Get the free REAL PROPERTY TAX APPEALS COMMISSION

Show details

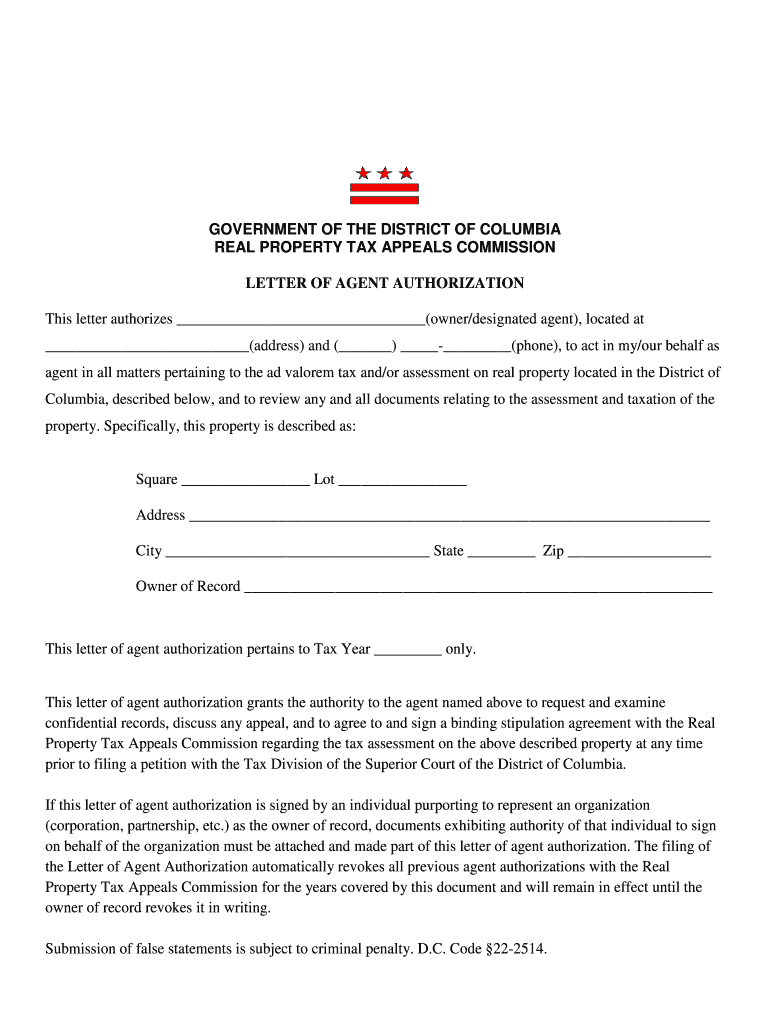

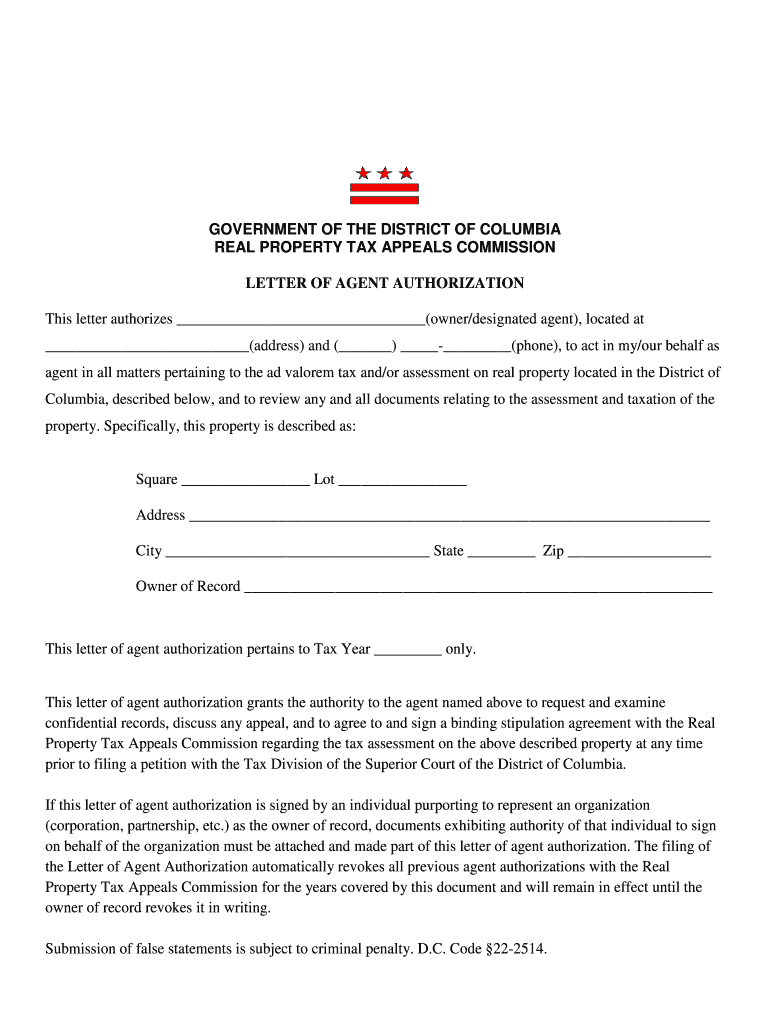

GOVERNMENT OF THE DISTRICT OF COLUMBIA REAL PROPERTY TAX APPEALS COMMISSION LETTER OF AGENT AUTHORIZATION This letter authorizes (owner×designated agent×, located at (address) and () (phone×, to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real property tax appeals

Edit your real property tax appeals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real property tax appeals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing real property tax appeals online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit real property tax appeals. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real property tax appeals

How to fill out real property tax appeals:

01

Research your local real property tax appeal process: Begin by familiarizing yourself with the specific rules and regulations of your local jurisdiction. Visit the website of your local tax assessor's office or reach out to them directly to gather information about the process, deadlines, required forms, and any additional documentation needed.

02

Review your property assessment: Before proceeding with the appeal, carefully examine your current property assessment. Look for any errors or discrepancies that may have led to an inflated tax assessment. This could include mistakes in the property's square footage, incorrect information about the property's condition or features, or discrepancies in comparable properties used to determine your assessment.

03

Gather evidence to support your appeal: To bolster your case, compile relevant documentation that supports your argument for a lower property tax assessment. This could include recent appraisals, photographs or videos of the property's condition, records of recent comparable property sales in your area, or any other evidence that demonstrates that your property has been overassessed.

04

Fill out the necessary forms: Once you have a clear understanding of the appeal process and have gathered all the required documentation, complete the necessary forms provided by your local tax assessor's office. These forms typically require you to provide your contact information, the specific reasons for your appeal, and details about your property's current assessment.

05

Submit the appeal within the specified timeframe: Ensure that you submit your completed appeal forms and supporting documents within the established deadline. Pay attention to any specific instructions regarding the submission method, such as mailing, faxing, or submitting in-person.

Who needs real property tax appeals?

Property owners:

