Get the free 2016 SEC EDGAR FILING CALENDAR - DEADLINES AND HOLIDAYS

Show details

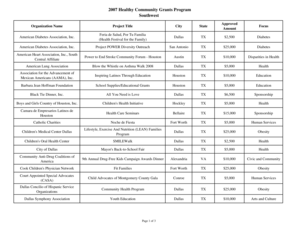

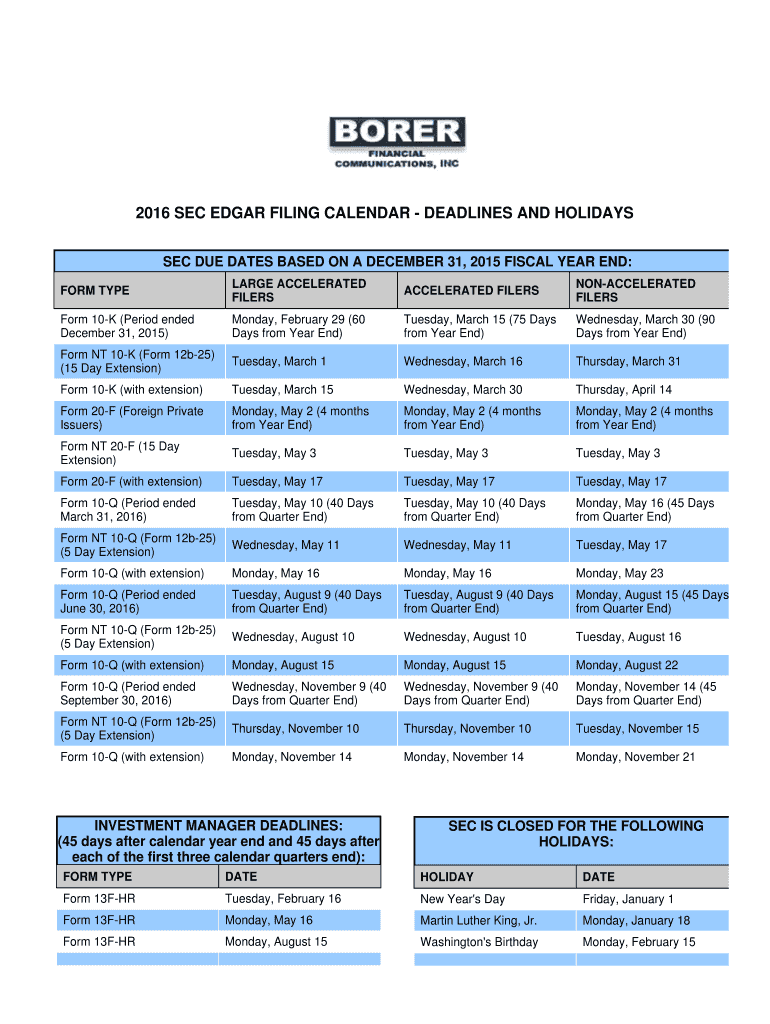

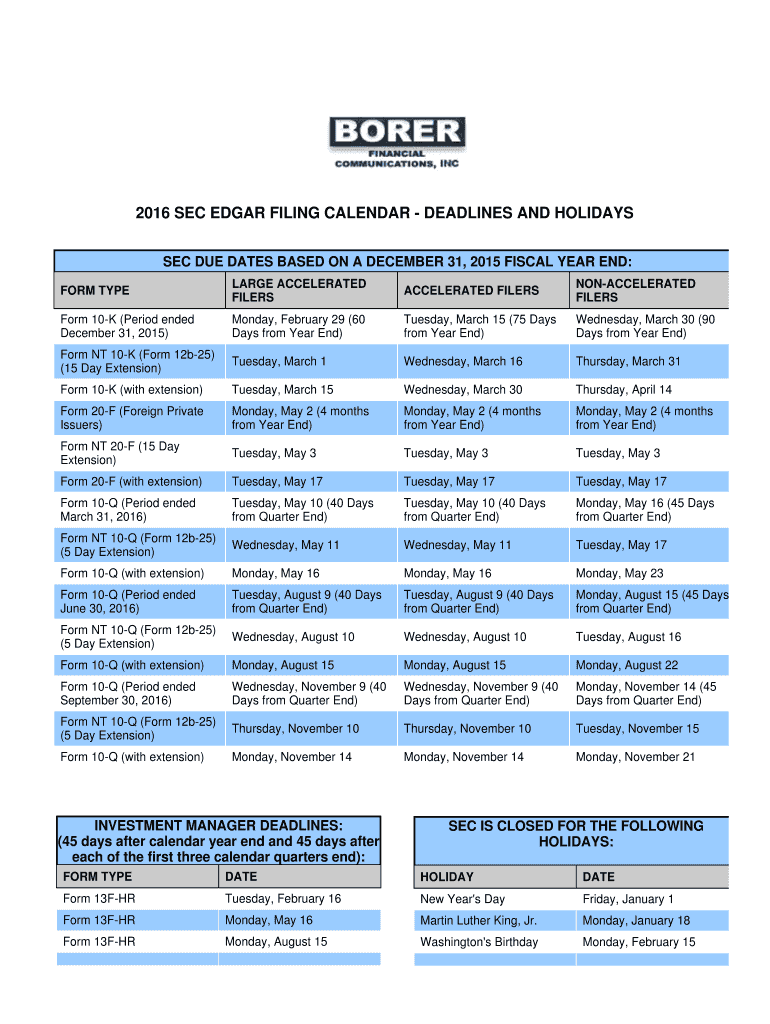

2016 SEC EDGAR FILING CALENDAR DEADLINES AND HOLIDAYS SEC DUE DATES BASED ON A DECEMBER 31, 2015, FISCAL YEAR END: FORM TUTELAGE ACCELERATED FILERSACCELERATED FILERSNONACCELERATED Firestorm 10K (Period

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2016 sec edgar filing

Edit your 2016 sec edgar filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2016 sec edgar filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2016 sec edgar filing online

Follow the steps below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2016 sec edgar filing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2016 sec edgar filing

How to Fill Out 2016 SEC EDGAR Filing:

01

Ensure you have all the necessary information and documents ready for filing. This includes detailed financial statements, disclosures, and any other relevant information required by the SEC.

02

Access the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system through the official SEC website.

03

Create an EDGAR account if you do not already have one. Provide the requested information and follow the instructions to set up your account.

04

Login to your EDGAR account and select the appropriate form for the 2016 filing. This will typically be Form 10-K for annual reports or Form 10-Q for quarterly reports.

05

Fill out the required information in the selected form, following the prompts and instructions provided. Be thorough and accurate when providing the requested details.

06

Attach any necessary exhibits, financial statements, or other supporting documents to the filing. These should be in the required format specified by the SEC.

07

Review the completed filing for any errors or omissions. Make sure all the information provided is accurate and complete.

08

Submit the filing through the EDGAR system. You may be required to pay any applicable fees at this stage, depending on the type of filing and your company's status.

09

After submitting the filing, carefully review the confirmation page to ensure the filing has been successfully accepted by the SEC.

10

Keep a record of the filing confirmation and any other relevant documentation for future reference.

Who Needs 2016 SEC EDGAR Filing:

01

