Get the free User Fees Relating to Enrollment and Preparer Tax Identification Numbers

Show details

This document outlines proposed amendments to regulations concerning user fees for individuals applying for or renewing a preparer tax identification number (PTIN), detailing the administrative costs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign user fees relating to

Edit your user fees relating to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your user fees relating to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing user fees relating to online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit user fees relating to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out user fees relating to

How to fill out User Fees Relating to Enrollment and Preparer Tax Identification Numbers

01

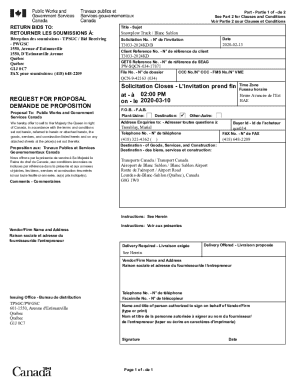

Obtain the User Fees Relating to Enrollment and Preparer Tax Identification Numbers form from the official IRS website.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal information, including your name, address, and Social Security Number or Individual Taxpayer Identification Number.

04

Indicate the type of enrollment you are applying for (e.g., tax preparer, organization) and provide necessary details.

05

Calculate the appropriate fee based on the type of enrollment and ensure it is current as per IRS guidelines.

06

Include payment information, such as credit card details or a check, as required by the form.

07

Review all information for accuracy and completeness before submission.

08

Submit the form as per the instructions, either electronically or by mail, depending on the options provided.

Who needs User Fees Relating to Enrollment and Preparer Tax Identification Numbers?

01

Individual tax preparers seeking to obtain or renew their Preparer Tax Identification Number (PTIN).

02

Organizations that assist taxpayers in preparing return filings and need to enroll in IRS programs.

03

Professionals who provide tax-related services and require compliance with IRS regulations.

04

Individuals pursuing IRS recognition for their role in tax preparation and advisory services.

Fill

form

: Try Risk Free

People Also Ask about

What is the PTIN number in India?

A PTIN (Property Tax Identification Number) is a unique identifier assigned to property owners for property tax purposes. It helps municipalities track property tax payments and assessments efficiently.

How do I find my property tax number in India?

To find your property tax number in India, you can contact your local municipal authority or visit their official website. They usually provide online platforms where you can input your property details to retrieve the tax number.

How to get TIN number in India for NRI?

Step 1: Visit the official VAT or Commercial Tax Department portal of your state. Step 2: Fill out the online registration form with all required details specific to your state. Step 3: Upload supporting documents like identity proof, business registration certificate, address proof, and other relevant paperwork.

Does everyone have a TIN number in India?

If you are a business or individual involved in the sale or purchase of goods or services in India, you will need to obtain a TIN number. This includes manufacturers, wholesalers, retailers, dealers, and traders. Additionally, anyone who is registered under the Service Tax Act will also need a TIN number.

How do I check my TIN number in India?

Taxpayers can obtain their TIN information using online portals provided by tax authorities in various jurisdictions, including India. For example, the Income Tax Department of India has an online portal where people may check the data of their PAN and obtain TAN information for companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is User Fees Relating to Enrollment and Preparer Tax Identification Numbers?

User fees relating to enrollment and Preparer Tax Identification Numbers (PTINs) are fees charged by the IRS for processing applications for PTINs, which are required for paid tax preparers.

Who is required to file User Fees Relating to Enrollment and Preparer Tax Identification Numbers?

Any individual who prepares or assists in preparing federal tax returns for compensation must file for a PTIN and pay the associated user fees.

How to fill out User Fees Relating to Enrollment and Preparer Tax Identification Numbers?

To fill out the user fee form, applicants need to provide personal information, a valid PTIN application, and payment information, usually through an online portal or by submitting a paper application.

What is the purpose of User Fees Relating to Enrollment and Preparer Tax Identification Numbers?

The purpose of these user fees is to fund the IRS's administration of the PTIN system and to ensure that tax preparers meet certain regulatory standards.

What information must be reported on User Fees Relating to Enrollment and Preparer Tax Identification Numbers?

Reportable information includes the applicant's name, Social Security number, contact details, and any required documentation related to their tax preparation qualifications.

Fill out your user fees relating to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

User Fees Relating To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.