Get the free and keeping

Show details

P11D

Our guide to

completing your

P11Ds...

And keeping

HMRC happyOverview

There are 14 sections on the P11D form lettered AN. Some sections include more than one box and the

P11D actually has 24 boxes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign and keeping

Edit your and keeping form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your and keeping form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing and keeping online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit and keeping. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out and keeping

01

Start by gathering all the necessary information and documents that are required for filling out and keeping records. This may include forms, receipts, invoices, financial statements, and any other relevant paperwork.

02

Create a well-organized system for storing and categorizing the records. This could involve using physical folders and filing cabinets or setting up a digital filing system on your computer. Make sure to label each file or folder clearly for easy reference.

03

When filling out forms or documents, take your time and ensure that all the required fields are accurately completed. Double-check for any errors or missing information before proceeding. It's important to be thorough and avoid any mistakes that could lead to complications later on.

04

Keep track of deadlines and due dates for submitting records or paperwork. This could include tax filing deadlines, invoice payment due dates, or any other important dates related to record-keeping. Set reminders or create a calendar system to stay organized and avoid missing any deadlines.

05

Regularly update and review your records to ensure they are up-to-date and accurate. This is particularly important for financial records, as accurate financial information is crucial for making informed decisions and filing taxes. Make it a habit to review and reconcile your records on a monthly, quarterly, or annual basis.

06

It's also important to maintain the confidentiality and security of your records. Store physical documents in a secure location and consider using password protection or encryption for digital records. Only share confidential information with authorized individuals or entities.

Who needs record-keeping?

01

Individuals: Individual taxpayers need to keep records of their income, expenses, and deductions for filing accurate tax returns. It's also recommended to keep records related to important financial transactions, investments, and insurance policies.

02

Small Businesses: Small business owners are legally required to keep records of their business transactions, expenses, income, and other financial documents. These records are essential for filing taxes, tracking business performance, and ensuring compliance with financial regulations.

03

Organizations and Nonprofits: Organizations and nonprofits need to maintain records of their financial activities, including income, expenses, donations, and grants. These records are necessary for financial reporting, accountability, and compliance with legal and regulatory requirements.

In summary, filling out and keeping records involves gathering necessary information, organizing it systematically, accurately completing forms and documents, staying on top of deadlines, regularly reviewing and updating records, ensuring confidentiality and security, and meeting the record-keeping requirements for individuals, small businesses, and organizations.

Fill

form

: Try Risk Free

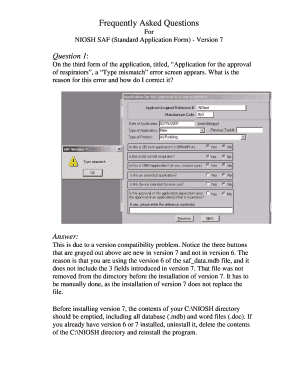

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit and keeping from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like and keeping, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out and keeping using my mobile device?

Use the pdfFiller mobile app to fill out and sign and keeping on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete and keeping on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your and keeping. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is and keeping?

And keeping refers to the practice of organizing and maintaining records or documents in a systematic way.

Who is required to file and keeping?

Any individual or organization that is required by law to maintain certain records or documents is also required to file and keeping.

How to fill out and keeping?

To fill out and keeping, one must systematically organize and maintain records or documents either physically or digitally.

What is the purpose of and keeping?

The purpose of and keeping is to ensure that important records or documents are organized and kept for future reference or compliance purposes.

What information must be reported on and keeping?

The information that must be reported on and keeping will vary depending on the specific requirements of the law or regulation that requires the records or documents to be kept.

Fill out your and keeping online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

And Keeping is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.