Get the free Provision, BEPS, and More

Show details

R E G I S T R AT I O N F O R M Provision, BEDS, and More End of Year Tax Workshop November 6, 2015, Sheraton Tampa River walk Hotel Tampa, FL 33602 Full Name: Title: Organization: Preferred Mailing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign provision beps and more

Edit your provision beps and more form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your provision beps and more form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing provision beps and more online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit provision beps and more. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out provision beps and more

How to fill out provision beps and more:

01

Start by gathering all necessary information and documentation related to your financial activities and international transactions. This may include invoices, profit and loss statements, tax returns, and other relevant documents.

02

Familiarize yourself with the guidelines and requirements outlined in the provision beps and more. This may involve studying the relevant tax laws and regulations, understanding the reporting obligations, and identifying any specific forms or schedules that need to be completed.

03

Fill out the provision beps and more forms accurately and completely. Pay attention to details and ensure that all required fields are filled in correctly. Double-check for any errors or omissions before submitting the forms.

04

If you are unsure about any specific aspect or have questions regarding the provision beps and more, seek professional advice or guidance. Consulting with a qualified tax professional or accountant can help ensure compliance and avoid potential penalties or issues.

05

Keep a copy of all documents and forms submitted for your records. This will serve as evidence of your compliance and can be helpful if any queries or investigations arise in the future.

Who needs provision beps and more:

01

Multinational corporations that engage in cross-border transactions and have operations in multiple jurisdictions may need to comply with provision beps and more. These regulations aim to prevent base erosion and profit shifting, ensuring that companies pay their fair share of taxes in the countries where they conduct business.

02

Tax authorities and government bodies also require provision beps and more to monitor and enforce tax compliance among multinational corporations. These regulations help identify and address tax avoidance strategies and ensure proper tax reporting and transparency.

03

Financial institutions, tax professionals, and advisors may also need to be familiar with provision beps and more to assist their clients in complying with the regulations and providing accurate tax advice.

Note: It is important to consult with a tax professional or advisor to understand the specific applicability and requirements of provision beps and more in your jurisdiction.

Fill

form

: Try Risk Free

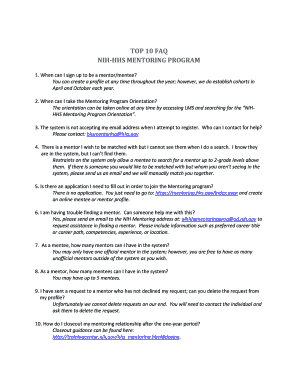

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send provision beps and more to be eSigned by others?

When your provision beps and more is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I fill out provision beps and more on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your provision beps and more by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit provision beps and more on an Android device?

You can edit, sign, and distribute provision beps and more on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is provision beps and more?

Provision BEPS refers to the measures agreed upon by countries under the Base Erosion and Profit Shifting (BEPS) initiative to prevent multinational companies from shifting profits to low-tax jurisdictions.

Who is required to file provision beps and more?

Multinational companies with a significant global presence are required to file provision BEPS.

How to fill out provision beps and more?

Provision BEPS is typically filled out using the guidance provided by the tax authorities of each country.

What is the purpose of provision beps and more?

The purpose of provision BEPS is to ensure that multinational companies pay their fair share of taxes in the countries where they generate profits.

What information must be reported on provision beps and more?

Information on the company's revenue, expenses, profits, and tax payments in each country where it operates must be reported on provision BEPS.

Fill out your provision beps and more online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Provision Beps And More is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.