Publicly traded companies: Companies listed on major stock exchanges or that have registered securities with the SEC are required to file annual and quarterly reports through the EDGAR system.

02

Non-profit organizations: Certain non-profit organizations that issue publicly traded debt must also file with the SEC through EDGAR.

03

Other entities: In addition to companies and non-profits, individuals or other entities may be required to file certain forms or reports with the SEC if they meet specific criteria, such as owning a significant stake in a company or conducting certain securities-related activities.

Note: It is important to consult with legal or financial professionals to ensure compliance with the specific rules and regulations governing SEC filings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2016 sec edgar filing in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2016 sec edgar filing along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send 2016 sec edgar filing to be eSigned by others?

Once your 2016 sec edgar filing is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the 2016 sec edgar filing electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2016 sec edgar filing in seconds.

What is sec edgar filing calendar?

SEC EDGAR filing calendar is a schedule of mandatory submission deadlines for companies to electronically file required reports and disclosures with the Securities and Exchange Commission.

Who is required to file sec edgar filing calendar?

Publicly traded companies and other entities that are required to submit reports to the SEC are required to file SEC EDGAR filing calendar.

How to fill out sec edgar filing calendar?

SEC EDGAR filing calendar can be filled out by accessing the SEC's Electronic Data Gathering, Analysis, and Retrieval system and following the instructions provided.

What is the purpose of sec edgar filing calendar?

The purpose of SEC EDGAR filing calendar is to ensure that companies meet their disclosure obligations to investors and the public in a timely manner.

What information must be reported on sec edgar filing calendar?

The information reported on SEC EDGAR filing calendar includes financial statements, annual reports, quarterly reports, and other required disclosures.

Fill out your 2016 sec edgar filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2016 Sec Edgar Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.