Get the free FORM 10-KSB/A

Show details

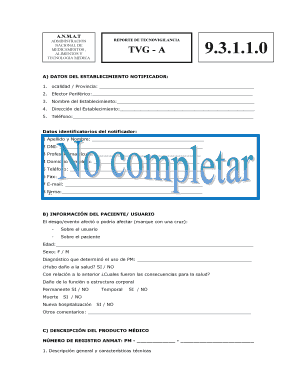

This document is an amended annual report for YP.Net, Inc. for the fiscal year ended September 30, 2001, focusing on financial disclosure and management's analysis, including revisions on accounting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10-ksba

Edit your form 10-ksba form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10-ksba form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 10-ksba online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 10-ksba. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10-ksba

How to fill out FORM 10-KSB/A

01

Begin by gathering all necessary financial statements, including balance sheets and income statements.

02

Review the latest annual report and any amendments to ensure accurate information.

03

Complete the cover page by providing your company's name, SEC file number, and fiscal year-end date.

04

Fill out Part I by summarizing the business, risk factors, and management's discussion.

05

Move to Part II to include financial statements and supplementary data.

06

Ensure all disclosures, including changes in accounting policies or significant events, are documented.

07

Review the entire document for accuracy and completeness before submission.

08

Sign the report, typically by the principal executive officer, and include the date.

Who needs FORM 10-KSB/A?

01

Small public companies that are filing for the first time or amending previous filings.

02

Investors seeking detailed financial and operational information about a company.

03

Analysts and financial institutions that require comprehensive data for investment decisions.

04

Regulatory bodies for the purpose of ensuring compliance with securities laws.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of Form 10 IC?

Form 10-IC is required to filed only if a Domestic Company chooses to pay tax at concessional rate of 22% under Section 115BAA of the Income Tax Act,1961.

What is the purpose of the Form 10?

Form 10 is used to register securities under either Section 12(b) or Section 12(g) of the Exchange Act. One common use of Form 10 is to register the shares of common stock of a subsidiary that are distributed to a parent company's shareholders on a pro-rata basis ("spin off").

What does Form 10 mean?

The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals, HUF, AOP (other than co-operative societies), BOI & Artificial Judicial Persons (AJP) having income from business and profession.

What is the difference between Form 8 A and Form 10?

Form 10 of the Exchange Act requires financial statements and other more extensive disclosure than Form 8-A. A Form 10 registration statement is more similar to a Form S-1 registration statement under the Securities Act than to Form 8-A and includes much of the information required to be disclosed in a Form S-1.

Why is it called Form 10-K?

The name of the Form 10-K comes from the Code of Federal Regulations (CFR) designation of the form pursuant to sections 13 and 15(d) of the Securities Exchange Act of 1934 as amended.

What is the tax form k10?

The 10-K includes information such as company history, organizational structure, executive compensation, equity, subsidiaries, and audited financial statements, among other information.

What are the requirements for Form 10 D?

How to fill EPF Form 10D By whom the pension is claimed. Types of pensions claimed. Member details. EPF account details. Name & address of the organisation in which the member was last employed. Date of leaving the service. Reason for leaving the service. Address for communication.

Who must receive Form 10-K?

Every publicly traded company is required to file financial reports with the Securities and Exchange Commission, or the SEC. The SEC Form 10-K offers a comprehensive snapshot of the company's financial health throughout the year, almost like an annual report for the business numbers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 10-KSB/A?

FORM 10-KSB/A is an amended annual report that small businesses in the United States must file with the Securities and Exchange Commission (SEC) to disclose their financial performance and other company information.

Who is required to file FORM 10-KSB/A?

Small public companies that qualify as 'small business issuers' under SEC rules are required to file FORM 10-KSB/A.

How to fill out FORM 10-KSB/A?

To fill out FORM 10-KSB/A, companies must provide updated information reflecting any changes from their previous 10-KSB, including financial statements, management's discussion and analysis, and other disclosures as necessary.

What is the purpose of FORM 10-KSB/A?

The purpose of FORM 10-KSB/A is to ensure that investors receive timely and accurate information about a small business's financial health and operations, especially after amendments to previously filed reports.

What information must be reported on FORM 10-KSB/A?

FORM 10-KSB/A must report updated financial statements, management analysis, risk factors, executive compensation, and any other relevant disclosures that have changed since the initial filing.

Fill out your form 10-ksba online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10-Ksba is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.