Real property tax appeals are typically pursued by property owners who believe that their property has been overassessed, resulting in an unfairly high tax burden. By filing an appeal, property owners aim to have their property's assessment reevaluated and potentially reduced, thus lowering their property tax payments.

Homeowners' associations (HOAs):

In some cases, homeowners' associations may also initiate real property tax appeals on behalf of their members. HOAs may have a vested interest in ensuring that their members' properties are assessed accurately and fairly, as this affects the overall financial wellbeing of the community.

Commercial property owners:

Owners of commercial properties, such as businesses or rental properties, may also pursue real property tax appeals if they believe their assessments are overstated. Lowering the property tax burden can have a significant impact on the financial viability of commercial ventures and can help attract tenants or customers by keeping operating costs lower.

Note: The need for real property tax appeals may vary depending on individual circumstances and the specific guidelines set forth by each jurisdiction. It is always advisable to consult with a tax professional or seek legal advice to determine if pursuing a tax appeal is appropriate and beneficial in your particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute real property tax appeals online?

Completing and signing real property tax appeals online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in real property tax appeals?

The editing procedure is simple with pdfFiller. Open your real property tax appeals in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out real property tax appeals on an Android device?

Complete real property tax appeals and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is real property tax appeals?

Real property tax appeals are requests made by property owners to challenge the assessed value of their property for taxation purposes.

Who is required to file real property tax appeals?

Property owners who believe that their property has been overvalued for tax purposes are required to file real property tax appeals.

How to fill out real property tax appeals?

Real property tax appeals can typically be filled out by submitting a form provided by the local tax assessor's office along with any supporting documentation.

What is the purpose of real property tax appeals?

The purpose of real property tax appeals is to ensure that property owners are being taxed fairly based on the true value of their property.

What information must be reported on real property tax appeals?

Real property tax appeals usually require information such as the property's address, current assessed value, reasons for appeal, and any supporting evidence.

Fill out your real property tax appeals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Property Tax Appeals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.