Get the free Versatile Tax Services BUSINESS TAX ENGAGEMENT LETTER Tax ...

Show details

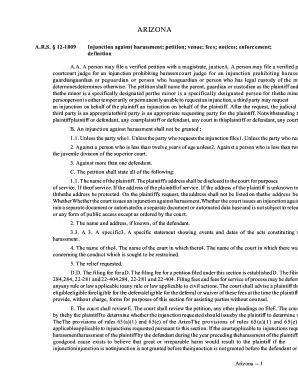

Versatile Tax Services 3000 Joe DiMaggio Blvd Ste 76 Round Rock, TX 78665 Off: 512.535.7332 Fax:512.275.6237 BUSINESS TAX ENGAGEMENT LETTER Tax year: Business name: Contact person: Street address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign versatile tax services business

Edit your versatile tax services business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your versatile tax services business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing versatile tax services business online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit versatile tax services business. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out versatile tax services business

Question: How to fill out versatile tax services business? Who needs versatile tax services business?

01

Start by conducting market research to identify the target audience for your versatile tax services business. This may include individuals, small business owners, freelancers, or corporations who require professional assistance with their taxation needs.

02

Create a comprehensive business plan that outlines your services, pricing structure, unique selling propositions, and marketing strategies. This will help you stay organized and guide you in successfully setting up your business.

03

Register your business and obtain all necessary licenses and permits required to operate legally in your jurisdiction. Consult with a business attorney or accountant to ensure compliance with local regulations and tax obligations.

04

Develop a strong brand identity for your versatile tax services business. This includes creating a memorable logo, choosing suitable colors and fonts, and developing a professional website that showcases your services and expertise.

05

Network with other professionals in the accounting and finance industry to build mutually beneficial relationships. Attend conferences, join industry associations, and utilize social media platforms to connect with potential clients and business partners.

06

Establish a streamlined system for managing client information and tax records. Invest in reliable tax software or collaborate with a professional tax specialist to ensure accurate record-keeping and timely filing of tax returns for your clients.

07

Offer a range of services that cater to the specific needs of your target audience. This may include tax preparation, tax planning, IRS representation, bookkeeping, payroll services, and financial consultation. Stay updated with the latest tax laws and regulations to provide accurate advice and minimize compliance risks for your clients.

08

Implement an effective marketing strategy to raise awareness about your versatile tax services business. Utilize online marketing techniques such as search engine optimization (SEO), content marketing, and social media advertising to reach your target audience effectively. Traditional marketing methods such as print advertisements or local networking events can also be beneficial.

Who needs versatile tax services business?

01

Individuals: Individuals with complex tax situations or limited knowledge about tax laws benefit from the expertise of versatile tax services businesses. They can provide guidance on deductions, credits, and help maximize tax benefits for individuals.

02

Small Business Owners: Small business owners often struggle with managing their business finances and tax obligations. Versatile tax services businesses can offer assistance with tax planning, payroll, financial statements, and tax compliance to ensure smooth operations and legal compliance.

03

Freelancers: Freelancers often have unique tax requirements due to their self-employed status. Versatile tax services businesses can help freelancers understand and meet their tax obligations, track expenses, and recommend tax-saving strategies.

04

Corporations: Large corporations require specialized tax services due to the complexity of their financial operations. Versatile tax services businesses can handle tax planning, compliance, and consulting services for corporations, helping them minimize tax liabilities and ensure accurate financial reporting.

In summary, filling out a versatile tax services business requires market research, a comprehensive business plan, legal compliance, branding, networking, client management systems, a wide range of services, and an effective marketing strategy. Individuals, small business owners, freelancers, and corporations are among the potential clients who would benefit from versatile tax services businesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete versatile tax services business online?

Filling out and eSigning versatile tax services business is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit versatile tax services business on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign versatile tax services business on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit versatile tax services business on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share versatile tax services business on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is versatile tax services business?

A versatile tax services business offers a range of tax services to individuals and businesses, including tax preparation, filing, planning, and consulting.

Who is required to file versatile tax services business?

Any individual or business offering tax services to clients is required to file as a versatile tax services business.

How to fill out versatile tax services business?

To fill out a versatile tax services business, one must accurately report all income, expenses, and other tax-related information for clients.

What is the purpose of versatile tax services business?

The purpose of a versatile tax services business is to assist clients in managing their taxes effectively and ensuring compliance with tax laws.

What information must be reported on versatile tax services business?

Information such as income, expenses, deductions, credits, and other tax-related data must be reported on a versatile tax services business.

Fill out your versatile tax services business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Versatile Tax Services Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.