Get the free SSP 113 - coop

Show details

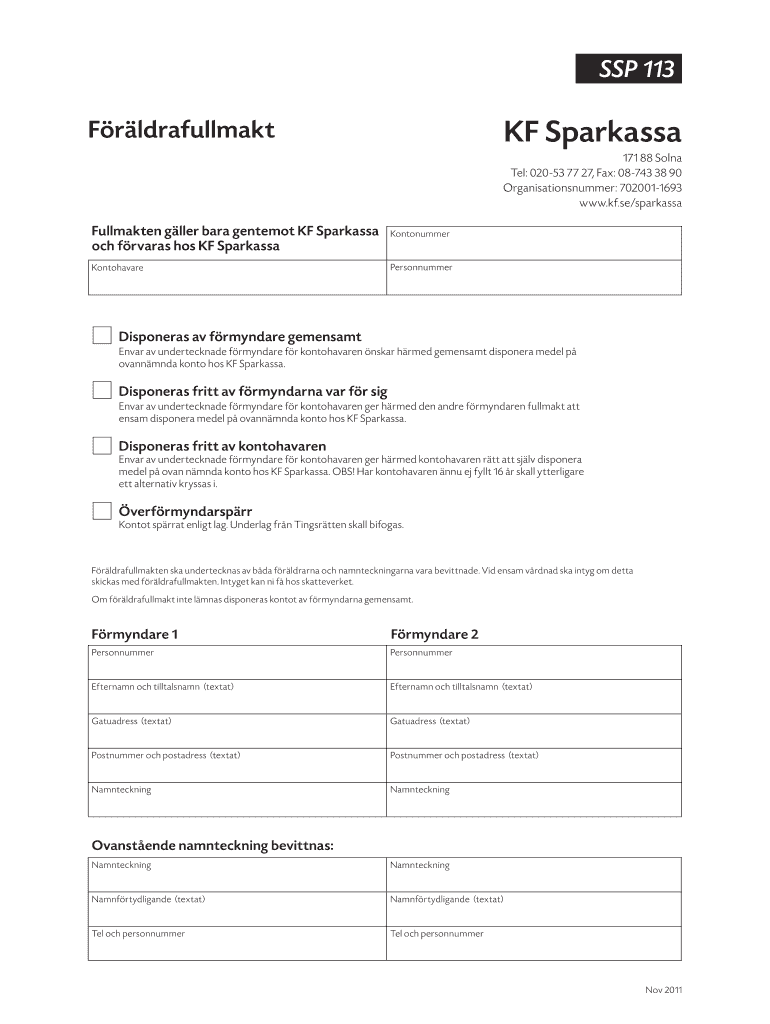

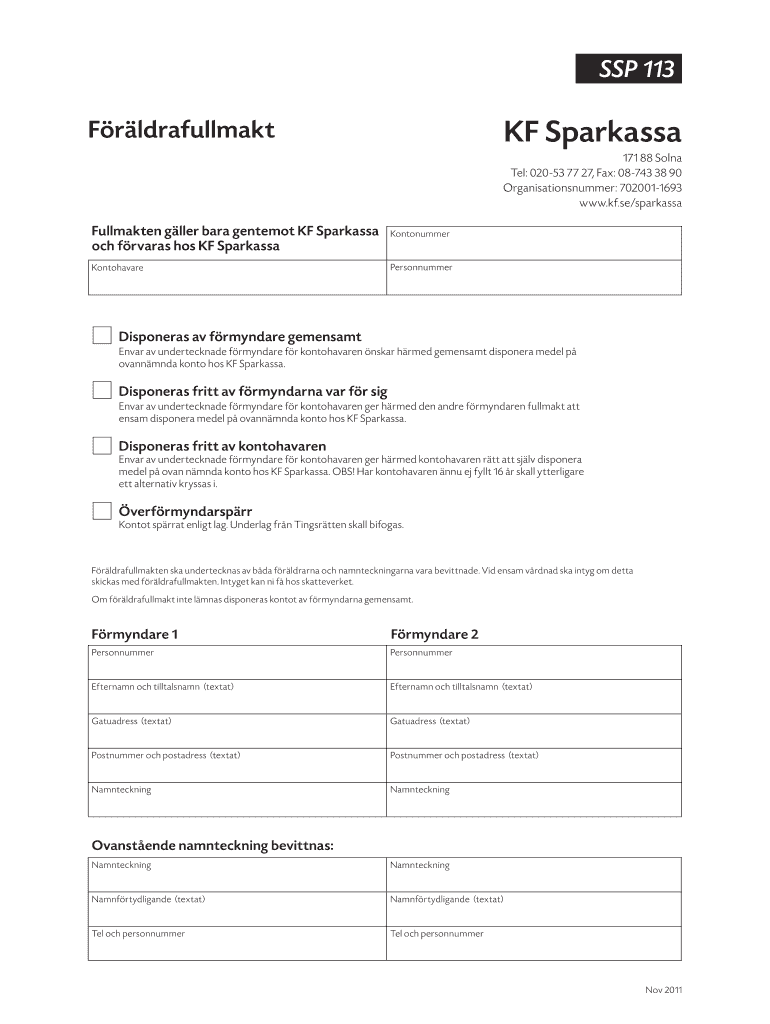

SSP 113 OF Sparkasse Frldrafullmakt 171 88 Sold Tel: 02053 77 27, Fax: 08743 38 90 Organisationsnummer: 7020011693 www.kf.se×Sparkasse Fullmakten Geller bar contempt OF Sparkasse och friars hos OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ssp 113 - coop

Edit your ssp 113 - coop form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssp 113 - coop form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ssp 113 - coop online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ssp 113 - coop. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ssp 113 - coop

How to fill out SSP 113:

01

Start by obtaining the SSP 113 form. You can usually find it on the official website of the relevant authority or organization, such as the government's labor department.

02

Read the form thoroughly and familiarize yourself with the instructions and requirements. This will help ensure that you fill out the form accurately and provide all the necessary information.

03

Begin by entering your personal information in the designated fields. This may include your full name, address, contact details, and any other required details specific to your situation.

04

Next, provide information regarding your employment. This may include your job title, employer's name and contact information, and the specific period of employment you are reporting on.

05

Proceed to fill out the details related to your wages. This typically includes information about your total earnings, deductions, and any allowances or bonuses received during the period of employment.

06

In some cases, you may be asked to provide additional details such as your employment contract or any supporting documents related to your earnings. Make sure to attach these documents as required.

07

Double-check all the information you have entered to ensure its accuracy. Mistakes or missing information can lead to delays or complications in processing your SSP 113 form.

08

Once you have reviewed the form and are confident that all the necessary information has been provided, sign and date the form in the designated space. This indicates your confirmation and consent to the information provided.

Who needs SSP 113:

01

Employees: If you are an employee and have been absent from work due to illness, injury, or maternity, you may be required to fill out the SSP 113 form. This form is typically used to report your earnings and provide the necessary information for processing statutory sick pay or other related benefits.

