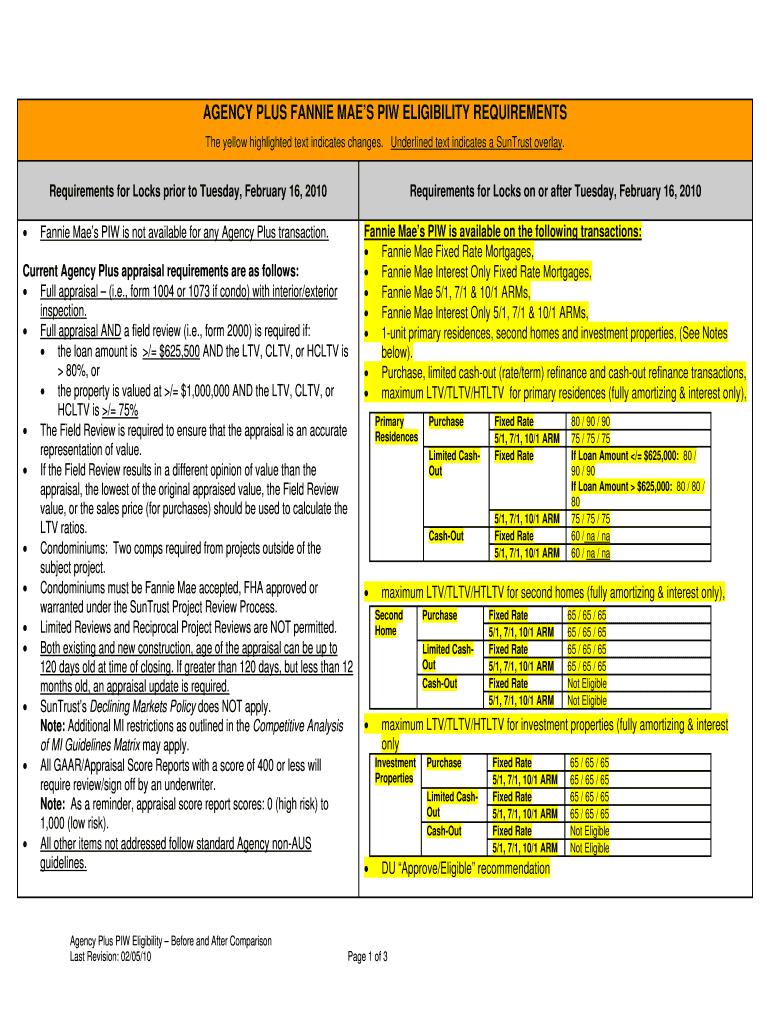

Get the free AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS

Show details

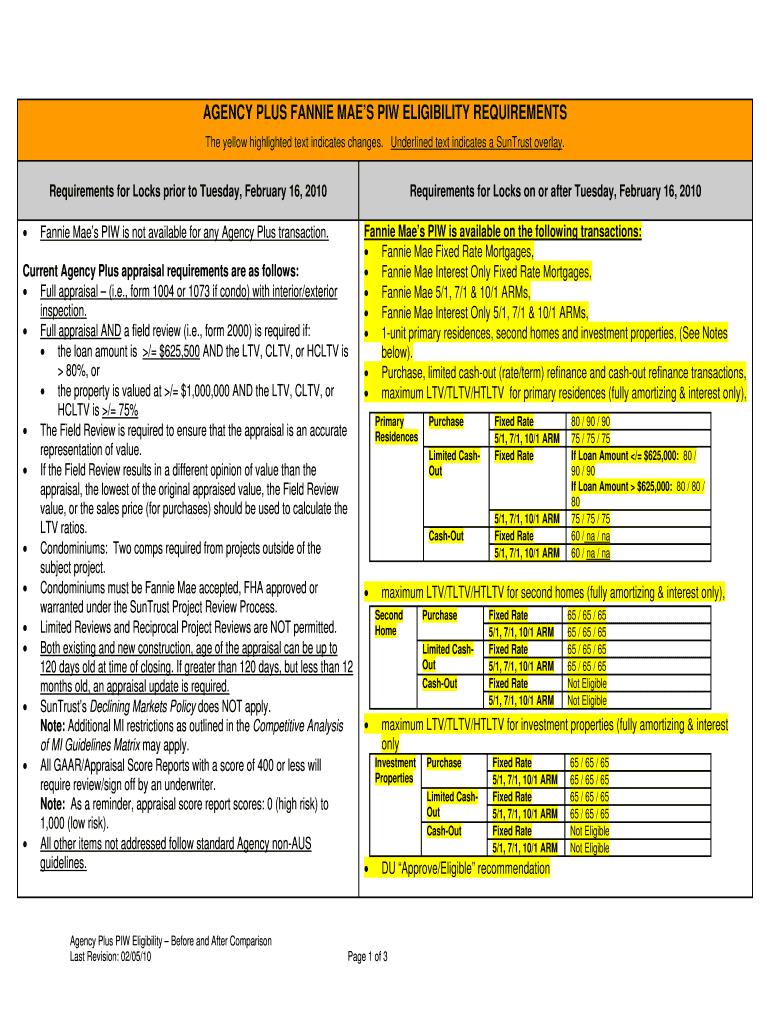

This document outlines the eligibility requirements for Fannie Mae’s Property Inspection Waiver (PIW) related to Agency Plus transactions, indicating when specific appraisals are needed and detailing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agency plus fannie maes

Edit your agency plus fannie maes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agency plus fannie maes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing agency plus fannie maes online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit agency plus fannie maes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agency plus fannie maes

How to fill out AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS

01

Gather all necessary documentation related to the property and borrower.

02

Confirm the borrower’s eligibility by reviewing their credit score and financial stability.

03

Check the property type and ensure it meets Fannie Mae's guidelines.

04

Review the loan-to-value ratio to ensure it falls within acceptable limits.

05

Complete the required forms accurately, providing all requested information.

06

Submit the documentation and completed forms to the lender for review.

Who needs AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS?

01

Real estate agents assisting clients in home purchases.

02

Loan officers working with potential homebuyers seeking Fannie Mae financing.

03

Mortgage brokers who need to qualify borrowers under Fannie Mae guidelines.

04

Homebuyers looking to understand their eligibility for mortgage options.

Fill

form

: Try Risk Free

People Also Ask about

Does Fannie Mae require all borrowers to have a credit score?

Credit scores are required for most loans purchased or securitized by Fannie Mae. The classic FICO credit score is produced from software developed by Fair Isaac Corporation and is available from the three major credit repositories.

What does piw mean in mortgages?

PIW stands for Property Inspection Waiver, and it's a valuable option that may allow you to skip the traditional home appraisal entirely, saving you both time and money.

What are the DTI requirements for Fannie Mae?

Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be exceeded up to 45% if the borrower meets the credit score and reserve requirements reflected in the Eligibility Matrix.

What is the minimum down payment for a Fannie Mae loan?

Down payment requirements for a Fannie Mae Fixed Rate Mortgage Loan can vary, but typically range from 3% to 20% of the home's purchase price. Lower down payments may require private mortgage insurance (PMI).

