Get the free PAPER 1 : ACCOUNTING

Show details

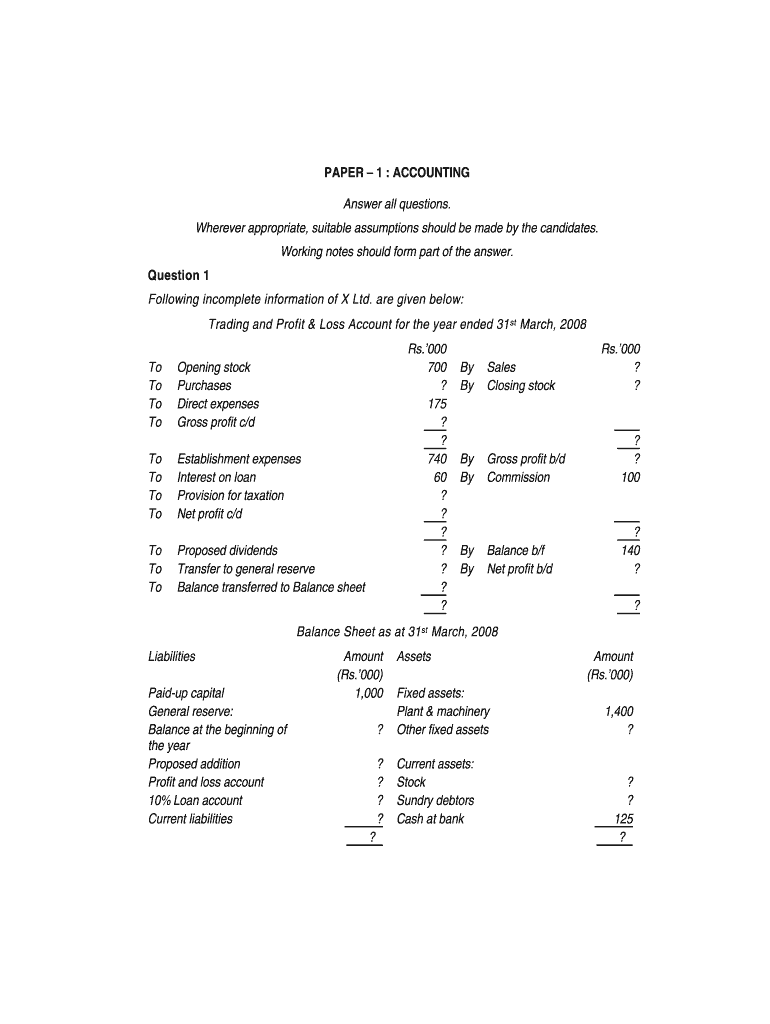

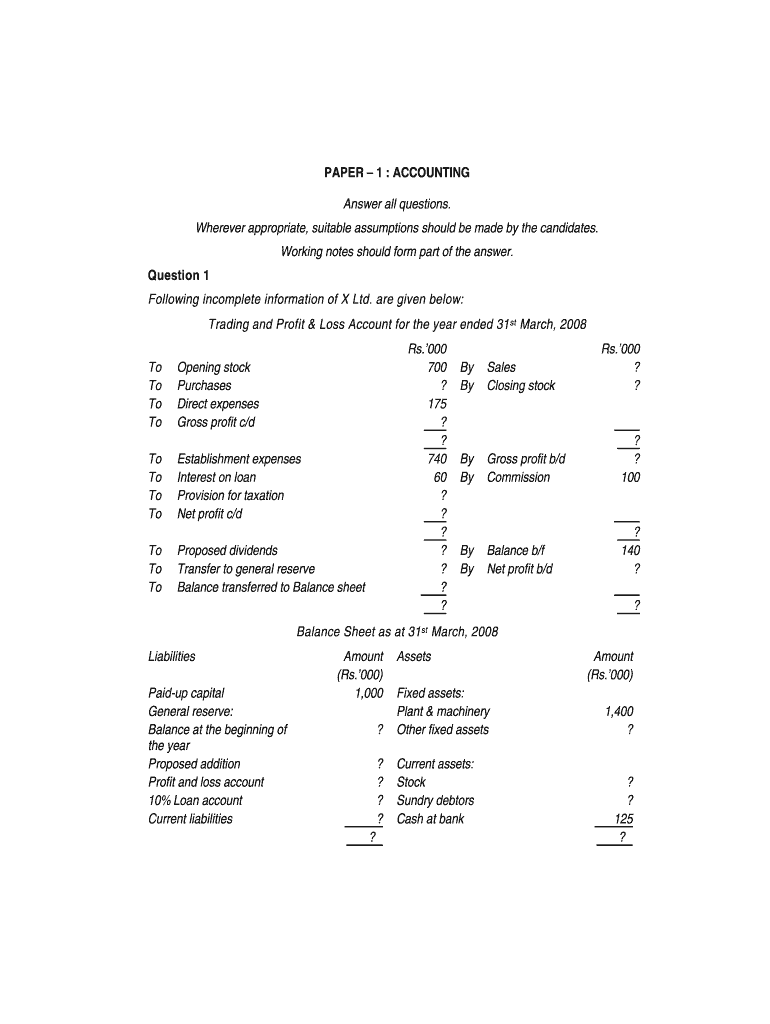

PAPER 1 : ACCOUNTING Answer all questions. Wherever appropriate, suitable assumptions should be made by the candidates. Working notes should form part of the answer. Question 1 Following incomplete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paper 1 accounting

Edit your paper 1 accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paper 1 accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit paper 1 accounting online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit paper 1 accounting. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paper 1 accounting

How to fill out paper 1 accounting?

01

Familiarize yourself with the instructions: Before starting to fill out paper 1 accounting, carefully read and understand the instructions provided. This will ensure that you have a clear understanding of what is expected of you.

02

Review the content: Go through your notes, textbooks, and any relevant materials to refresh your knowledge of accounting concepts and principles. Make sure you have a clear understanding of the topics covered in paper 1 accounting.

03

Organize your time: Set aside dedicated time to work on paper 1 accounting. Create a study schedule that allows you to allocate enough time to each section of the paper. This will help you stay on track and ensure that you complete the paper within the given timeframe.

04

Start with easy questions: Begin by answering the questions that you find the easiest. This will help build your confidence and give you momentum to tackle more challenging questions later on. It's important to manage your time effectively to ensure that you have enough time to answer all the questions.

05

Read questions carefully: Carefully read each question and make sure you understand what's being asked. Analyze the question and identify the key information required to answer it. This will help you provide relevant and accurate responses.

06

Show your working: When solving accounting problems or calculations, always show your working. This will not only help you organize your thoughts but also allow the examiner to understand your process and provide partial marks in case of any errors.

07

Double-check your answers: Before submitting your paper, it's crucial to review your answers. Check for any errors or omissions and ensure that your calculations are accurate. This extra step will help you catch any mistakes and make necessary corrections.

Who needs paper 1 accounting?

01