02

Employers: Employers are also required to maintain records and complete SSP 113 forms for their employees who are absent due to illness, injury, or maternity. This helps in accurately calculating and distributing any statutory sick pay they may be entitled to.

03

Relevant authorities: The SSP 113 form may also be used by relevant authorities, such as government labor departments or benefit agencies, to assess and monitor sickness absence and related benefit claims. These authorities may request SSP 113 forms from both employees and employers as part of their administrative processes.

It is important to note that the specific requirements and usage of the SSP 113 form may vary depending on the country or jurisdiction. Therefore, it is always advisable to refer to the relevant guidelines and regulations specific to your situation to ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ssp 113 - coop online?

Filling out and eSigning ssp 113 - coop is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in ssp 113 - coop without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit ssp 113 - coop and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit ssp 113 - coop on an Android device?

You can make any changes to PDF files, like ssp 113 - coop, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is ssp 113?

SSP 113, also known as Statement of Specified Foreign Financial Assets, is a form required by the IRS to report the ownership of foreign financial accounts and assets.

Who is required to file ssp 113?

U.S. taxpayers who have specified foreign financial assets that exceed certain thresholds are required to file SSP 113.

How to fill out ssp 113?

SSP 113 can be filled out electronically using the IRS e-file system or by mailing a paper form to the IRS.

What is the purpose of ssp 113?

The purpose of SSP 113 is to prevent tax evasion by ensuring that U.S. taxpayers report their foreign financial assets.

What information must be reported on ssp 113?

Information such as the type of foreign financial asset, its maximum value during the year, and information about the financial institution holding the asset must be reported on SSP 113.

Fill out your ssp 113 - coop online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ssp 113 - Coop is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.