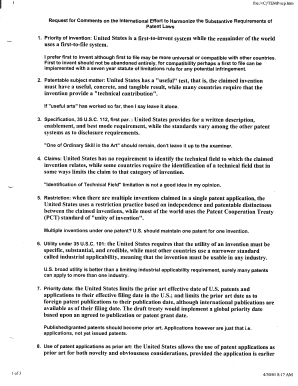

Get the free FHA 203b Loan Program Forms - STM Partners

Show details

FHA 203(b) Loan Program Forms The following is a list of forms for the FHA program: Form Number COR 0013 Name of Form COR 0322 FHA SellerPaid Interest Buy down 09/2005 COR 0344 FHA/VA Buy down & Escrow

We are not affiliated with any brand or entity on this form

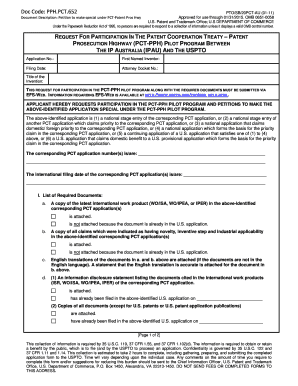

Get, Create, Make and Sign fha 203b loan program

Edit your fha 203b loan program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha 203b loan program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha 203b loan program online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fha 203b loan program. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha 203b loan program

How to fill out FHA 203b loan program:

01

Start by gathering all necessary documents: To fill out the FHA 203b loan program, you will need your personal identification, social security number, employment information, income documentation, tax returns, and asset details. Make sure to have these documents ready before starting the application process.

02

Research FHA-approved lenders: The FHA 203b loan program is offered by FHA-approved lenders, so it is important to find a reputable lender. Research different lenders online or ask for recommendations from friends or family who have gone through the FHA loan process before.

03

Contact the chosen lender: Once you have identified a lender, reach out to them to express your interest in the FHA 203b loan program. They will guide you through the application process and provide you with the necessary forms.

04

Complete the loan application: Fill out the loan application form provided by your lender. This form will require detailed information about your personal and financial situation, including employment history, income sources, debt obligations, and assets. Be sure to provide accurate information to ensure a smooth application process.

05

Submit supporting documents: Along with the loan application, you will need to submit the supporting documents mentioned earlier. Make copies of all the required paperwork and send them to your lender promptly to avoid any delays in the approval process.

06

Attend an FHA loan orientation session: Some lenders might require you to attend an FHA loan orientation session to educate you about the program's specifics and your responsibilities as a borrower. Take advantage of this opportunity to ask any questions you may have about the FHA 203b loan program.

07

Wait for loan approval: After submitting your application and supporting documents, the lender will review your information and determine if you meet the FHA loan requirements. This process may take some time, so be patient. Stay in touch with your lender to stay updated on the progress.

Who needs the FHA 203b loan program?

01

First-time homebuyers: The FHA 203b loan program is ideal for first-time homebuyers who may not have a substantial down payment or high credit score. It allows them to purchase a home with a lower down payment requirement and more flexible credit guidelines compared to conventional loans.

02

Low-income individuals or families: The program is also beneficial for individuals or families with limited income. The FHA 203b loan program offers more lenient qualification criteria and may be tailored to fit the borrower's financial situation.

03

Individuals with less-than-perfect credit: FHA loans are more forgiving when it comes to credit scores. If you have a less-than-perfect credit history, the FHA 203b loan program may be a suitable option for you.

04

Borrowers seeking home improvement loans: The FHA 203b loan program allows borrowers to include funding for home repairs and renovations in their mortgage. This feature is particularly useful for those looking to purchase a fixer-upper or make significant upgrades to their current property.

In summary, the FHA 203b loan program is designed for first-time homebuyers, low-income individuals/families, those with less-than-perfect credit, and borrowers seeking home improvement loans. Follow the step-by-step process mentioned above to successfully fill out the program's application and fulfill your homeownership goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fha 203b loan program from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your fha 203b loan program into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in fha 203b loan program without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing fha 203b loan program and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out fha 203b loan program using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign fha 203b loan program and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is fha 203b loan program?

The FHA 203b loan program is a mortgage insurance program provided by the Federal Housing Administration (FHA) that allows borrowers to purchase or refinance a home with a low down payment and flexible credit requirements.

Who is required to file fha 203b loan program?

Borrowers who wish to apply for an FHA 203b loan program are required to file the necessary documentation and meet the eligibility criteria set by the FHA, such as having a steady income, a good credit score, and the ability to repay the loan.

How to fill out fha 203b loan program?

To fill out the FHA 203b loan program, borrowers need to gather the required documentation, including income proof, credit history, employment details, and personal identification. The application can be completed online or through an approved FHA lender. It's important to carefully follow the application instructions and provide accurate information.

What is the purpose of fha 203b loan program?

The purpose of the FHA 203b loan program is to make homeownership more accessible by providing mortgage insurance to lenders. This encourages lenders to offer loans to borrowers who may not qualify for conventional mortgages due to lower income or credit scores. The program also helps stimulate the housing market.

What information must be reported on fha 203b loan program?

When filling out the FHA 203b loan program, borrowers need to report information such as their personal details, employment history, income, assets, liabilities, credit history, and the details of the property they intend to purchase or refinance.

Fill out your fha 203b loan program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha 203b Loan Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.