How do you qualify for a PIW?

PIW mortgages let you bypass the traditional home appraisal process by using existing property data instead. You'll need significant equity to qualify — for home purchases, you'll need at least a 10% down payment, while refinancing requires 10% to 40% equity depending on the loan and property type.

What are the requirements for Fannie Mae?

Fannie Mae guidelines: At a glance Minimum RequirementConventional purchaseConventional refinance Down payment 3% N/A Credit score 620 Rate-and-term refinance: 620 Cash-out refinance: 640 DTI ratio 45% to 50% 45% to 50% Maximum LTV 97% Rate-and-term refinance: 97% Cash-out refinance: 80% Jan 30, 2025

Why am I not getting an appraisal waiver?

FYI, lenders typically only waive appraisal if they believe your loan is very low risk, meaning you either have a high down payment and or the purchase price is not unrealistically high.

What is Fannie Mae and how does it work?

Congress created Fannie Mae to make sure there are funds available for residential mortgage lending nationwide. We do this by purchasing mortgages from lenders and bundling them into mortgage-backed securities that we sell to investors. Lenders use their replenished cash to offer new mortgages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS?

AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS refer to the guidelines set by Fannie Mae for determining the eligibility of loans being considered under the Property Inspection Waiver (PIW) program.

Who is required to file AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS?

Lenders who are originating loans that meet Fannie Mae's criteria for the Property Inspection Waiver program are required to file AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS.

How to fill out AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS?

To fill out the requirements, lenders need to provide necessary loan details, borrower information, and property information as per Fannie Mae's guidelines and submit it through the applicable systems.

What is the purpose of AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS?

The purpose is to streamline the mortgage approval process by allowing certain loans to bypass a traditional property inspection, thereby saving time and resources for both lenders and borrowers.

What information must be reported on AGENCY PLUS FANNIE MAE’S PIW ELIGIBILITY REQUIREMENTS?

The information that must be reported includes loan amount, property address, borrower creditworthiness, and any relevant supporting documentation as outlined in the Fannie Mae guidelines.

Fill out your agency plus fannie maes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agency Plus Fannie Maes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.