Get the free Debt Snowball Worksheet

Show details

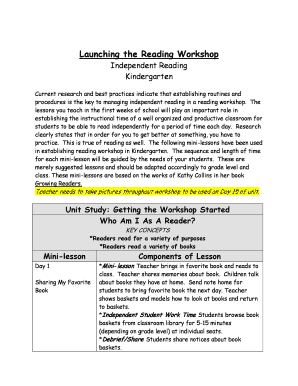

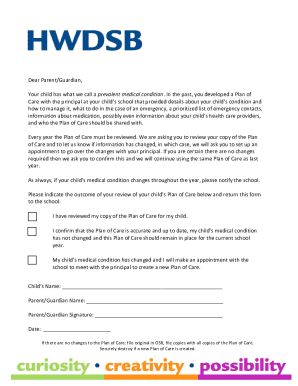

Debt Snowball Worksheet

Whom you owe

(List debts from smallest to largest×Payoff

AmountMinimum

PaymentPayment

with Snowball1

2

3

4

5

6

7

8

9

10One way to knock out your debt is to use the debt snowball.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt snowball worksheet

Edit your debt snowball worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt snowball worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debt snowball worksheet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit debt snowball worksheet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt snowball worksheet

How to fill out a debt snowball worksheet:

01

Start by gathering all the necessary information: This includes a list of all your debts, including the creditor's name, the outstanding balance, the minimum monthly payment, and the interest rate.

02

Order your debts from smallest to largest: The debt snowball method suggests tackling your smallest debts first while making minimum payments on larger debts. This approach helps build momentum and motivation as you cross off smaller debts from your list.

03

Determine your available funds: Look at your budget and determine how much extra money you can allocate towards debt repayment each month. This can be achieved by cutting expenses, increasing your income, or both.

04

Allocate funds towards your smallest debt: Take the extra money you identified in your budget and apply it towards your smallest debt. Make minimum payments on all other debts.

05

Track your progress: Ensure you update your debt snowball worksheet regularly to reflect any changes in your outstanding balances or monthly payments. This will help you stay on track and see your progress over time.

06

Snowball your payments: As you pay off each debt, take the entire amount you were paying towards the previous debt and apply it to the next debt on your list. This creates a snowball effect, accelerating your debt repayment progress.

Who needs a debt snowball worksheet?

01

Individuals with multiple outstanding debts: The debt snowball worksheet is particularly useful for individuals who have multiple debts and want to organize and prioritize their repayment strategy.

02

Those seeking motivation and momentum: The debt snowball method provides a psychological boost by allowing you to see quick wins as you pay off smaller debts first. This can help you stay motivated and committed to your debt repayment journey.

03

Individuals looking to create a structured plan: The debt snowball worksheet helps create a detailed plan by organizing your debts, payments, and progress. This structure can be empowering and give you a clear roadmap towards becoming debt-free.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my debt snowball worksheet directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your debt snowball worksheet and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the debt snowball worksheet electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your debt snowball worksheet in seconds.

How can I edit debt snowball worksheet on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing debt snowball worksheet, you need to install and log in to the app.

What is debt snowball worksheet?

The debt snowball worksheet is a tool used to track and prioritize your debts in order to pay them off efficiently.

Who is required to file debt snowball worksheet?

Anyone who wants to tackle their debt in a strategic and organized manner can use a debt snowball worksheet.

How to fill out debt snowball worksheet?

To fill out a debt snowball worksheet, list all your debts from smallest to largest, allocate a monthly budget towards paying them off, and track your progress as you eliminate each debt.

What is the purpose of debt snowball worksheet?

The purpose of a debt snowball worksheet is to help individuals pay off their debts in a systematic way, starting with the smallest debt and building momentum as they move on to larger debts.

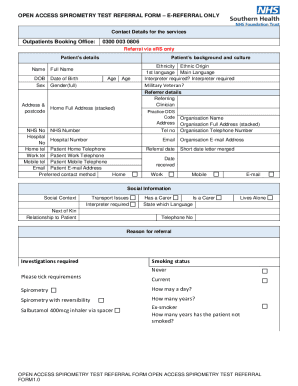

What information must be reported on debt snowball worksheet?

The debt snowball worksheet typically requires information such as the name of the creditor, outstanding balance, minimum monthly payment, and interest rate for each debt.

Fill out your debt snowball worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Snowball Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.