.

What is a NYS sales tax certificate of authority?

Businesses that sell tangible personal property or taxable services in New York State need a Certificate of Authority. The certificate allows a business to collect sales tax on taxable sales. The certificate comes from the New York State Department of Taxation and Finance (DTF).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

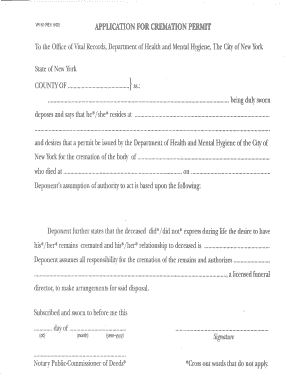

What is TP-584 (11/04)?

TP-584 (11/04) is a New York State form used to report the conveyance of real property, required by the New York State Department of Taxation and Finance.

Who is required to file TP-584 (11/04)?

The seller or transferor of real property is required to file TP-584 (11/04) when the property is sold or transferred.

How to fill out TP-584 (11/04)?

To fill out TP-584 (11/04), provide information such as the names and addresses of the seller and buyer, the property description, the sales price, and any applicable exemptions or deductions.

What is the purpose of TP-584 (11/04)?

The purpose of TP-584 (11/04) is to track real estate transactions and ensure compliance with New York State tax laws, specifically for the transfer of real property.

What information must be reported on TP-584 (11/04)?

Information that must be reported includes the names and addresses of the grantor and grantee, the parcel identification number, the date of transfer, the consideration paid, and any tax exemptions.

Fill out your tp-584 1104 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tp-584 1104 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.