Students pursuing an accounting degree: Paper 1 accounting is typically a requirement for students studying accounting or pursuing a degree in finance. It provides a foundation in accounting principles and prepares students for more advanced accounting courses.

02

Business professionals: Individuals working in the finance or accounting field can benefit from paper 1 accounting as it helps them understand the fundamental concepts and principles of accounting. Having a solid understanding of accounting is crucial for making sound financial decisions and analyzing financial statements.

03

Anyone interested in personal financial management: Learning accounting basics through paper 1 accounting can also be beneficial for individuals interested in managing their personal finances. It provides valuable knowledge and skills to understand and interpret personal financial statements and make informed financial decisions.

In conclusion, paper 1 accounting requires careful preparation, understanding of accounting concepts, and time management. It is essential for students pursuing an accounting degree, business professionals, and individuals interested in personal financial management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send paper 1 accounting to be eSigned by others?

Once your paper 1 accounting is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get paper 1 accounting?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific paper 1 accounting and other forms. Find the template you need and change it using powerful tools.

Can I sign the paper 1 accounting electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your paper 1 accounting in seconds.

What is paper 1 accounting?

Paper 1 accounting refers to a specific form or document used for financial reporting purposes.

Who is required to file paper 1 accounting?

Paper 1 accounting must be filed by all businesses or individuals who are legally obligated to report their financial information.

How to fill out paper 1 accounting?

To fill out paper 1 accounting, you will need to provide accurate and complete financial information in the designated sections of the form.

What is the purpose of paper 1 accounting?

The purpose of paper 1 accounting is to document and report financial transactions and activities for compliance, tracking, and analysis purposes.

What information must be reported on paper 1 accounting?

The specific information that must be reported on paper 1 accounting may vary depending on the jurisdiction and reporting requirements, but generally, it includes details of income, expenses, assets, and liabilities.

Fill out your paper 1 accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paper 1 Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.