Get the free Bankruptcy Order

Show details

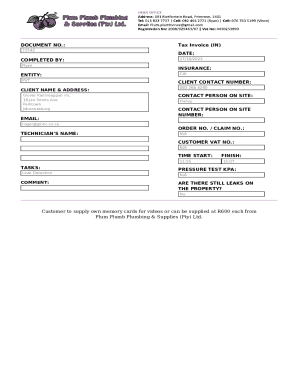

This document is an order from the United States Bankruptcy Court approving the first interim application for payment of compensation and reimbursement of expenses for Hays Financial Consulting, LLC

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy order

Edit your bankruptcy order form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy order form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bankruptcy order online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bankruptcy order. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy order

How to fill out Bankruptcy Order

01

Gather your financial documents, including income, expenses, assets, and debts.

02

Complete the bankruptcy petition form with accurate information about your financial status.

03

List all your creditors and the amount owed to each.

04

Include any additional forms required by your local bankruptcy court.

05

Submit the completed bankruptcy petition and forms to the appropriate bankruptcy court.

06

Attend the 341 meeting of creditors, where you will answer questions about your financial situation.

07

Obtain a bankruptcy discharge after successfully completing your bankruptcy case.

Who needs Bankruptcy Order?

01

Individuals overwhelmed by unmanageable debt.

02

Those facing foreclosure or repossession of assets.

03

People unable to pay their bills and experiencing constant creditor harassment.

04

Businesses seeking relief from debts to continue operations.

05

Anyone looking for a fresh financial start under legal protection.

Fill

form

: Try Risk Free

People Also Ask about

What cannot be wiped out by bankruptcies?

Bankruptcy is a great way to get rid of credit card debt, medical bills, and personal and payday loans. But bankruptcy can't wipe out recent income tax you owe, alimony, child support, or debt incurred from illegal acts (embezzlement, larceny, etc.)

What are the five steps in bankruptcy?

There are five main stages involved in the bankruptcy process, with several questions that may arise at each stage: Meet with a Licensed Insolvency Trustee. The trustee prepares the legal documents. The trustee files the documents with the government. The bankrupt person fulfills their obligations.

What is the order of priority in a bankruptcy?

The Code's Order of Priority In general, the Code provides that secured creditors are entitled to receive the entire value of the collateral securing their claims up to the full amount they are owed. Unsecured creditors, then, get to look to any remaining assets of the estate.

What is a bankruptcy procedure?

Bankruptcy is a legal process for relieving debt that the borrower cannot repay. It's a measure of last resort that typically requires liquidating assets or entering a repayment plan.

How to avoid a bankruptcy order?

Voluntary Arrangement The debtor discloses his assets and liabilities, and makes a proposal on how he intends to settle his debts with various creditors. If the proposal is accepted by the creditors and implemented successfully, it will benefit both the debtor and his creditors.

What are the four steps of bankruptcy?

The Six Steps in a Bankruptcy Process Step 1: Pre-Bankruptcy Counseling. Step 2: Filing the Bankruptcy Petition. Step 3: Automatic Stay. Step 4:Creditor's Meeting. Step 5:Debtor Education Course. Step 6: Notice of Discharge.

What is the British version of bankruptcy?

In the UK, filing for bankruptcy is called administration, and similar to the US, this law requires approval by a third body for business decisions. In the UK, the third body is called an administrator.

What is the hierarchy of bankruptcy?

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bankruptcy Order?

A Bankruptcy Order is a legal declaration by a court that an individual or organization is unable to repay their debts. This order triggers a legal process that can involve the liquidation of assets to pay off creditors.

Who is required to file Bankruptcy Order?

Individuals or entities that are unable to meet their financial obligations and have debts exceeding their assets are required to file for a Bankruptcy Order.

How to fill out Bankruptcy Order?

To fill out a Bankruptcy Order, one must gather financial information, including debts, assets, income, and expenses. The appropriate court forms must then be completed accurately, and may require details about creditors and any attempts made to resolve debts.

What is the purpose of Bankruptcy Order?

The purpose of a Bankruptcy Order is to provide a legal procedure for individuals or organizations to eliminate or restructure their debts, offering them a fresh start financially while also providing a method for creditors to recover what they can.

What information must be reported on Bankruptcy Order?

The information that must be reported on a Bankruptcy Order includes personal identification details, a list of all creditors, total amount of debts, a summary of assets, income and expenses, and any financial transactions made prior to filing.

Fill out your bankruptcy order online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy Order is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.