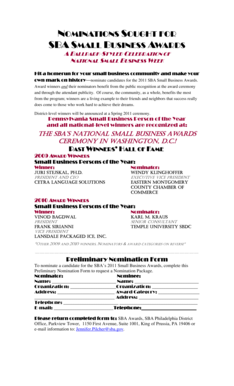

Get the free Is your financial advisor Efficient 1

Show details

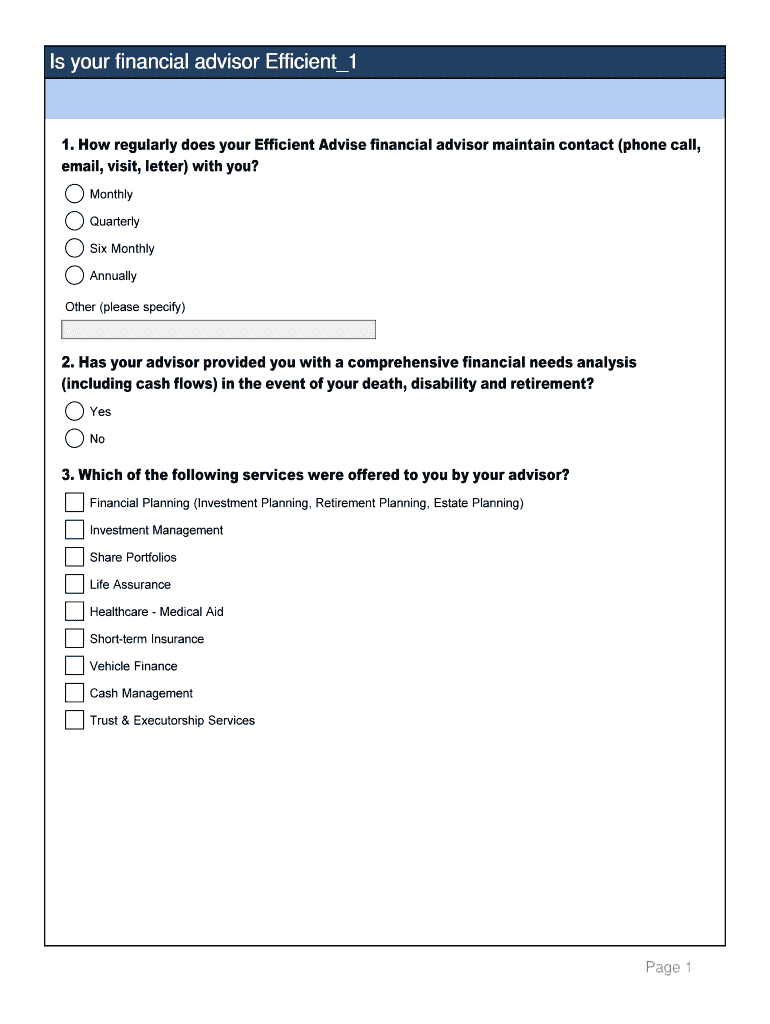

Is your financial advisor Efficient 1 1. How regularly does your Efficient Advise financial advisor maintain contact (phone call, email, visit, letter) with you? J k l m n Monthly j k l m n Quarterly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign is your financial advisor

Edit your is your financial advisor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your is your financial advisor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing is your financial advisor online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit is your financial advisor. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out is your financial advisor

How to fill out is your financial advisor:

01

Start by gathering all your financial information, including bank statements, investment documents, insurance policies, and any other relevant documents. This will help your financial advisor get a comprehensive understanding of your current financial situation.

02

Identify your financial goals and objectives. Think about what you want to achieve in the short term and long term and communicate these goals effectively to your financial advisor. This will help them tailor their advice and recommendations to your specific needs.

03

Assess your risk tolerance. Understand how much risk you are willing to take with your investments and communicate this to your financial advisor. This will help them determine the most suitable investment strategy for you.

04

Evaluate the qualifications and experience of potential financial advisors. Look for certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their track record, client testimonials, and any disciplinary actions against them. This will ensure that you choose a reputable and knowledgeable advisor.

05

Schedule a meeting with potential financial advisors to discuss your goals, risk tolerance, and their approach to financial planning. Ask them about their investment strategies, fee structure, and how they communicate with clients. This will help you assess whether they are a good fit for your needs.

Who needs a financial advisor:

01

Individuals who lack the time or expertise to effectively manage their own finances may benefit from a financial advisor. A financial advisor can provide valuable guidance and expertise in areas such as investment planning, retirement planning, tax planning, and risk management.

02

People who have complex financial situations, such as high-net-worth individuals or business owners, may require the services of a financial advisor. These professionals can provide tailored solutions and strategies to help manage and grow wealth in a tax-efficient manner.

03

Those who want to ensure their financial future and achieve their long-term goals may find value in working with a financial advisor. Advisors can help create a comprehensive financial plan, provide ongoing advice, and monitor progress towards financial goals.

Overall, is your financial advisor is crucial for anyone looking to make informed financial decisions, navigate complex financial markets, and optimize their financial well-being.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my is your financial advisor in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign is your financial advisor and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit is your financial advisor on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing is your financial advisor.

How do I complete is your financial advisor on an Android device?

Use the pdfFiller mobile app and complete your is your financial advisor and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is is your financial advisor?

A financial advisor is a professional who provides financial guidance and advice to clients.

Who is required to file is your financial advisor?

Individuals or businesses who have hired a financial advisor may be required to file certain documents or reports.

How to fill out is your financial advisor?

You can fill out forms or reports related to your financial advisor by providing accurate and up-to-date information about your financial situation.

What is the purpose of is your financial advisor?

The purpose of having a financial advisor is to help individuals or businesses make informed decisions about their finances and investments.

What information must be reported on is your financial advisor?

Information such as income, expenses, assets, liabilities, investments, and financial goals may need to be reported on documents related to a financial advisor.

Fill out your is your financial advisor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Is Your Financial Advisor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.