Get the free vat sahf form

Show details

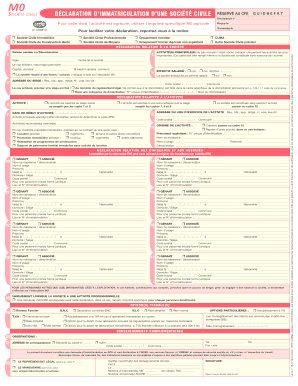

00 incl. VAT per annum SAHF BANKING DETAILS ABSA Bank Branch Tygervalley Branch Code 630510 Acc No 9154 238 570 Swift Code ABSAAZAJJ Acc Type INDIVIDUAL AFFILIATION FEE PER ANNUM R775. 00 incl. VAT per annum Name Savings STUDENT AFFILIATION FEE PER ANNUM Please contact the SAHF office at the above telephone and fax number or by E-mail for any further information.. Za www. sahf.org. za Co. Reg. No 2005/009976/07 Company VAT No 4550227385 2014 APPLICATION FOR AFFILIATION TO THE SAHF I / we wish...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat sahf form

Edit your vat sahf form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat sahf form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat sahf form online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vat sahf form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat sahf form

How to fill out VAT SAHF form:

01

Gather all the necessary information: Before filling out the VAT SAHF (Value Added Tax Self-Assessment and Higher Frequency) form, make sure you have all the relevant details such as your business information, tax registration number, and any applicable invoices or receipts.

02

Complete the personal details section: Begin by filling in your personal information, including your name, address, contact number, and email address. This information will help the tax authorities to identify you and contact you if necessary.

03

Provide business information: In this section, you need to provide details about your business, such as the name, address, and tax registration number. Make sure all the information is accurate and up to date.

04

Enter VAT details: Next, you will need to enter your VAT details. This includes the total value of taxable supplies made during the relevant period, both for standard rate (if applicable) and zero-rated supplies. You should also include any exempt supplies.

05

Calculate the VAT liability: Using the information you provided in the previous step, calculate your VAT liability by applying the appropriate VAT rate to the taxable supplies. This will give you the amount of VAT you need to pay.

06

Enter input VAT: Input VAT refers to the VAT paid on goods or services purchased for use in your business. Calculate the total input VAT paid during the relevant period and enter it in the designated section.

07

Determine VAT payable or refundable: Subtract the input VAT from your VAT liability to determine whether you have a VAT payable or refundable amount. If the result is positive, you need to pay the VAT amount to the tax authorities. If it is negative, you are eligible for a VAT refund.

08

Verify and sign the form: Double-check all the information you have entered in the VAT SAHF form for accuracy. Once you are satisfied with the details, sign the form to declare that the information provided is true and complete to the best of your knowledge.

Who needs VAT SAHF form:

01

Businesses registered for VAT: Any business that is registered for VAT and exceeds the threshold set by the tax authorities is required to submit the VAT SAHF form. This helps the tax authorities monitor and assess the VAT liabilities and compliance of these businesses.

02

Self-employed individuals: If you are self-employed and your annual turnover exceeds the VAT threshold, you are also required to fill out the VAT SAHF form. It helps to ensure accurate reporting and calculation of VAT liabilities for self-employed individuals.

03

Individuals making exempt supplies: Even if your business consists mostly of VAT-exempt supplies, you may still need to complete the VAT SAHF form to declare and report these exempt supplies accurately. This allows the tax authorities to have a complete overview of your business activities.

In conclusion, filling out the VAT SAHF form may seem daunting initially, but by following the step-by-step process and providing accurate information, you can ensure compliance with VAT regulations and avoid any penalties or issues with the tax authorities.

Instructions and Help about vat sahf form

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vat sahf form?

VAT SAHF form is a Value Added Tax Self-Assessment and Payment Form used for taxpayers to declare and pay their VAT liabilities.

Who is required to file vat sahf form?

Businesses and individuals registered for VAT are required to file VAT SAHF form.

How to fill out vat sahf form?

VAT SAHF form can be filled out manually or electronically through the tax authority's online portal. The form requires taxpayers to provide details of their taxable sales and purchases, calculate the VAT payable, and make the payment accordingly.

What is the purpose of vat sahf form?

The purpose of VAT SAHF form is to enable taxpayers to self-assess and declare their VAT liabilities accurately and ensure timely payment of the tax due.

What information must be reported on vat sahf form?

Taxpayers must report their taxable sales, purchases, input and output VAT amounts, and calculate the net VAT payable on the VAT SAHF form.

How do I make edits in vat sahf form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your vat sahf form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the vat sahf form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your vat sahf form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the vat sahf form form on my smartphone?

Use the pdfFiller mobile app to complete and sign vat sahf form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your vat sahf form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat Sahf Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.